Receive free The Art Market updates

We’ll send you a myFT Daily Digest email rounding up the latest The Art Market news every morning.

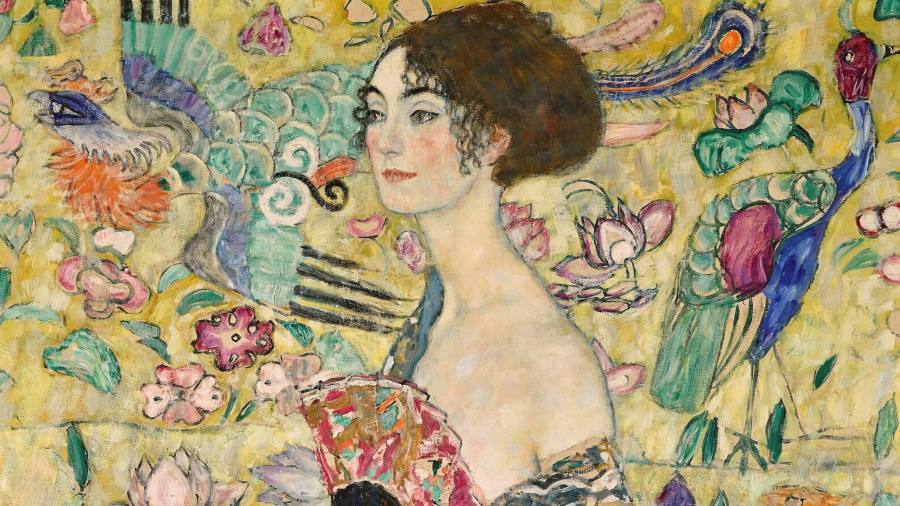

Sotheby’s gave London’s slim summer auction season a boost this week with the above-estimate sale of Gustav Klimt’s “Dame mit Fächer” (“Lady with a Fan”, 1917-18) for £74mn (£83.3mn with fees), a record public price for the artist and for a work sold at auction in Europe. The picture, on Klimt’s easel when he died in 1918, shows a kimono-clad woman surrounded by lotus blossom and phoenix motifs and appealed — as expected — to buyers in Asia.

It was bought by Patti Wong, Sotheby’s former head of Asia and now an independent art adviser, bidding on behalf of a Hong Kong buyer, against her previous colleague, Jen Hua, Sotheby’s deputy chair of Asia, on the phone to a client from the continent, Sotheby’s confirmed.

Wong’s presence in the London saleroom on June 27, plus the spectacle of a bidding war, gave the auction a buzz that has long been missing from these heavily orchestrated events. But the weakening art market, already apparent at the end of last year and in New York last month, remained the unsettling backdrop this season. The Klimt dominated Sotheby’s evening total of £167.2mn (£199mn with fees), at the low end of its presale estimate.

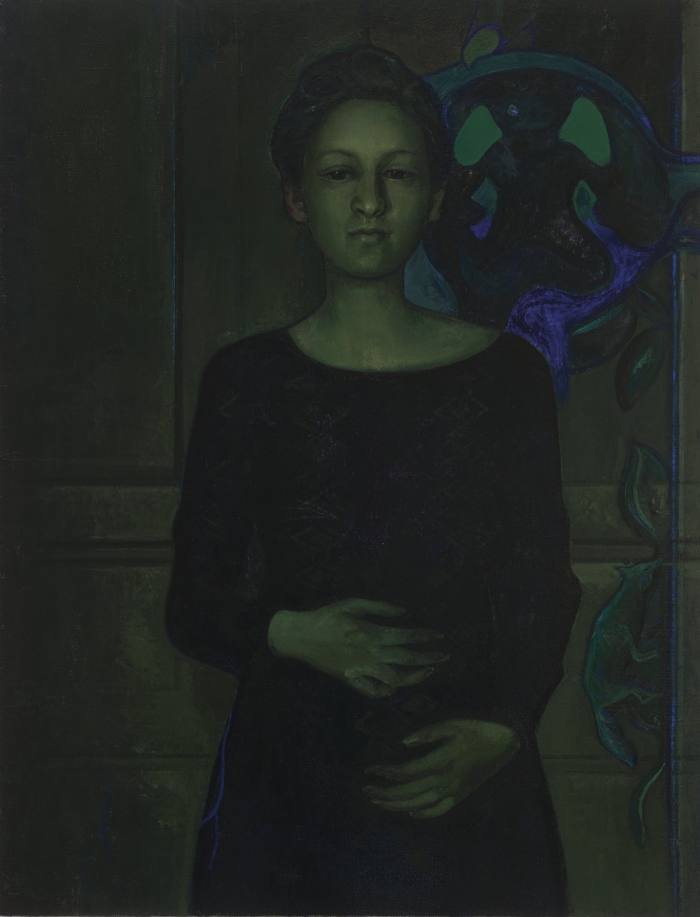

Christie’s had the weaker sale of the two this week, posting a below-estimate total of £51.7mn (£63.8mn with fees) on June 28. The proportion of works sold was still impressive — 61 of 65 offered — but was helped by consignors accepting bids far below estimates. One example, Marlene Dumas’s work on paper “Chained to the Bed for 15 years” (1986), sold for £90,000 (£113,400 with fees) against a presale estimate of £200,000-£300,000. In 2020, the same work had sold in London for a fee-inclusive £325,000. The sale still had some high points, notably for the Romanian painter Victor Man whose “Weltinnenraum” (“World Within”, 2017), a haunting image of his pregnant girlfriend, soared above its £150,000 high estimate to sell via the telephone for £1.4mn (£1.7mn with fees), an artist record.

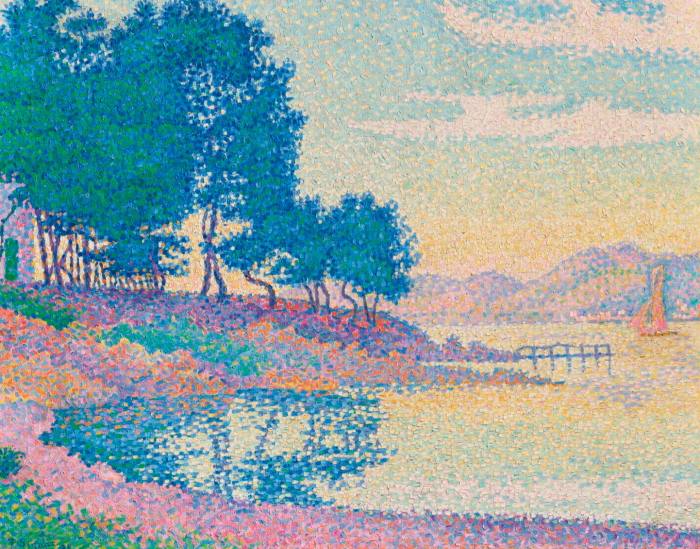

Another talking point of Christie’s auction was Paul Signac’s “Calanque des Canoubiers (Pointe de Bamer), Saint-Tropez” (1896), which was at the centre of a London High Court claim in 2020. The painting was sold in 2013 on behalf of the US collector Linda Hickox by the since disgraced British art dealer, Timothy Sammons; it fetched $4.85mn, with Simon C Dickinson gallery acting as agent to the new buyer. Hickox never received the $4.5mn owed from the sale and subsequently filed a complaint of criminal activity. In 2019, Sammons pleaded guilty to 15 counts of fraud and grand larceny against multiple clients, and was sentenced to up to 12 years of prison in the US.

Through London’s High Court in 2020, Hickox then sought an order for Dickinson and his gallery to reveal information of Sammons’s sale, including the name of the painting’s buyer, a reversal of the art market’s norms of client confidentiality. The order was granted and Dickinson — never accused of any wrongdoing — complied. The painting reappeared at Christie’s this week, “sold by and with the agreement of the interested parties in the claim, pursuant to an out-of-court agreement settling the ownership”, says Hickox’s lawyer, Tim Maxwell, partner at Wedlake Bell. Estimated for £5.5mn-£8mn, the work sold for £6.7mn (£8mn with fees), the top lot of the sale.

The frowned-on practice of “flipping” contemporary art — quickly reselling recently made works — more than doubled in volume during 2022, finds a new report published by the insurers Hiscox, using data from ArtTactic. It finds that 1,033 unique works were offered at auction within two years of being made and first sold privately (defined as “wet paint” works), up from 478 in 2021. Totals and price points have fallen considerably, though. The Hiscox report finds that in 2021, wet paint sales proceeds were $130mn (average price $272,000), while in 2022, the higher volume made $109mn (average $106,000).

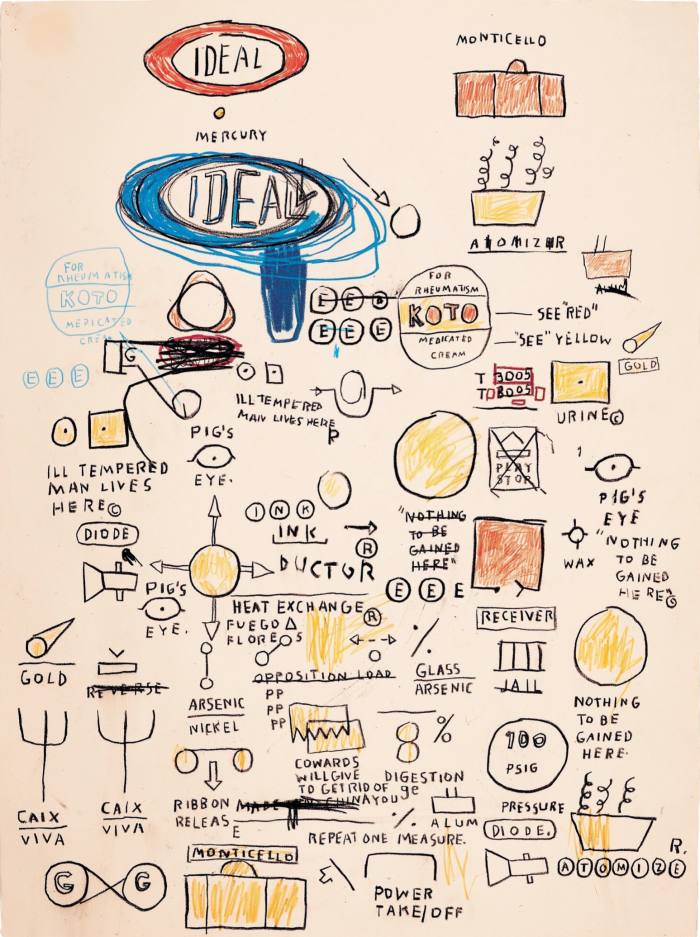

Wet paint works seemed less in evidence and demand at the London sales this week. At Sotheby’s, Hilary Pecis’s “Studio Vases”, made last year and estimated between £120,000 and £180,000, was one of three works withdrawn from the 17-lot Now portion of its auction, while two works from 2021 — by Caroline Walker and Dana Schutz — were among those withdrawn from its day sale. More noticeable this season were quick resales of works that were bought publicly within the past two years. These included, at Christie’s, Jean-Michel Basquiat’s “Untitled” work on paper (1987) bought for $1.5mn with fees in December 2021 and resold this week for $1.25mn with fees.

London’s inaugural mixed-category Treasure House fair (June 22-26) was rougher around the edges than its swanky predecessor, Masterpiece — literally, as the surrounding lawns, exhausted by the previous month’s Chelsea Flower Show, remained unturfed. But many of the fair’s 52 exhibitors praised organisers Harry Van der Hoorn and Thomas Woodham-Smith for getting it going at all. “London was crying out for this, it is important to keep a fair here at this time,” said Kathleen Slater, director at the ceramic specialists Adrian Sassoon. She reported “particular interest” in its antique Sèvres porcelain, priced from the low thousands to £145,000.

This reflected the fair’s more old-school feel, something that Woodham-Smith says is intentional. “Masterpiece was more about luxury partnerships, this is more like Grosvenor House [a traditional London fair that closed in 2009]. This is a different fair for a different time,” he says.

Footfall was disappointing — “there were not as many people through as we had thought,” Woodham-Smith said midway — but he expects that an increase in exhibitors next year, up to about 80, plus being a more established fixture, will help to spread the word. Most of this year’s exhibitors back him. “If they can do this in just four months, imagine what they could do with a year’s run-up,” said Maureen Diner, co-owner of the Washington, DC art and design specialists Geoffrey Diner Gallery.

Find out about our latest stories first — follow @ftweekend on Twitter