Receive free Global inflation updates

We’ll send you a myFT Daily Digest email rounding up the latest Global inflation news every morning.

The writer is an FT contributing editor and writes the Chartbook newsletter

Half a century on, the return of inflation has stirred the 1970s ur-trauma. Last year, inflation hawks in Europe and the US were obsessing about the threat of wage-price spirals. As it turns out, inflation not only failed to accelerate but is now well off its peaks. Nevertheless, the scaremongering goes on.

The angst now is about inflation persistence. Getting it back down to 2 per cent is the battle-cry. As it was half a century ago, this is a profoundly conservative political argument dressed in the garb of economic necessity.

This is not to say that inflation is not a real problem. In Europe, notably in the UK, core inflation is proving stubborn. In the US, the question arises as to how the Federal Reserve will cross the “last mile” from 4 to 2 per cent.

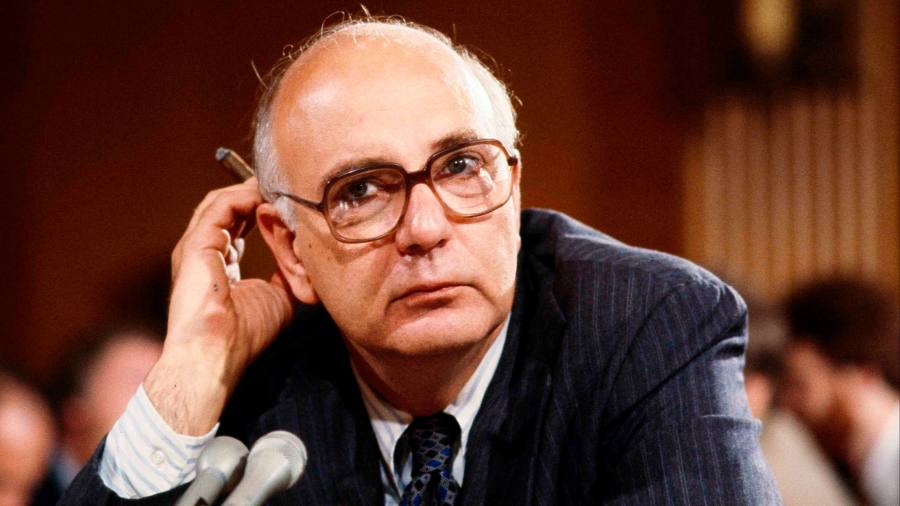

The issue would not be so acute if we were confident that monetary policy worked. In 1979, then Fed chair Paul Volcker applied sky-high rates. Since then, advanced economies have precious little experience of managing serious inflation. The economics is ambiguous. Different models give wildly different estimates as to how high rates need to go. What is clear is that even in a soft-landing scenario getting to 2 per cent will entail higher unemployment. In the worst case, it will bring down banks and, as the IMF has warned, it will pressure fragile emerging and developing economies.

To achieve the disinflationary purge without putting the financial system at risk, the banker to the central bankers, the Bank for International Settlements, is now advocating that fiscal policy must also join the fight, to further squeeze aggregate demand.

So this is where we have arrived in 2023: to bring inflation back to 2 per cent while preserving the banks, common sense insists that we need higher interest rates for longer, plus austerity. And, at this point, you have to ask whether western elites have learnt anything from the last decade and a half.

How long is it since we were calling for a new social contract, championing democracy against lopsided capitalism and asserting the priority of sustainable development and the climate crisis? Of course, price stability is important and even moderate inflation inflicts real costs, notably on vulnerable groups. But the cost of living crisis is a social problem that should be addressed with adequate welfare support.

We are told that abandoning 2 per cent would make a society such as Britain into a joke. There are plenty of ways in which the UK has made itself a laughing-stock of late, but to use that as an argument for a radical and deliberately recessionary policy is to add injury to insult. You don’t demonstrate that you are serious by compulsively clinging to symbols and obsessing about your reputation. It is precisely that kind of politics, piled on top of years of austerity, that led Britain into the folly of Brexit.

Of course, public commitments are important pillars of social life. We should not lightly discard an institution like the 2 per cent goal. But like any other quasi-constitutional rule it should be held up for public scrutiny and judged against the demands of the moment. The 2 per cent target was a realistic one in the era of the “great moderation”. The question we ought to be asking is: is it fit for purpose in an age of polycrisis? Does it prejudice or help us in managing the fraught balance between capitalism and democracy?

This is a matter of tough trade-offs.

In an age of populism and mounting calls for racial justice, can marginal reductions in inflation take priority over youth and minority unemployment? If we favour trade unions as defenders of democracy and a powerful countervailing force against inequality, should we not be backing them rather than denouncing wage-price spirals? If we are serious about rebuilding the fabric of our common life with public investment, how far can we subordinate fiscal policy to the demands of financial stability? And if you understand the extreme urgency of the climate problem, can we risk throttling green investment with austerity, as we did in the 2010s?

These are serious choices. But if liberal democracy means anything it must involve reasoned public debate. And that means not slamming the door shut to argument by invoking the bogeymen of the 1970s and demanding that central banks must do whatever it takes. That is not democratic debate. That is the old neoliberal logic of “there is no alternative”. That logic bequeathed us the truculent reaction of populism. If you are truly interested in finding a better balance between capitalism and democracy, the one thing you should be about if alternatives. Even when it comes to inflation.