This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening.

Uncertainty around China’s economy and its relations with the west cranked up a notch today as western business leaders warned of the hit to investor confidence and fresh data confirmed the country’s recovery was faltering.

JPMorgan chief Jamie Dimon said at a conference in Shanghai that China’s crackdown on consultants and tech businesses would not only damage foreign direct investment in the country but also exacerbate the growing tensions between Washington and Beijing.

Yesterday it was the turn of Tesla boss Elon Musk who (according to the Chinese foreign ministry) called for “stable and constructive” ties between the “conjoined twins” of the US and China as he met foreign minister Qin Gang.

US-China tensions are also causing great anxiety in Taiwan as western businesses look to extract themselves under the fear of invasion from their larger neighbour, which, in the words of one industry executive, would leave the tech and electronics industry worldwide “basically screwed”.

Another casualty of the growing tensions was highlighted yesterday by the head of Goldman Sachs’s private equity business in Asia, who said they had led her to stop raising money in the US.

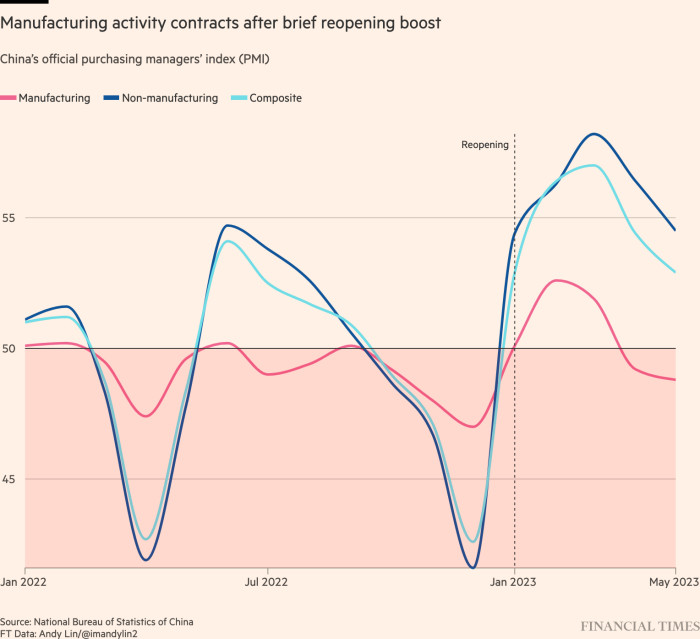

Meanwhile the steady drip of disappointing news on the Chinese economy continues. New data today showed factory activity shrank in May, denting global stocks and raising the prospect of a government stimulus package.

It follows worse than expected reports on industrial production and profits, property sales and credit growth that have sapped confidence in near term economic prospects as well as denting commodity and currency markets.

Dimon also highlighted “scary” youth unemployment of more than 20 per cent amid concerns about the country’s broader demographic challenge, which could rival similar crises in Japan and Italy.

On the positive side, the US and China have made tentative efforts to stabilise the situation with trade ministers holding talks. And despite the recent tech tussles, Chinese companies are still keen on opening factories in the US.

Washington needs to grasp any opportunity to steady the situation, argues Evan Medeiros, who served in the US National Security Council, and who characterises the process as one of “reconnection” rather than “detente”.

One thing that definitely needs to be addressed, according to FT contributing editor Ruchir Sharma, is the series of inflated expectations from Wall Street about a “booming” Chinese economy. A growth model dependent on stimulus and debt was always going to be unsustainable, he argues, and now it has run out of steam.

“Boomy” chatter has let to investors losing hundred of billions of dollars in China over the past few months, Sharma writes. And global growth in 2023 may be weaker than expected as hopes fade that an American downturn will be countered by a strong Chinese recovery, which may never come. “It is time to expose this charade before the fallout gets worse,” he concludes.

Need to know: UK and Europe economy

UK prime minister Rishi Sunak visits the US next week but a trade deal between the two countries is not on the agenda.

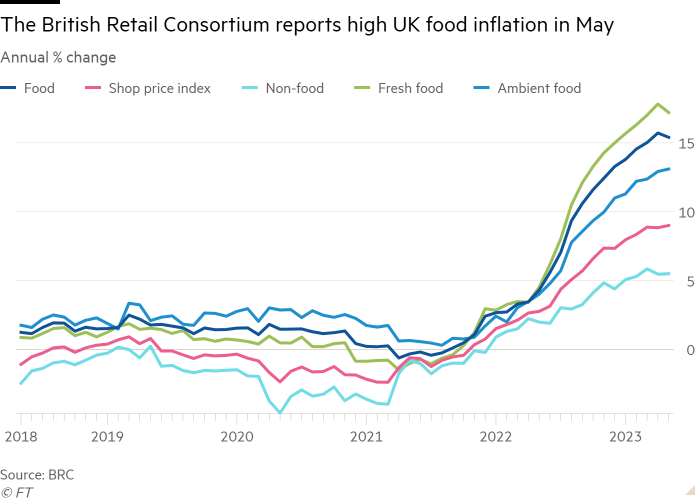

Retail industry data showed UK shop price inflation reached its highest rate for at least 18 years in May, despite the pace of food price growth marginally easing. The UK’s most vulnerable parts of society are suffering the most.

Welcome news on falling inflation in Germany, France and Spain has boosted hopes that the European Central Bank might stop increasing interest rates by July.

Brussels said it would extend EU single market benefits to western Balkan countries waiting their turn to enter the bloc. The would-be members could benefit in areas such as ecommerce or cyber security as well as easier trade in goods and payments.

Need to know: Global economy

The bipartisan deal to raise the US debt ceiling cleared its first big hurdle in Congress and is set for a make-or-break vote in the full House. US national editor Edward Luce says it’s game, set and almost match to Joe Biden. Read our explainer on the deal.

US business leaders are starting to seek alternatives to Donald Trump and Ron DeSantis for the Republican presidential nomination without the former’s unpredictability and the latter’s culture-war fervour.

India’s economy grew by a greater-than-expected 7.2 per cent in the year to March, confirming the country’s status as one of the world’s fastest growing.

Need to know: business

Nvidia became the first chipmaker with a $1tn valuation as investors flocked to benefit from AI developments. The company on Monday launched a new supercomputer and announced a string of new AI alliances.

Rising interest rates have set back European bank mergers and acquisitions by at least two years, dealmakers warned, as accounting rules mean assets being revalued at significantly lower levels.

Philip Morris chief Jacek Olczak said the tobacco company’s move away from cigarettes and towards less harmful vaping alternatives meant it should now qualify as an ethical stock.

US retailers are warning of a surge in thefts, costing some of them hundreds of millions of dollars as they try to outwit organised criminals with extra security and surveillance.

An FT Big Read does a deep dive into Centerview, the Wall Street boutique bank involved in a bitter lawsuit over the departure of a company founder.

Read how a self-made Chinese billionaire has come to dominate a key component of electric car batteries, with plans to further his country’s lead in the market.

The World of Work

The FT rounds up the views of bosses about “the right to disconnect” and how they view legislation to protect workers’ time.

White-collar jobs seem to expand to fill the available time, whatever the progress of technology, writes columnist Sarah O’Connor.

Formal pre-pandemic workwear doesn’t feel quite right anymore, but what should we choose instead? FT fashion experts offer some tips for updating your look in the new Working It podcast.

Do say: I loved The Diplomat! Don’t say: Hey, who’s the muscular guy with the sunglasses following you everywhere? Columnist Stephen Bush offers some tips on how to make small talk at a diplomatic function.

Some good news

The York groundsel, a flower that became extinct in 1991 thanks to excessive use of weedkiller, has been resurrected in the city of its name in Britain’s first ever “de-extinction event”.

Recommended newsletters

Working it — Discover the big ideas shaping today’s workplaces with a weekly newsletter from work & careers editor Isabel Berwick. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at [email protected]. Thank you