This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

The US Federal Reserve pinned the blame for the failure of Silicon Valley Bank on Trump-era changes in regulation.

Richard Sharp quit as BBC chair after an investigation found that he breached the rules by failing to declare his role in a loan guarantee made to former prime minister Boris Johnson before Sharp’s appointment.

The UK government’s hopes of easing the health workers’ pay dispute in England were boosted after the GMB union said its members had accepted a deal. Although members of the Unite union have voted against, the GMB’s backing is likely to swing a crucial vote at next week’s meeting of NHS employer representatives, unions and the government.

For up-to-the-minute news updates, visit our live blog

Good evening.

Fresh economic data on both sides of the Atlantic today has complicated matters for policymakers ahead of key policy decisions next week from the US Federal Reserve and the European Central Bank.

The eurozone returned to growth in the first quarter but the rise in output was a less than expected 0.1 per cent, as weaknesses in Germany, the bloc’s biggest economy, offset better figures from France, Italy and Spain.

Meanwhile national data showing inflation remaining high in several eurozone countries such as France led investors to bet that the ECB would stick with the pace of its interest rate-rising programme next Thursday. Just to make the ECB’s job that much more difficult, Germany then reported inflation had slowed more than expected, to 7.6 per cent.

Pierre Wunsch, the head of Belgium’s central bank and one of those who will be part of the ECB decision, told the FT this week that investors were underestimating how high rates could still go, especially if wage growth remains stubbornly high.

The Fed, which makes its decision on Wednesday, also faces a difficult balancing act.

US labour costs, which it sees as one of the most reliable indicators of wage growth and hence inflation, increased by more than expected in the first quarter. Separate inflation data, including the “core” reading of the personal consumption expenditures price index — the Fed’s favoured measure — was also higher than expected at 4.6 per cent in the year to March, down from an upwardly-revised 4.7 per cent in February.

Separate data yesterday showed economic growth in the first quarter slowing more than expected to 1.1 per cent. Officials have said that returning to the Fed’s longstanding 2 per cent target for inflation would need a period of below-trend growth as well as a softening in labour market conditions.

For comparison, the US economy is now 1.6 per cent larger than in the first quarter of 2022, compared with eurozone growth of 1.3 per cent and 4.5 per cent for China.

Need to know: UK and Europe economy

The UK is set to abandon its much-criticised plan to ditch thousands of pieces of EU-derived law by the (arbitrary) deadline of the end of this year, sparking fury among Brexit ultras.

The UK also announced the biggest shake-up in the gambling industry since 2005 with new restrictions on online platforms to curb problem gambling and a levy on operators to fund public health initiatives.

Brussels is discussing restrictions on certain EU exports to countries that it suspects are re-exporting sanctioned products to Russia, in an effort to prevent critical components from ending up on the battlefield in Ukraine.

Coal demand in Europe fell over the winter despite the energy crisis, leaving renewable energy outstripping fossil fuels for electricity generation for the first time.

Need to know: Global economy

US president Joe Biden is urging Wall Street donors to help fill a $1bn-plus war chest to fund his campaign for re-election. Republican donors meanwhile are uncertain where to place their bets as would-be contender Ron DeSantis, in London today to burnish his foreign policy credentials, struggles to mount an effective challenge to Donald Trump.

American authorities ordered a tanker of Iranian crude oil to redirect towards the US, in a move officials believe was the trigger for Iran’s decision to capture a US-bound tanker on Thursday. The Opec cartel hit out at the International Energy Agency’s calls to halt investment in oil, arguing it was stoking “volatility”.

The latest sign of Chinese consumers tightening their belts? Falling demand for cheese lollipops.

Our latest piece of visual journalism is an in-depth look at India’s changing population. Can the country’s policymakers seize the demographic dividend of a large youthful population to accelerate growth and help it become an economic superpower?

Need to know: business

Deutsche Bank reported its highest profit in a decade in the first quarter, a 12 per cent rise to €1.9bn, but revealed it was subjected to a speculative attack during the recent banking turmoil. It also announced the acquisition of UK broker Numis.

Barclays reported a 27 per cent rise in profits to £1.8bn as rising interest rates boosted income from retail banking and credit cards. NatWest shares fell on disappointing deposit figures despite reporting better than expected pre-tax operating profits of £1.8bn.

Profits at ExxonMobil and Chevron fell from record highs in the first quarter, but still beat Wall Street forecasts. Exxon made $11.4bn while Chevron reported earnings of $6.6bn.

Solid first-quarter results from US Big Tech have buoyed confidence in the sector after a period of cost-cutting. AI is clearly a better investment proposition for Facebook parent Meta than its earlier focus on the metaverse, the Lex column says. Norway’s $1.4tn wealth fund called for AI to be state regulated.

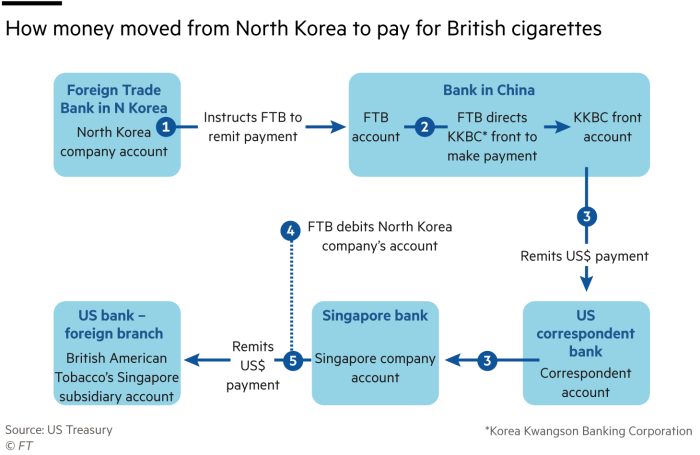

British American Tobacco this week agreed to pay a $635mn penalty to US authorities after a subsidiary pleaded guilty to charges that it violated US sanctions on North Korea, in the largest settlement of its kind. Here’s our explainer.

Science round up

A Japanese company’s bid to make the first commercial Moon landing ended in failure after the module crashed on to the lunar surface. The mission was masterminded by ispace, a start-up that carried the hopes of thousands of investors and a country desperate for success in outer space.

Commentator Anjana Ahuja, reporting on historical treasures being made accessible online by the Royal Society, highlights the power of scientific rivalries in driving innovation.

US pharma group Eli Lilly is seeking approval for its obesity drug Tirzepatide, which tests have shown can slash body weight by nearly a sixth.

US regulators approved the first human pill derived from human faeces for the potentially deadly gut infection C.difficile. It is one of a new class of “microbiome therapeutics” that aim to restore the balance of live bacteria in patients’ guts to boost their immune system and prevent infection.

The devastating drought in the Horn of Africa was made 100 times more likely because of climate change, scientists have concluded. The drought that has hit swaths of east Africa since 2021 has led to crop failures, animal deaths and left more than 4mn people in need of humanitarian assistance and 20mn at risk of food insecurity.

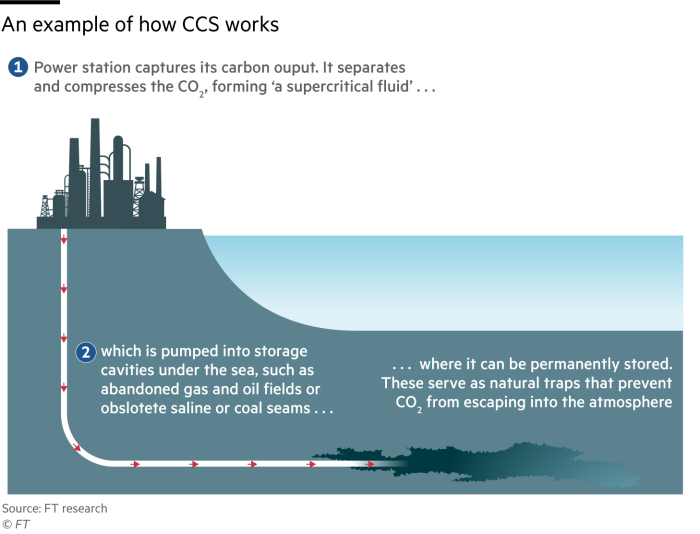

British companies are finally attempting to make carbon capture a reality after years of encouragement from the government. The big prize is a domestic industry that not only helps reduce domestic emissions but can ensure its profitability by storing carbon shipped in from other countries.

Some good news

US researchers say they have discovered how long-lasting memories form in the brain, potentially shedding light on the causes of neurological illnesses such as Alzheimer’s.

Something for the weekend

The FT Weekend interactive crossword will be published here on Saturday, but in the meantime why not try today’s cryptic crossword?

Interactive crosswords on the FT app

Subscribers can now solve the FT’s Daily Cryptic, Polymath and FT Weekend crosswords on the iOS and Android apps

Some good news

Recommended newsletters

Working it — Discover the big ideas shaping today’s workplaces with a weekly newsletter from work & careers editor Isabel Berwick. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at [email protected]. Thank you