Miss something this week? Don’t panic. CBC’s Marketplace rounds up the consumer and health news you need.

Want this in your inbox? Get the Marketplace newsletter every Friday.

‘Elaborate scam’ leaves seniors with high-interest mortgages they didn’t want or understand

It started with a knock on the door, but became a high-interest mortgage that 79-year old Karl Hoffmann’s family says he never asked for or understood.

Some seniors are at risk of losing their homes in a scheme involving door-to-door equipment rental contracts, questionable renovations and mortgages worth hundreds of thousands of dollars that many didn’t know they had and can’t afford, a Marketplace investigation has found.

Lawyers familiar with the situation say there are potentially hundreds of victims throughout Ontario — in what one called an “elaborate scam.”

“These homeowners are at risk of homelessness and the loss of their life savings and the entire equity in their homes,” said Graham Webb, the executive director of the Advocacy Centre for the Elderly (ACE), a legal aid clinic for low-income seniors in Ontario.

Each situation is unique, but many seem to follow a general pattern where homeowners — usually seniors — who have previously been duped into various door-to-door HVAC equipment rental contracts are again approached at their homes by people who say they can help the homeowner consolidate their debt.

In some cases, the homeowners are told they are eligible to receive money back if they buy more equipment or have renovations done on their homes. In reality, their home is used as collateral and they are allegedly tricked into signing mortgage papers that many say they did not understand.

The Ontario Provincial Police provided Marketplace with a list of tips for people to use to protect themselves and their loved ones, including:

- Answer the door only if you are expecting a guest.

- Hang up on unsolicited phone calls.

- Never share personal information or copies of any bills or financial statements.

- And check regularly on family or others who might be vulnerable to persuasive individuals Read more

Once featured on HGTV, pool builder accused of swindling customers

Dozens of Kurt Wittin’s customers have called him a scammer, a conman, a snake oil salesman — and far worse. They claim to be out tens of thousands of dollars each.

The Winnipeg man is facing — and has lost — lawsuits from across North America. But it hasn’t stopped him. In spite of all this, he landed a prime spot for his prefabricated pool business on popular HGTV show Fixer to Fabulous in 2022.

“That is exactly what got me to sign a contract with him,” said Winnie Lin. She paid Wittin $27,000 to build a pool out of a metal shipping container and ship it to her in Prince George, B.C.

Lin never received her pool, or a refund. She even contacted the police, who recommended filing a civil suit against Wittin.

Wittin’s business address has changed multiple times, and process servers attempting to deliver legal documents have been among those facing challenges in finding him.

But Wittin did agree to meet a CBC crew at a new address in Headingley, Man.

The new business location did have shipping containers in various stages of being converted into pools. Wittin showed one complete pool that he said had been ordered in the last six months and was set to be shipped out in days. He did not explain why pools ordered previously had not been built or shipped.

Wittin said the failure to make deliveries or offer refunds was the result of a business partnership gone bad, COVID and supply issues. Disappointed customers say they’ve heard the same explanations for years. Read more.

You can watch the full investigation into Wittin, including his interview with Marketplace host David Common, on CBC Gem.

From groceries to booze, payday loans to plane tickets — here’s what the budget means for your wallet

With inflation still near its highest level in decades, the federal budget unveiled in Ottawa on Tuesday offered a lot of talk about making life more affordable for Canadians — but few details about how it’s all going to work.

One of the biggest items leaked prior to the budget’s release is something the government is calling a “grocery rebate,” which is meant to mitigate the cost of grocery prices that are still rising at an annual rate of more than 10 per cent.

It’s an extended version of the existing GST rebate program, which gives cash payouts to refund GST payments incurred by low-income Canadians.

The government says the rejigged program will put an extra $467 into the pockets of the average family with two kids, and $234 for a single person. Government estimates suggest roughly 11 million people will qualify for the rebate, which is to be doled out via a quarterly cheque or direct deposit.

Here are other budget highlights that you’ll want to know about:

- The Air Travel Security Charge, a fee for flyers, is set to increase by almost 33 per cent.

- The federal government says it has struck a deal with credit card companies to reduce interchange fees by about 27 per cent.

- The “excise” tax for booze-makers was set to go up by six per cent this year, but the budget has slashed that increase to just two per cent above last year’s level.

- Some “predatory” lenders will see interest rates capped at 35 per cent, and payday lenders, which are currently exempt from those regulations, will see their rates capped at $14 for every $100. borrowed. Read more

Marketplace has investigated high-interest, long-term loans before. You can watch that story on CBC Gem.

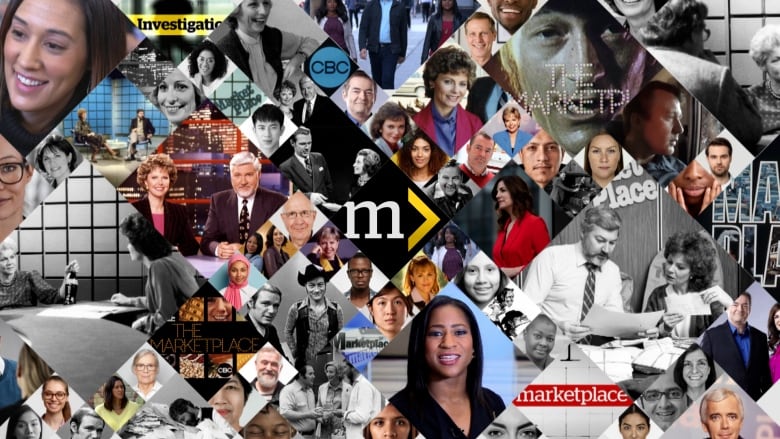

It’s our 50th season finale but we’re not done yet.

Friday marked the finale of our monumental 50th season.

You’ve been with us as we’ve investigated the cost of living, digging into inflation, sneaky fees and rental prices.

We’ve tested products important to you, like whether diamonds match up to how they’re being advertised, why your jeans aren’t fitting and whether dog DNA tests can really tell you the breed of your dog.

We’ve warned you of possible scams to watch out for, like a healer claiming to cure cancer and real estate agents offering to facilitate mortgage fraud,

You’ve fought with us to get action, like when police moved in on movers allegedly ripping people off, when big online retailers removed counterfeit helmets from their sites and when Shoppers Drug Mart got rid of the ‘pink tax’ on some of its products.

But we’re not finished yet. We want to know what you think we should investigate next. Send us your woes, gripes and story ideas to [email protected].

Our show will be back in the fall, but don’t panic. The newsletter will be back in just a few weeks to keep you informed over the spring and summer.

Catch up on past episodes of Marketplace on CBC Gem.