Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. China’s ambassador to the EU has sent a stark warning to the bloc, saying that any country that curbs business ties with his nation would do so “at their own peril”.

Fu Cong claimed the US would “stop at nothing” to disrupt normal relations between the EU and China, adding that a “protectionist tendency” was on the rise in Europe.

The ambassador singled out the Netherlands for having “yielded to the pressure of the US” by announcing restrictions on exports to China of its high-end semiconductor-making technology this year. He hinted Beijing could retaliate if needed and urged the EU to continue its drive for “strategic autonomy”.

Fu’s comments came after European Commission president Ursula von der Leyen earlier pledged to tighten scrutiny of trade and investment flows in sensitive technological areas in the face of an increasingly assertive China.

-

More on US-China tensions: Speaking at a conference of global political and business leaders, China’s premier Li Qiang has warned against allowing “chaos and conflicts” to erupt in Asia amid soaring tensions with Washington.

Here’s what else I’m watching today:

-

China’s overseas listing regulations: Beijing’s new rules for Chinese companies seeking offshore listings come into effect today. (Reuters)

-

China hosts Malaysia’s PM: Malaysia’s Anwar Ibrahim will meet Xi Jinping today on his first visit to China as prime minister. (Al Jazeera)

-

Labour market figures: Japan and the EU will publish labour market updates today.

What did you think of today’s FirstFT? Let us know at [email protected]. Thanks for reading.

Five more top stories

1. BREAKING: Donald Trump has been indicted following a years-long investigation by Manhattan prosecutors that has led to the first criminal charges against a former American president in the country’s history, according to US media reports. We’ll be updating FT.com with the latest.

2. Alibaba will consider ceding control of some of its businesses if they opt to list as part of a break-up into six semi-autonomous units, top executives said, as the Chinese tech group maps out its biggest restructuring in years.

3. Ford plans to invest in a $4.5bn battery materials plant in Indonesia alongside a Chinese mining group, the latest gamble by the US carmaker that drawing China into its supply chain for electric vehicles will not backfire in Washington.

4. Russia has detained Wall Street Journal reporter Evan Gershkovich on suspicion of spying, the first arrest by its secret service of a foreign journalist since the invasion of Ukraine. The crime carries a sentence of up to 20 years in prison.

5. Ken Griffin’s hedge fund Citadel plans to reopen its Tokyo office later this year, almost a decade and a half after shutting down its Japan operations during the global financial crisis. Citadel’s expansion comes as other investors, including the activist fund Elliott, have been growing their Japan-focused teams.

How well did you keep up with the news this week? Take our quiz.

News in-depth

The end of historically low interest rates was billed as good news for banks, but recent crises on both sides of the Atlantic show the reality is more complex, against conventional wisdom. We break down the new threats and challenges at banks as interest rates rise.

We’re also reading . . .

Chart of the day

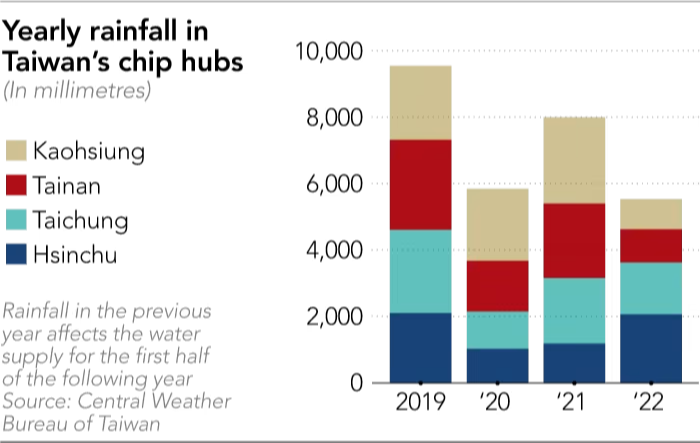

Chipmaking is a thirsty business. Taiwan, home to Asia’s biggest semiconductor industry, is bracing itself for another water shortage less than two years after overcoming its worst drought in a century.

Take a break from the news

Roger Federer reunites with friend and comedian Trevor Noah to give an exclusive interview to the FT on the set of the tennis great’s latest film for Switzerland Tourism, in which they share advice on visiting the country, from Appenzell to Zurich, via cold-water swimming, train travel and skiing the Matterhorn — or not.

Additional contributions by Gordon Smith and Tee Zhuo

Recommended newsletters for you

Asset Management — Find out the inside story of the movers and shakers behind a multitrillion-dollar industry. Sign up here

The Week Ahead — Start every week with a preview of what’s on the agenda. Sign up here

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to [email protected]