This article is an on-site version of our Europe Express newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday and Saturday morning

Good morning and welcome to Europe Express.

Negotiators at the UN climate conference in Egypt are burning the midnight oil to eke out an agreement today, when COP27 should draw to a close. We’ll run through the remaining issues and the likelihood of the meeting ending in disarray.

In Brussels, EU ambassadors have another day of tense energy talks starting with the commission’s gas price cap paper and ending with a crunch vote on the Energy Charter Treaty, a controversial 53-country agreement that has prompted fossil fuel companies to sue several EU governments for lost investments.

A domino slide of EU countries, including France and Germany, have said they will leave the treaty in recent weeks and abstain from a vote on a three-year EU-driven effort to modernise it. The Czech presidency is making a last-ditch attempt to persuade them to vote for the modernisation. Today is the last chance for the EU to agree its position before a crunch vote on the update by all ECT parties next week.

Jeremy Hunt, the UK chancellor, unveiled an austere budget yesterday in response to the dismal economic forecast his country is facing, and we’ll look at his plans to scrap EU-era regulations in five areas.

Last-ditch effort

The EU is turning up the heat at the COP27 climate summit after the Egyptian hosts so far failed to mediate a compromise between the developing world and high-income countries on how to fund measures to protect countries most at risk from climate change, writes Alice Hancock in Brussels.

Jan Dusík, the Czech deputy minister for climate protection, one of the EU’s lead negotiators, told Europe Express that some of the wording in the latest document released yesterday morning by the Egyptian COP presidency was “very difficult for us to live with” and that concrete language on a phase down or phase out of fossil fuels was “not there”.

“We have made clear to the presidency that time is running out and we are worried,” Dusík said, adding he was concerned that the final agreement would show less ambition to halt the climate crisis than there was at last year’s COP in Glasgow.

The conference has exposed deep divisions between rich western nations, the world’s historical polluters, and developing countries that are suffering the most immediate effects of climate change in the form of extreme weather events.

The G77 group of 134 developing countries plus China has put forward a proposal for the two dozen richest countries in 1992 to pay for a fund to repair climate change-induced damage.

But the EU, which has previously been opposed to a dedicated so-called loss and damage fund, came out all guns blazing to say that while it could support a fund, any such financing should be calculated on the basis of the economic and emitting state of countries in 2022, not 1992 — a less than veiled shot at China, now one of the world’s largest polluters with vastly more economic heft than it had 30 years ago.

Under the G77 proposal, China would benefit from financing measures that should be destined for poorer and more vulnerable countries. This focus was shifting attention from its efforts to cut emissions, one EU diplomat at COP noted.

“The discussion is really focused now on the fund and that actually means that as a consequence of that China gets away very easily,” they said.

Frans Timmermans, the EU’s Green Deal commissioner and head of the EU’s delegation to Sharm el-Sheikh, will announce a proposal for an EU-supported fund early this morning as part of a “mosaic” of solutions including stronger efforts to limit global warming to 1.5C.

He said in a news conference on Thursday that the text put forward by the Egyptian presidency was a compilation of concerns from different parties rather than a draft agreement.

“I hope the presidency will present us soon with a text that we can take as a basis for negotiation,” Timmermans said. “If this COP fails, we all lose. And we have absolutely no time to lose.”

Timmermans warned that it was “going to be quite a long and difficult journey to the end of this process”.

Several EU representatives were already contemplating whether to delay their return tickets.

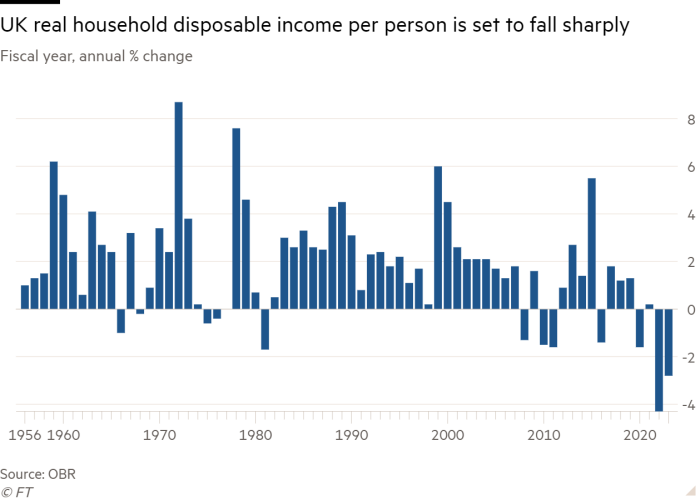

Chart du jour: Two lean years

UK households will be “worse off” for two years in a row, as trade shocks hit the economy and push inflation to a 41-year high while driving historic falls in real disposable income, the Office for Budget Responsibility said yesterday.

Deregulation nation

UK chancellor Jeremy Hunt unveiled £55bn of tax rises and spending cuts yesterday and announced deregulatory plans in five areas where EU rules are still in place, writes Andy Bounds in Brussels.

The UK will have the highest tax burden since the second world war as high energy prices, inflation and Brexit erode its economic performance.

More than six years after the UK voted to leave the EU a poll by YouGov found record numbers — 56 per cent of the population — believe it was the wrong decision, with just 32 per cent in favour.

Hunt himself voted Remain so he was under pressure from pro-Brexiters in his party to stress its benefits. One of their favoured methods is to replace EU regulations with homegrown ones.

He said: “By the end of next year, we will decide and announce changes to EU regulations in our five growth industries: digital technology, life sciences, green industries, financial services and advanced manufacturing.”

He also commissioned a report by chief scientific adviser Sir Patrick Vallance on how to change regulation to “better support safe and fast introduction of new emerging technologies”.

Deregulatory drives in the past have not gone to plan. This week London said it would delay once again the introduction of the “UKCA” product safety mark, a replacement for the CE mark (until 2025) to save industry money.

Last month the government also announced it was delaying the implementation of its new Medical Device Regulations for another 12 months.

The Treasury did finally publish its changes to the Solvency II regime for insurers, a relaxing of capital requirements that will “unlock tens of billions of pounds of investment for our growth-enhancing industries”, Hunt said.

The European Commission declined to comment but will go through every change with a fine-tooth comb to ensure it complies with the UK’s commitment to a “level playing field” with EU rules under its post-Brexit trade agreement.

What to watch today

-

Last day of COP27 in Sharm el-Sheikh, Egypt

-

EU affairs ministers meet in Brussels

Smart reads

-

Overrated deglobalisation: This paper by the Bruegel think-tank largely dispels fears of protectionism having dealt a fatal blow to globalisation. While trade has slowed markedly since the global financial crisis, international integration across nearly all goods and services has continued, keeping protectionism at bay (for the most part).

-

Energy carrots and sticks: To meet EU-wide emergency targets for the reduction of electricity and gas demand, more actionable information campaigns are needed, writes the Centre for European Reform. Governments should also encourage utilities to set up incentive schemes to reward energy savings.

Recommended newsletters for you

Britain after Brexit — Keep up to date with the latest developments as the UK economy adjusts to life outside the EU. Sign up here

Trade Secrets — A must-read on the changing face of international trade and globalisation. Sign up here

Are you enjoying Europe Express? Sign up here to have it delivered straight to your inbox every workday at 7am CET and on Saturdays at noon CET. Do tell us what you think, we love to hear from you: [email protected]. Keep up with the latest European stories @FT Europe