This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Buckle up: Google, Microsoft, Coca-Cola and dozens of other big companies report earnings today. We’re hoping for the best and don’t expect any disasters, but on the other hand, disasters make good copy. Email us: [email protected] and [email protected].

China stock rout

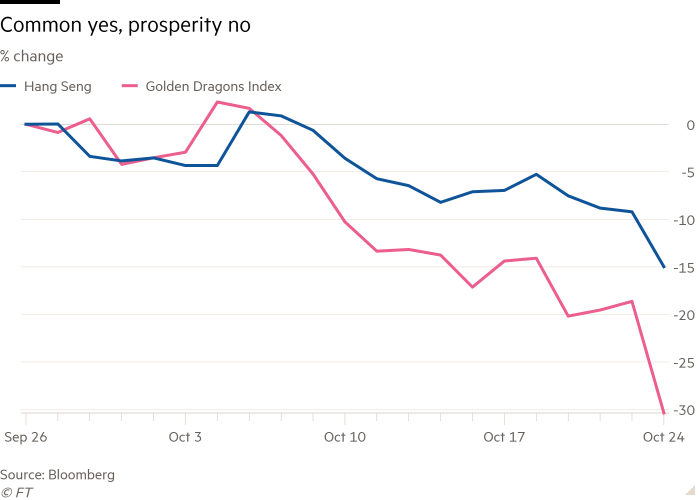

Well, this doesn’t look very good:

On Monday alone, Hong Kong’s Hang Seng index fell 6.4 per cent, and the Golden Dragon index of US-listed Chinese companies fell 14.4 per cent. In one sense, this is just the continuation of a trend. Over two years, the two indices are off a third and two-thirds, respectively. At the same time, the sharpness of the day’s move was striking. The cause, broadly speaking, was the culminating events of the Communist party congress over the weekend and the delayed release of China’s official GDP figures on Monday.

What is odd is that — at least from where Unhedged is sitting, on the other side of the world — the basic picture of China’s political order and economy doesn’t look much different on Monday afternoon than it did on Friday afternoon. To put the point another way, if the news had been the same, and the markets had been stable, would that have been a surprise? Not to us.

The congress was universally expected to be a coronation for Xi Jinping, marking his centralisation of all the powers of the state. And so it was, but perhaps to a slightly greater degree than anticipated. The unsettling scene in which former president Hu Jintao was escorted from the Great Hall of the People was a potent symbol of the removal from the politburo of anyone who is not an absolute Xi loyalist. That removal has economic implications, as Capital Economics’ Julian Evans-Pritchard sums up neatly:

Whether or not one believes Xi’s consolidation of power is good or bad for the economic outlook largely depends on one’s view of his policy agenda . . . it appears to involve a shift away from market-based reforms in favour of a state-led campaign to increase self-sufficiency and economic security, along with a push to redistribute income and wealth. Our view is that it risks undermining productivity growth.

This sounds a bit general but, as almost every commentator has pointed out, a very concrete example of the risks unfolding before us: the wildly destructive zero-Covid policy. Duncan Wrigley of Pantheon Macro noted to Unhedged that the total authority of Xi loyalists “is a further signal of no immediate move from zero-Covid despite the economic disruption”.

Is it really a surprise that Xi’s consolidation of power was absolute? The outcome is bang in line with what was being written in the weeks leading up to the conference.

Turning to the GDP growth, the number was released on a delay and was lower, at 3.3 per cent, than China’s full-year target of 5.5 per cent. Still, it was higher than most analysts expected. The worry, in fact, is that the number was too high to raise the odds of stronger fiscal or monetary stimulus from the government. Retail sales were a little weaker than hoped, but not the stuff of violent sell-offs.

Monday’s sell-off does not reflect a political or economic surprise. What it reveals, instead, is that investors were hoping for a surprise — some small victory for pragmatism amid a celebration of orthodoxy — that never came. Investors’ hopes for China die hard. But die they must.

Bitcoin: Quiet. Too quiet

Crypto, an asset class known for volatility, has been oddly stable since June. Someone out there is buying bitcoin at $20,000 and ethereum at $1,300:

Unhedged has no idea why this particular support level has held. But the sudden (relative) stability of crypto is an occasion to revisit and reassess the question of what cryptocurrencies are.

In last year’s bull market, you heard a few popular stories justifying why bitcoin remained valuable. Broadly, they were that:

-

Bitcoin is a store of value akin to digital gold.

-

Bitcoin is a hedge against inflation.

-

Bitcoin, and crypto, are an immature, ambitious tech project. Investing in it is like betting on a speculative, high-beta tech stock.

The store-of-value argument remains as it ever was. If you are inclined to think an asset that is much more volatile than stocks is a store of value, it will be hard for us to convince you otherwise.

Bitcoin as an inflation hedge is more interesting. In its simplest form, the story now looks just wrong (it looked dubious before). Inflation is at multi-decade highs across the world while crypto is off 70 per cent or more from last year’s peaks. Meanwhile, commodities have returned 33 per cent since US inflation took off in March 2021. Gold, too, has beat the S&P 500.

A subtler version of the story was offered earlier this year by Jeff Currie’s commodities team at Goldman Sachs. They call bitcoin a “risk-on inflation hedge”, as opposed to a risk-off hedge like gold. Bitcoin works for hedging inflation when risk appetites are strong, but not when investors are pulling back, as they have this year.

This case looks weaker now. Inflation is still very high, but changes in sentiment observable in other markets have only moved crypto a bit. Witness the summer bear market rally that reignited risk appetites so much that meme stocks enjoyed a brief spurt of attention. As the S&P rose 17 per cent trough to peak, bitcoin was up just 28 per cent, modest by crypto standards. By contrast, Cathie Wood’s Ark Innovation ETF, a bundle of speculative tech stocks, shot up 43 per cent.

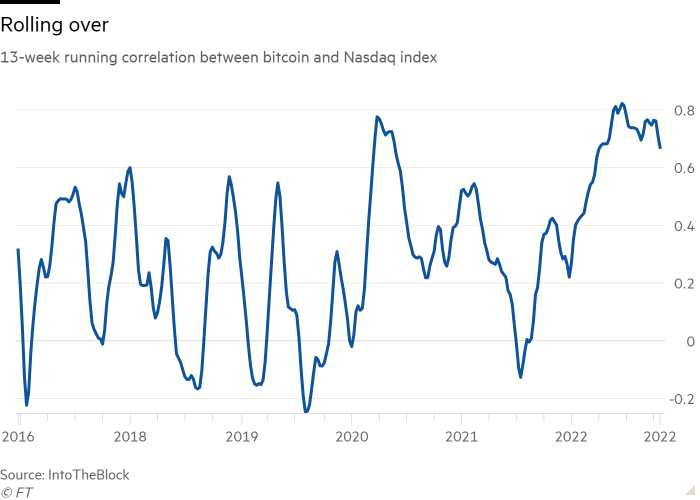

The last theory, crypto as a high-beta tech stock, has looked most convincing to us. At a high level, 2022 seemed to confirm this, with crypto trading in near lockstep with equities (though this is now reversing):

As far as we can tell, the best explanation for the rising correlation is that Wall Street and crypto have become intertwined. Coinbase is serving BlackRock clients, established market makers are peddling crypto and institutional traders are crowding out retail crypto punters.

That also goes some way towards explaining calmer crypto prices. But it shows the limits of the high-beta stock analogy. What would cause shares in an early stage tech company to crash and then stabilise, indifferent to this year’s big swings in risk appetite and interest rate expectations? And, further, why should ethereum and bitcoin trade so close together, despite different designs and technological promises?

Recent experience, in other words, has answered a few questions while leaving many wide open (perhaps they are unanswerable). An asset class you can trade but can’t understand doesn’t appeal to us. But someone out there is happy paying $20,000 per bitcoin, understanding be damned. (Ethan Wu)

One good read

Whither UBS?

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Swamp Notes — Expert insight on the intersection of money and power in US politics. Sign up here