Rishi Sunak is prime minister, after the UK managed to get through an entire BoJo Cycle (opportunism, boosterism, lies, humiliating betrayal of the loyalists) in a matter of mere days — who says the national productivity puzzle can’t be solved?

Given the brief boost given to the pound by Johnson demonstrating he can, in fact, pull out, FT Alphaville is inclined to speculate the former PM simply wanted to make his next holiday a bit more affordable. With stable leadership now in place, it’s now plain sailing for the United Kingdom.

Oh, but the economy.

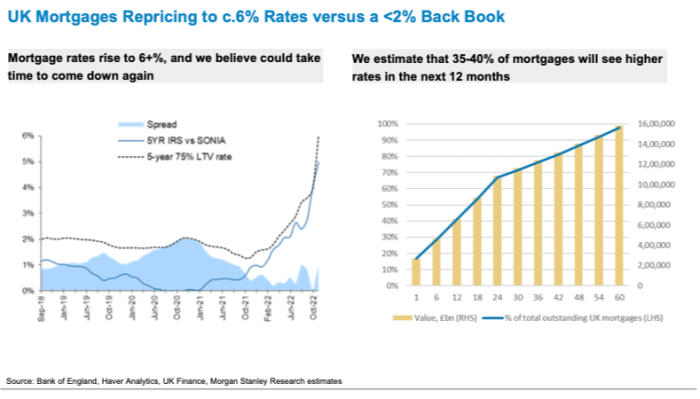

A lot of discussion over the past year has been about the cost of living crisis in terms of price inflation and energy bills. But the other major element is of course mortgage costs. Another vicious cycle: price are soaring —> your friendly, local central bank hikes rates —> now your mortgage is more expensive too. Thanks.

For anyone feeling relieved that the future of the UK is no longer in the hands of the Conservative party membership (we’re not going to get on our high horse about who has a mandates here), Morgan Stanley has a note out today that’s perfectly-timed to wipe the smile off your face. 🥰

A new PM for the UK is incoming, but we think the fiscal course is already changed. A recession awaits, and we forecast the BoE to hike much less than markets next year as growth slows…

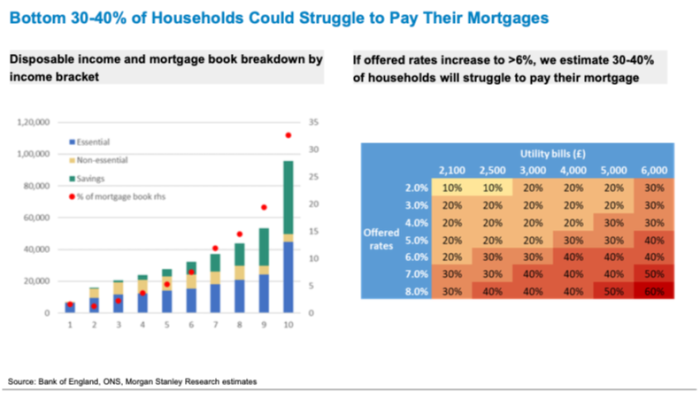

Given short fixed-rate periods, 35-40% of UK mortgages may see higher rates in the next 12 months. Resets are significant for both banks and borrowers; ~6% new rates versus ~2% rates in the back book. With higher utility bills, a 6% mortgage rate could mean that 30-40% of UK households struggle to pay their mortgage.

Read that again. Up to four in ten UK mortgaged households may struggle to stay current on their house over the next year.

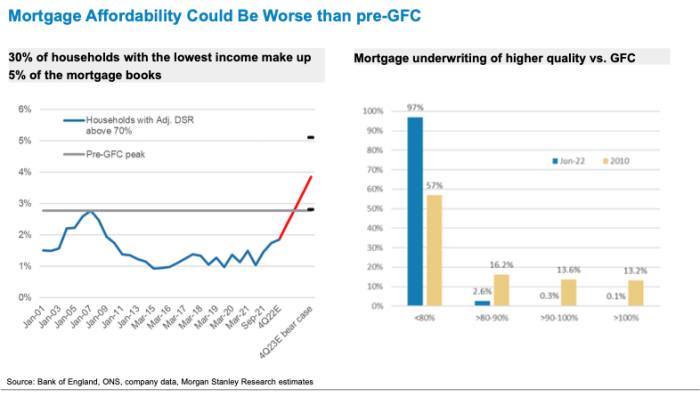

On the plus side, Andrew Sheets, Morgan Stanley’s chief cross-asset strategist, argues that “mortgage underwriting was of significantly higher quality than pre-GFC”. Bank investors may be (a little) relieved; households are probably not.

The further slides are . . . grim:

When Johnson’s leadership fell apart in the early summer, there was a sense that the Conservatives were operating in effectively suspended animation: determined to spend the summer playing to the party faithful despite the tough looming winter.

Now, three-and-a-half months later, we‘re down a monarch and a chunk of credibility, and up some kind of energy bill relief (although exactly what form it will take still seems somewhat up in the air). It would be a great thing to have a fully-functioning government right now. We know that’s a lot to ask though.