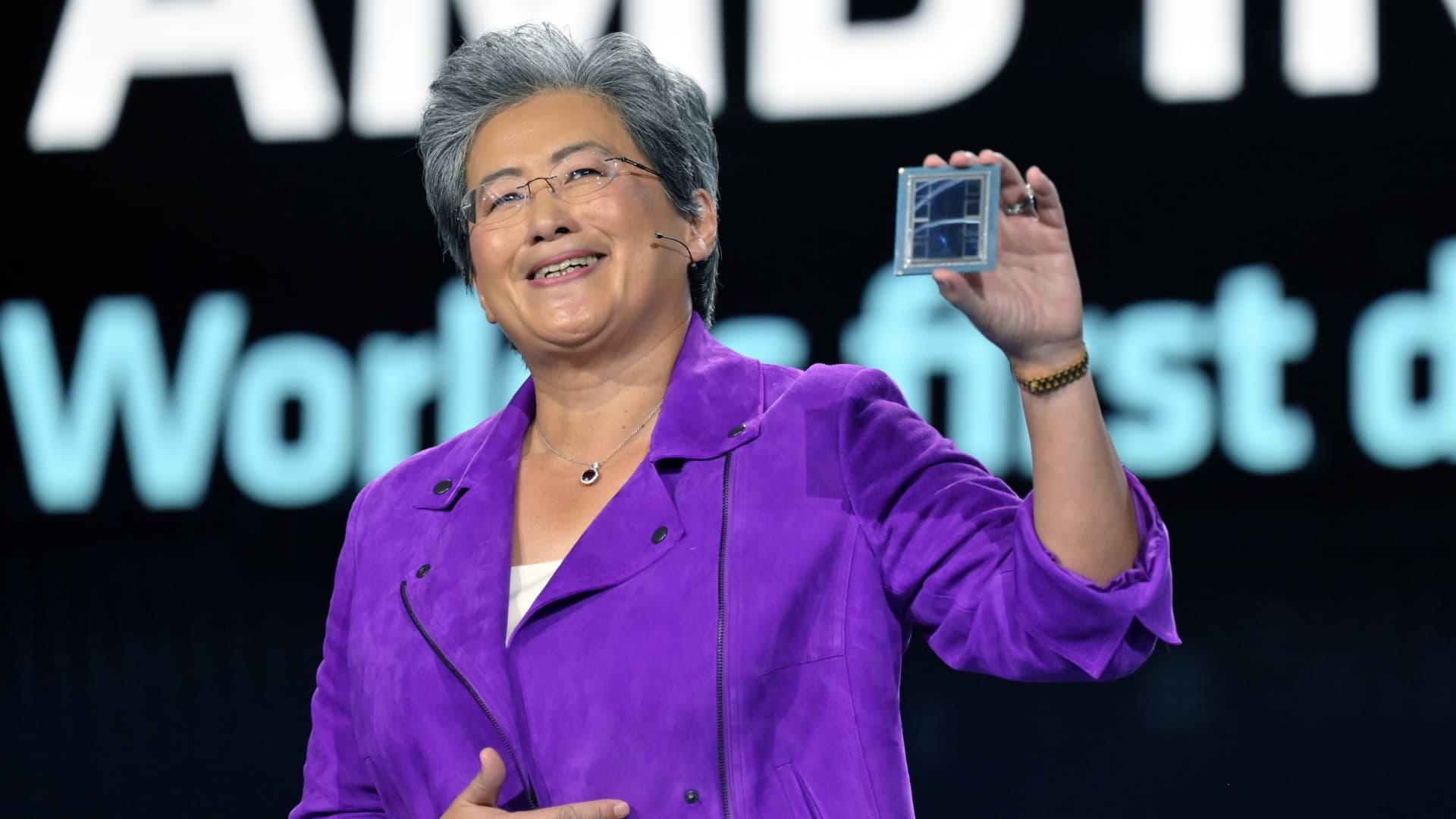

Lisa Su displays an ADM Instinct M1300 chip as she delivers a keynote address at CES 2023 at The Venetian Las Vegas on January 04, 2023 in Las Vegas, Nevada.

David Becker | Getty Images

AMD reported second fiscal quarter earnings on Tuesday, including an 18% decline in year-over-year revenue and a forecast that trailed analyst estimates.

Here’s how the company did:

- Earnings: $0.58 per share, adjusted. That may or may not compare with $0.57 per share expected by Refinitiv consensus estimates.

- Revenue: $5.36 billion. That may or may not compare with $5.31 billion expected by Refinitiv consensus estimates.

For the third quarter, AMD said it expected $5.7 billion in sales, versus a Refinitiv estimate of $5.81 billion.

The company reported net income of $27 million, or $0.02 per share, versus $447 million, or $0.27 per share, in the same quarter last year. AMD excludes certain losses on investments and acquisition-related costs from its earnings.

AMD’s processor business has slowed in recent quarters as the global PC market is in a deep slump. But AMD is one of the few companies making high-end GPUs needed for artificial intelligence, and analysts are watching to see if its server chips can take market share away from Intel. Overall sales at AMD fell 18% on an annual basis.

Intel, AMD’s primary competitor, posted a surprise profit last week after earnings and sales were higher than expected.

AMD’s client group, which includes sales from PC processors, dropped a massive 54% annually to $998 million because of a “weaker PC market,” it said. AMD noted that market conditions are improving.

AMD’s data center segment reported a 11% decline to $1.3 billion, which the company said was due to lower server processor sales because of soft demand. It added that some cloud providers had extra inventory during the quarter.

During the quarter, AMD announced a new chip that is intended to build and run the kind of AI models that are at the heart of applications like ChatGPT. AMD said that chip, the MI300X, was currently being provided to customers for sampling.

AMD sells less-powerful chips and networking parts in its embedded segment, which was the only sector of AMD to grow at about 16% year-over-year to $1.5 billion.

AMD’s gaming segment includes graphics processors for PCs as well as chips for consoles like Sony Playstation 5. It dropped 4% on an annual basis to $1.6 billion, which AMD said was because of high demand for “semi-custom” chips like the ones it makes for game consoles.