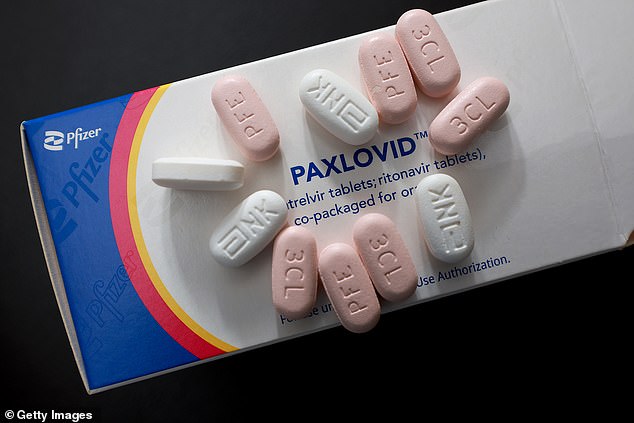

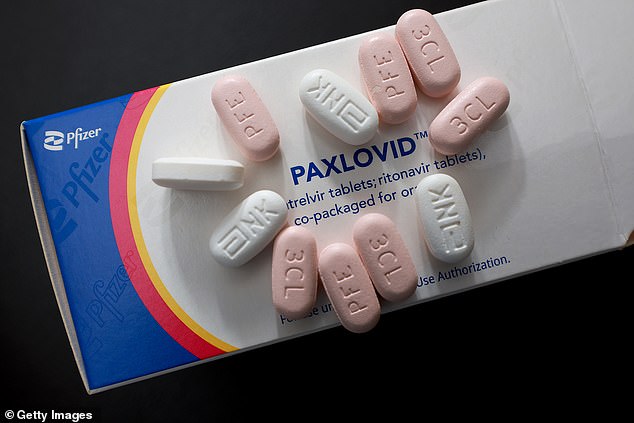

A former Pfizer employee has been charged with insider trading, after prosecutors said he tipped off a friend to confidential trial results for the COVID-19 antiviral drug Paxlovid.

Amit Dagar, 44, of Hillsborough, New Jersey was arrested on Thursday morning and is charged with four counts of securities fraud and one count of conspiracy to commit securities fraud.

Prosecutors say that on November 4, 2021, Dagar tipped off his close friend Atul Bhiwapurkar that a clinical trial had produced promising results, showing Paxlovid significantly reduced hospitalization or death for high-risk COVID patients.

The duo then purchased stock options that would soar in value if Pfizer’s stock price rose, before the drug company announced the successful trial results the following day, according to the indictment.

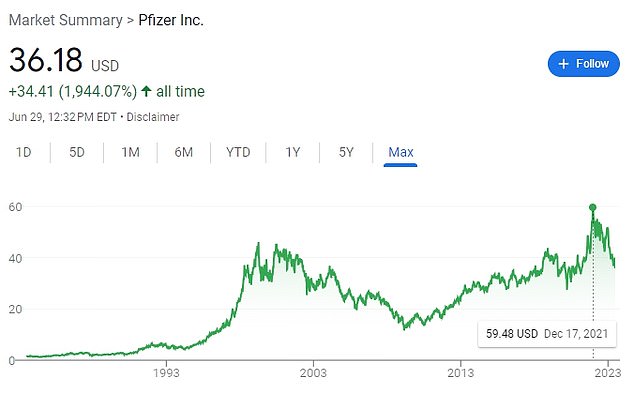

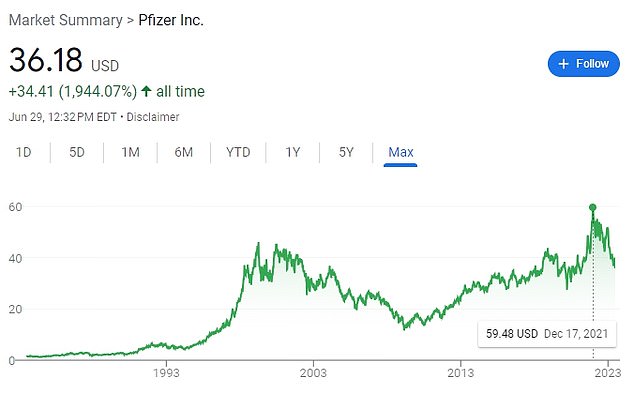

The Paxlovid announcement send Pfizer shares surging 10 percent on November 5, 2021, on their way to an all-time high in the following weeks, and prosecutors say that Dagar and Bhiwapurkar together made roughly $325,000 in illicit gains.

A former Pfizer employee has been charged with insider trading, after prosecutors said he tipped off a friend to confidential trial results for the COVID-19 antiviral drug Paxlovid

The Paxlovid announcement send Pfizer shares surging 10 percent on November 5, 2021, on their way to an all-time high in the following weeks

Bhiwapurkar, 45, of Milpitas, California, was also arrested on Thursday morning and is charged with two counts of securities fraud and one count of conspiracy to commit securities fraud.

According to the indictment, Dagar was a statistician for Pfizer and was not supposed to know about the results of the Paxlovid trial before they were publicly announced.

But he learned of the trial’s success from a boss, who warned him about the pending announcement in a message telling him to ‘prepare for some hard work ahead’, the indictment says.

Prosecutors say that hours later, Dagar purchased $8,380 worth of short-dated, out-of-the-money call options in Pfizer stock, which earned him a profit of $270,000 when he sold them the next day, a 3,000 percent gain.

Bhiwapurkar similarly spent $7,426 on stock options which he sold the following day for $76,000, a 900 percent profit.

The indictment notes that an unindicted coconspirator identified as Individual-1 also acted on a tip from Dagar, and made a profit of $25,000.

It was not clear whether Dagar and Bhiwapurkar had attorneys to speak on their behalf. A Pfizer spokesperson did not immediately respond to a request for comment from DailyMail.com on Thursday morning.

A Pfizer spokesperson did not immediately respond to a request for comment from DailyMail.com on Thursday morning

The charges were made public in a sweeping announcement of 10 arrests in four separate insider trading cases unsealed on Thursday in US District Court for the Southern District of New York.

The other cases involved a police chief in Massachusetts, an investment firm executive director, and investors in the Special Purpose Acquisition Company (SPAC) that acquired Donald Trump’s media company.

‘Insider trading is not easy money,’ US Attorney Damian Williams said in a statement. ‘It’s cheating. It’s a bad bet.’

Prosecutors said the three defendants charged in relation to Trump’s media company made more than $22 million through insider trading of the SPAC that acquired Trump Media & Technology Group in a reverse merger.

The charges were outlined in an indictment unsealed in Manhattan federal court that did not implicate Trump in any way.

According to the indictment pertaining to the media company, the men were invited to invest in the special purpose acquisition company, Digital World Acquisition Corp.

Prosecutors said they were provided confidential information that a potential target of DWAC and another acquisition company, Benessere Capital Acquisition Corp, was Trump Media & Technology Group.

Separately, three Florida men were arrested Thursday and charged with illegally making more than $22 million by insider trading in the SPAC that bought Trump’s media company

Authorities said the defendants bought millions of dollars of DWAC securities on the open market before news of the Trump media business was made public.

After the public announcement, the men dumped their securities for a significant profit, according to the court papers.

The men who were arrested in that case were identified as Michael Shvartsman, Gerald Shvartsman and Bruce Garelick.

It was unclear who would represent them at initial court appearances scheduled for later Thursday in Miami.