Amazon Web Services logo at the Web Summit in Lisbon.

Henrique Casinhas | Sopa Images | Lightrocket | Getty Images

The cloud-computing market keeps growing as companies move an increasing number of workloads out of their own data centers, but executives from the leading cloud vendors said this week that clients are looking for ways to trim costs.

The result is slowing revenue growth at the cloud divisions run by Amazon, Microsoft and Google. And for Amazon Web Services, the leader in the space, it means a slimmer operating margin and less profit for its parent company.

related investing news

It’s a phenomenon that began in 2022, as fears of a recession hit the economy. AWS saw deceleration in the third and fourth quarters, and last quarter Microsoft finance chief Amy Hood spooked analysts with comments about a slowdown in December that she expected to persist.

Amazon finance chief Brian Olsavsky was the bearer of bad news for investors on Thursday, when he said that in April, AWS revenue growth had slumped by about five percentage points from the first-quarter growth rate of almost 16%. The company’s stock price slid in response.

Amazon CEO Andy Jassy said “what we’re seeing is enterprises continuing to be cautious in their spending in this uncertain time.”

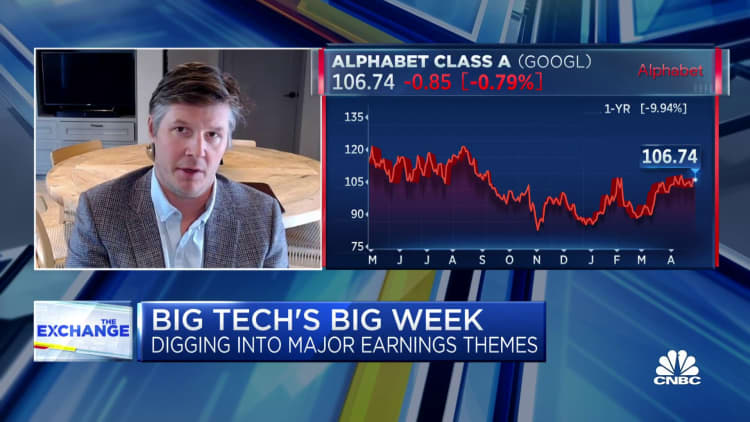

At Google, cloud growth slowed to 28% from a year earlier in the first quarter from 32% in the prior period. The deceleration occurred even as Google’s cloud segment reached profitability for the first time on record.

“We saw some headwind from slower growth of consumption with customers really looking to optimize their costs given that macro climate,” said Ruth Porat, Alphabet’s finance chief, on Tuesday’s earnings call.

Sundar Pichai, Alphabet’s CEO, said the slowdown is understandable.

“We are leaning into optimization,” he said. “This is an important moment to help our customers, and we take a long-term view. And so it’s definitely an area we are leaning in and trying to help customers make progress on their efficiencies where we can.”

The companies remain optimistic that cloud will continue to be a strong market for tech, as businesses still have a long way to go before they’ll be fully taking advantage of the benefits.

“People sometimes forget that 90-plus percent of global IT spend is still on-premises,” Jassy said.

And Hood noted that pretty soon the financial comparisons will be against numbers from the point last year when the market was softening.

“When you start to anniversary that, you do see that it gets a little bit easier in terms of the comps year-over-year,” Hood said.

WATCH: Ongoing deceleration in IT spending not reflected in tech earnings