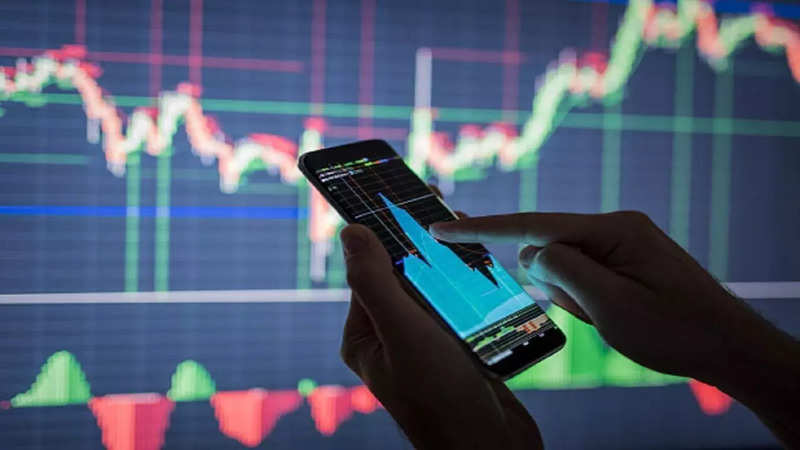

A rally in technology stocks drove up Indian shares more than 1 percent on Monday, with the market also benefiting from an improvement in the global mood after China eased its COVID-19 curbs.

The NSE Nifty 50 index was up 1.61 percent at 16,614.60 by 0427 GMT, while the S&P BSE Sensex rose 1.64 percent to 55,785.70. Both the indexes added more than 1 percent.

All the major sub-indexes advanced, with Nifty’s IT sub-index leading the pack with a 3.6 percent rise.

HCL Technologies and Infosys jumped more than 3 percent and were the top gainers on the Nifty 50.

The market is set for a near-term rally and the beaten down IT segment is likely to stage a good comeback, assisted by short-covering, said V K Vijayakumar, chief investment strategist at Geojit Financial Services, in a note.

Stocks in India’s $194-billion IT sector have taken a beating in recent months from growing investor worries about inflation, supply chain issues and the impact of the Ukraine war on client spending.

The sentiment was also underpinned by news that Shanghai will cancel many conditions for businesses to resume work from Wednesday, which along with hopes of an eventual slowdown in U.S. monetary tightening, sent MSCI’s broadest index of Asia-Pacific shares outside Japan up 1.2 percent.

Among the top movers, automaker Mahindra and Mahindra rose 3.6 percent to a near four-year high after it reported a jump in quarterly profit over the weekend.

Tata Motors gained 2.3 percent after the automaker said it could acquire Ford India’s plant in Gujarat.

Realty stocks advanced 3.5 percent to a one-week high.

Electronic components maker 3M India soared 18.9 percent on the back of strong March-quarter numbers.

Among the few decliners, JSW Steel fell 4.2 percent after it logged a fall in quarterly profit.

FacebookTwitterLinkedin