Do the United States and China truly shape the global economic agenda? A new study investigating the relationship between global powers and the stock market has revealed they have more economic influence than previously thought.

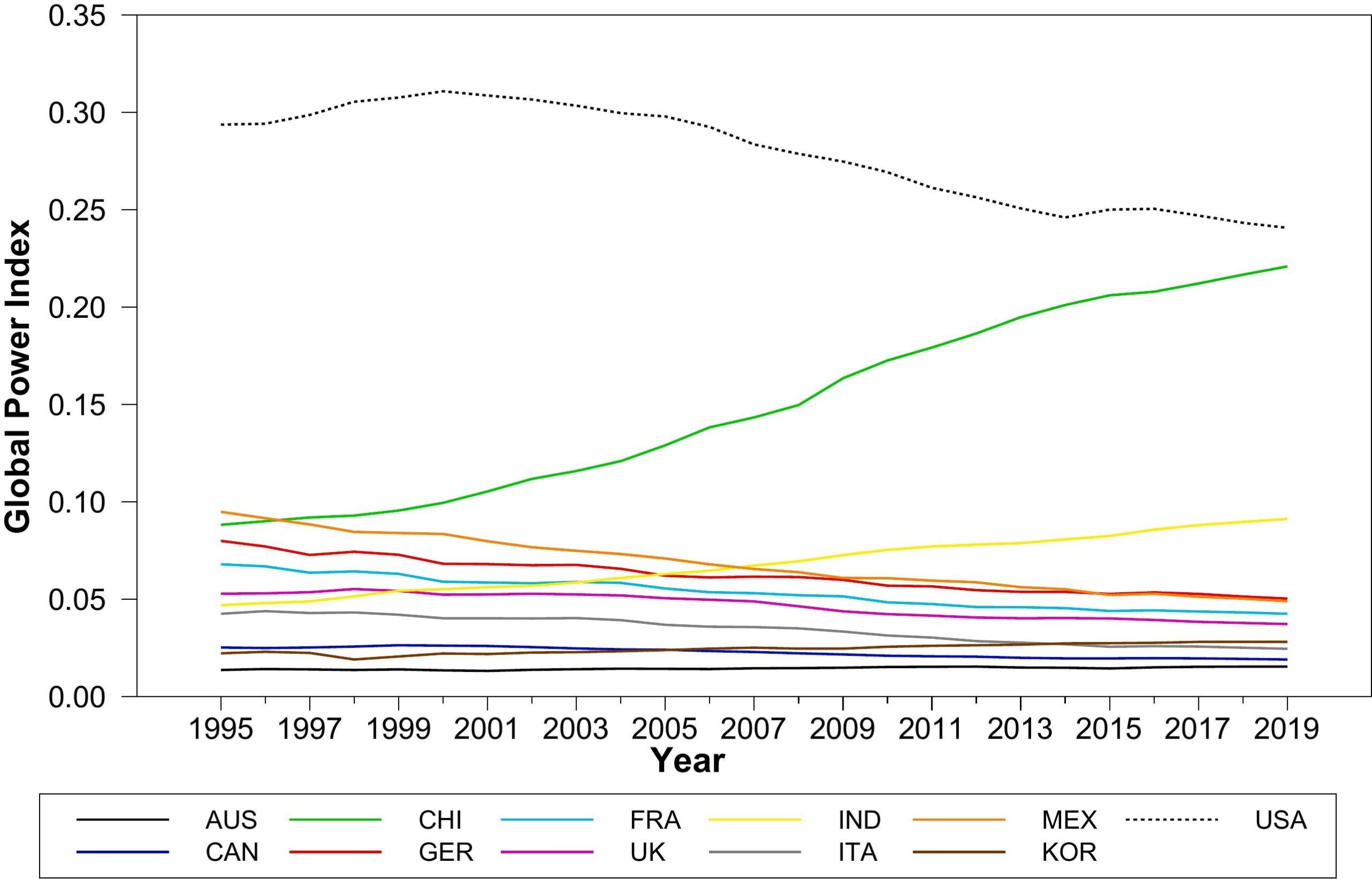

The study by Charles Darwin University (CDU) and Griffith University revealed how rich and powerful nations influence the policies of less powerful economies by exploring the correlation between the Global Power Index (GPI) and relative stock market performance and integration.

This study is the first of its kind to establish such a relationship. The research is published in the Global Finance Journal.

The authors examined economic and stock market data over 25 years for 11 nations: Australia, Canada, China, Germany, France, India, Italy, Korea, Mexico, the United Kingdom and the United States.

These regions represent 58.05% of the gross domestic product of global markets and 46.17% of the global population.

Lead author and CDU Associate Professor of Accounting and Finance Rakesh Gupta said the results showed the Australia and United States stock market changes with respect to other markets were more stable, whereas India’s and China’s stock market changes with respect to other markets were more volatile.

“The findings of the study are significant for investors who seek to benefit from investing in international investments,” Dr. Gupta said.

“A portfolio manager from a market with strong global power who seeks international diversification benefits is less likely to benefit from diversifying into markets that have stronger and increasing global power. They will need to invest in markets with weaker and declining global power.”

The study also found education and environmental awareness are likely to impact the stock market.

“Findings suggest that more environmentally aware investors cause stock markets to deviate from each other,” Dr. Gupta said.

“Similarly, a higher level of education impacts negatively on the convergence of the stock markets. This can also be interpreted as environmentally aware investors and more educated investors looking at domestic markets more favorably and, as such, cause investors to invest locally.”

Dr. Gupta said based on the study’s findings, Australia should continue aligning itself economically with major powers such as the United States.

“When we consider Australia, it is developed but not powerful from a global perspective and as such it may not have an impact on global markets,” Dr. Gupta said.

“Whereas China, which is a developing economy but powerful, may influence more. This has implications for Australian investors who seek to invest in overseas markets. To gain benefits of diversification, investors need to consider investments in markets that have lesser global power.

“From an economic perspective, Australia’s alignment with strong global power, such as the U.S. may be implicitly a good and strategic decision in terms of influencing global economic policy. Australia may continue to benefit from its alignment with China as well because of its rising global power.”

More information:

Rakesh Gupta et al, Global power and Stock market co-movements: A study of G20 markets, Global Finance Journal (2024). DOI: 10.1016/j.gfj.2024.101028

Provided by

Charles Darwin University

Citation:

New study reveals how much influence global powers have on the economy (2024, September 24)

retrieved 24 September 2024

from https://phys.org/news/2024-09-reveals-global-powers-economy.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.