Research by the Australian Institute of Criminology (AIC) and the Australian Transaction Reports and Analysis Centre (AUSTRAC) provides clear evidence of the close connection between organized crime and money laundering, and the significant harm this is causing to the Australian community.

The work is published by the Australian government.

Money laundering is the life blood of organized crime—exploiting Australia’s financial system and property market and costing the economy billions of dollars every year.

The research, undertaken as part of a collaborative project between the AIC and AUSTRAC, reinforces the need for the Albanese Government’s commitment to extend Australia’s anti-money laundering and counter-terrorism financing (AML/CTF) regime to cover the “tranche two” entities being exploited by criminal groups.

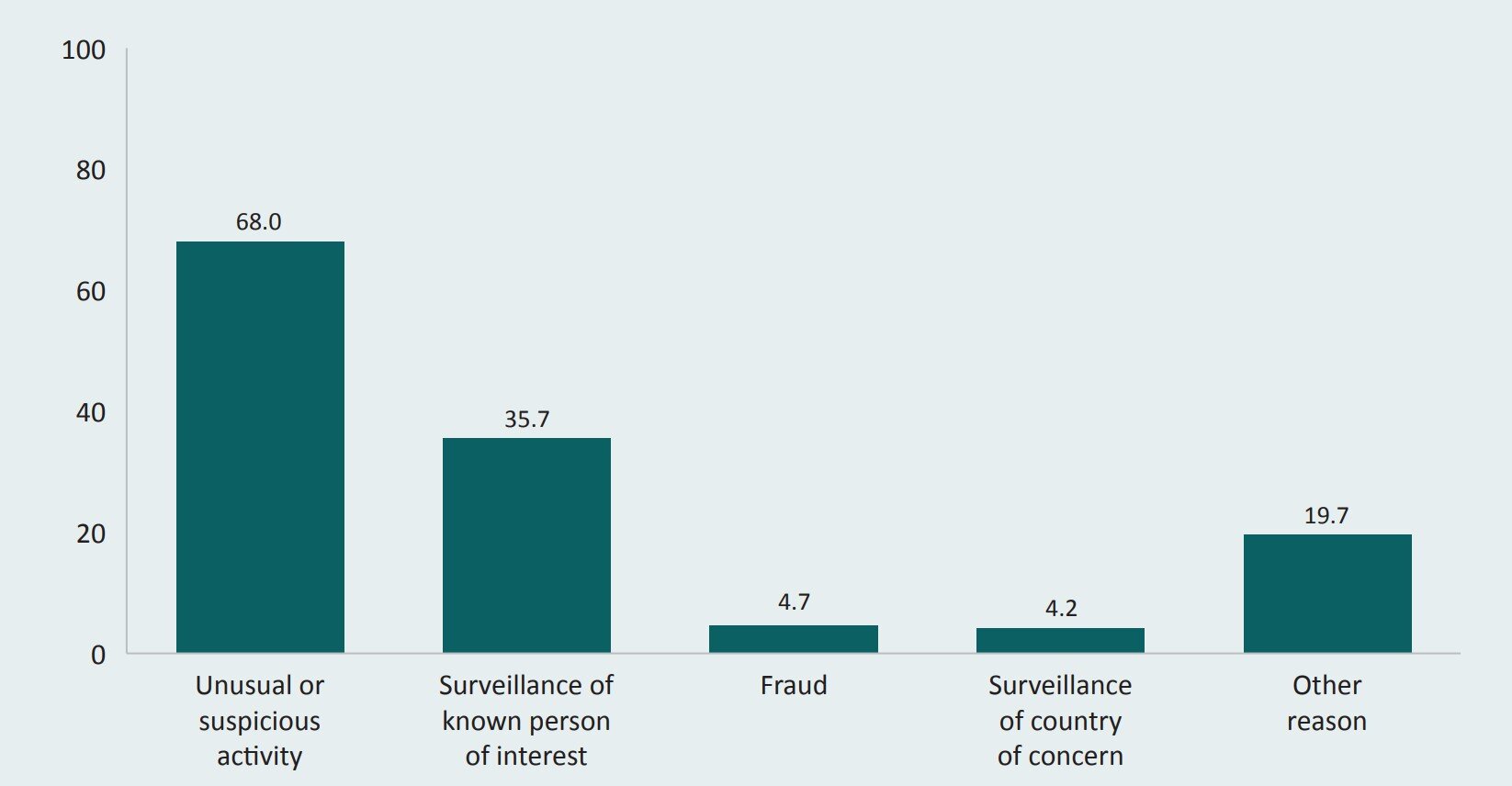

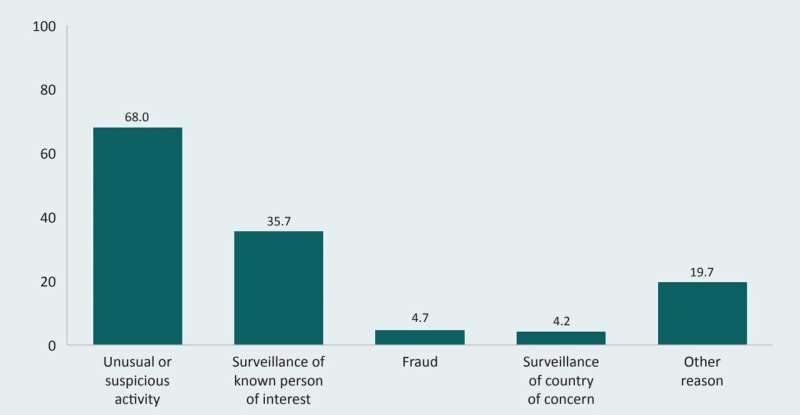

The report analyzes the link between money laundering and organized crime, using data on organized crime groups known to law enforcement from the Australian Criminal Intelligence Commission and suspicious transactions reported to AUSTRAC.

The research finds that larger amounts of money are being laundered through the real estate and gambling sectors, relative to other sectors.

It also finds that when organized crime groups include professional facilitators among their membership—tranche two entities such as lawyers, accountants and real estate agents—they are more likely to be involved in money laundering and with larger sums involved.

The report shows that criminal groups involved in money laundering are responsible for more than twice as much crime-related harm as groups not involved in money laundering. Every year a criminal group is able to launder money increases the crime-related harm it causes to the community by nearly 50%.

It confirms that reducing the amount of money laundered by organized crime groups would significantly limit their ability to reinvest illicit funds in future criminal enterprises.

Australia must remain vigilant and harden our businesses against exploitation. The Australian Government is committed to strengthening our anti-money laundering regime through these reforms which are critical in protecting Australians and our economy from the impact of transnational, serious and organized crime.

We intend to expand the regime to certain services, provided by “tranche two” entities, including lawyers, accountants, trust and company service providers, real estate agents and dealers in precious metals and stones.

We also intend to modernize the AML/CTF Act to ensure it keeps pace with the increasingly digital, instant nature of our global financial system—closing those gaps that we know increasingly sophisticated, professional criminal organizations can exploit.

And we demonstrated our commitment to this action in this year’s Budget, committing $166.4 million to implement these overdue proposed reforms. This investment will enable AUSTRAC to implement the new simplified and expanded regime, including delivering comprehensive education and guidance to support tranche two businesses.

More information:

Anthony Morgan, Money laundering and the harm from organised crime: Results from a data linkage study, (2024). DOI: 10.52922/sp77628

Provided by

Australian Institute of Criminology

Citation:

Australian research examines money laundering and harm from organized crime (2024, September 9)

retrieved 9 September 2024

from https://phys.org/news/2024-09-australian-money-laundering-crime.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.