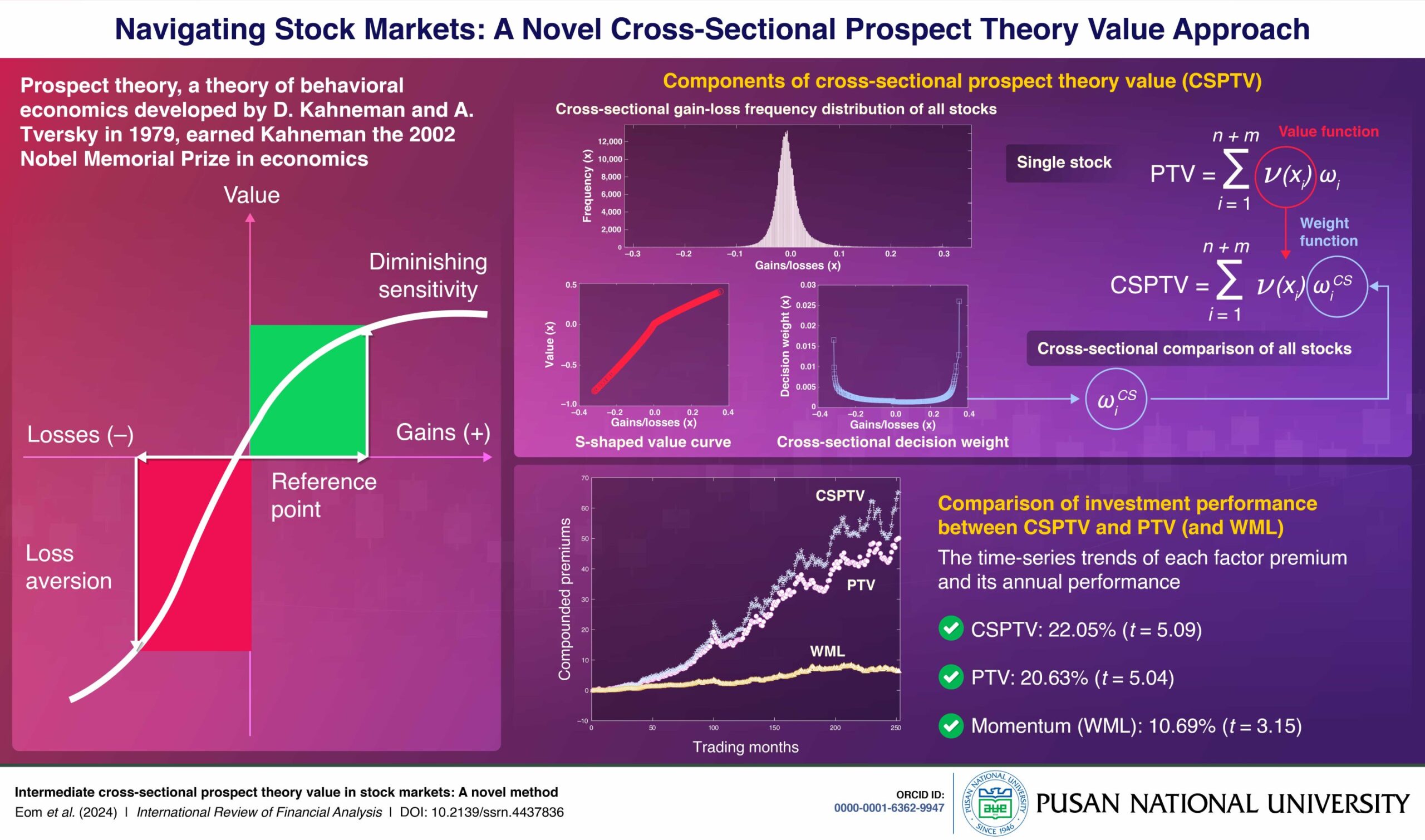

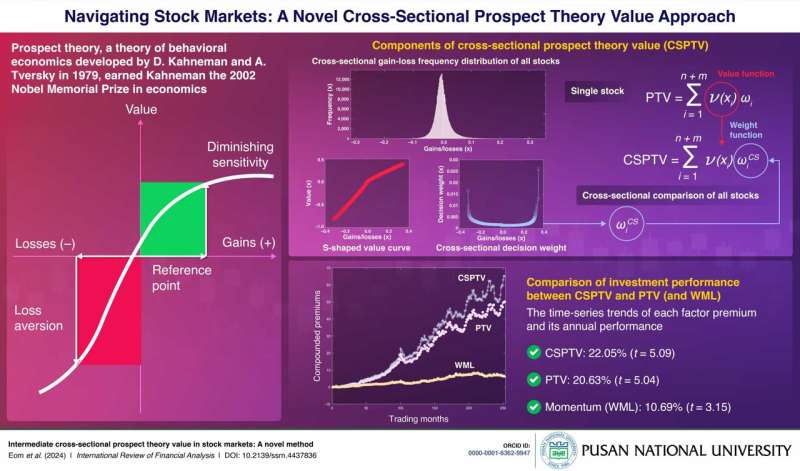

Prospect theory, proposed by Kahneman and Tversky in 1979, has been acknowledged as an excellent decision-making theory for the bounded rationality of investors tending to show cognitive bias under conditions of uncertainty. In terms of gains and losses in prospect theory, investors tend to be more sensitive to losses than equal-magnitude gains (loss aversion). Together, they show different risk attitudes: risk-averse in the case of gains and risk-seeking in the case of loss (diminishing sensitivity).

According to a 2016 study by Baberis and team., under the premise of prospective utility, investors determine the values of prospect theory for stocks using past return distributions as a representativeness heuristic. The study defines the past 12-month return distributions as the heuristic of investor decision-making based on prospect theory.

Accordingly, a group of researchers led by Professor Cheoljun Eom from the School of Business at Pusan National University, Korea, recently empirically investigated whether prospect theory values from the past 12-month return distributions have the power to predict performance persistence for the cross-sectional returns of stocks in future holding periods.

Furthermore, as the methods measuring the values of prospect theory for cross-sectional stock returns improve, they devised a new measurement of cross-sectional prospect theory value (CSPTV) to enable cross-sectional comparison among stocks, compared with the existing prospect theory value (PTV) specific to a single stock. Their study was made available online in the International Review of Financial Analysis on 1 May 2024.

“Our work robustly demonstrates the ability of CSPTV to outdo PTV in terms of predictive power of performance persistence,” remarks Prof. Eom.

The present study, through its research goals and results, is expected to make contributions on several fronts. First, it shows the predictive power of performance persistence in future holding periods using PTVs from the past 12-month return distributions. Particularly, the scope of prospect theory for cross-sectional stock returns in stock markets has now been successfully expanded over the past 12 months.

Moreover, this work devises a CSPTV reflecting investors’ tendency to compare gains and losses among stocks cross-sectionally, unlike the PTV specific to a single stock. The comparative advantage of CSPTV in better capturing the predictive power of prospect theory compared to PTV is thus empirically proven. .

Lastly, this study confirms that PTVs from the past 12 months can explain both the momentum and disposition effects observed during the same period. This means that the information value in a prospect theory portfolio has been robustly proven to be unique and not redundant for the above effects.

Prof. Eom concludes, “Overall, we anticipate differentiated contributions from the CSPTV design, which expands the scope of the existing prospect theory to the past 12-month return distribution and improves the predictive power of prospect theory in cross-sectional stock returns.”

More information:

Cheoljun EOM et al, Intermediate cross-sectional prospect theory value in stock markets: A novel method, International Review of Financial Analysis (2024). DOI: 10.1016/j.irfa.2024.103120

Provided by

Pusan National University

Citation:

A novel method implementing investment decision-making of prospect theory utility toward stock markets (2024, July 29)

retrieved 29 July 2024

from https://phys.org/news/2024-07-method-investment-decision-prospect-theory.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.