Consumer sentiment was essentially unchanged this month, edging up less than two index points from March, according to the University of Michigan Surveys of Consumers.

Sentiment is now about 3% below a year ago but 27% above the all-time low from last June. Sentiment rose for lower-income consumers, offsetting declines among those with higher incomes. Buying conditions for durables surged 11% due to improvements in affordability, said U-M economist Joanne Hsu, director of the surveys.

However, the persistence of high prices more broadly left consumers with high expenses, weighing down their personal finances. Overall, consumers perceived few changes in the economic environment since last month.

“The mild recovery in consumer sentiment we saw last fall and winter appears to have stalled. Consumers are bracing for the labor market to weaken,” Hsu said. “Sustained, meaningful improvements in economic conditions—which will have to come from cooling inflation, given how little room there is for labor markets to strengthen—will be required for their sentiment to rise again.”

Despite easing inflation, concerns over high prices persist

While consumers have noticed that overall inflation has slowed in recent months, the prices they face day-to-day remain painfully high, Hsu said. About 40% of consumers blamed high prices for eroding their personal finances, up from last month and a year ago when overall inflation was even higher.

Concerns over gas prices are starting to grow again, with about 17% of consumers spontaneously mentioning gas, fuel or energy prices, up from 14% last month. Furthermore, consumers expect gas prices to rise in the year ahead, which would exert even more pressure on household budgets.

Consumers aware of bank failures but sentiment largely unaffected

The full month of data now available following the collapse of Silicon Valley Bank confirms that the financial turbulence that ensued had little measurable impact on overall consumer sentiment, according to Hsu. That said, the recent developments have weighed on a small subset of consumers. In April, 13% of consumers, primarily those with higher incomes, spontaneously mentioned bank failures during their interviews, up from 8% in March.

Consumers mentioning bank failures had more favorable long-run economic outlooks than those who did not. Those mentioning bank failures held stronger views of their personal finances and may feel better equipped to weather any economic downturn to come.

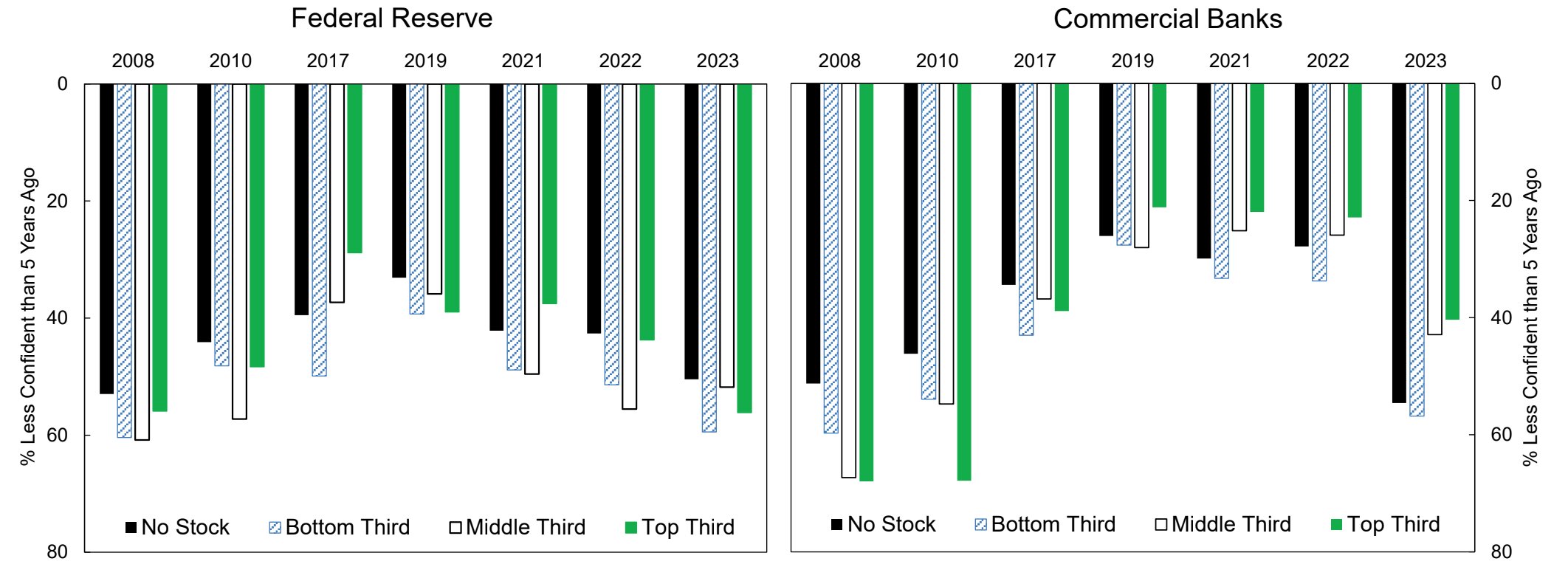

While consumer sentiment regarding the economy was generally unaffected by bank failures, their confidence in commercial banks deteriorated markedly compared with last fall. This decline in confidence did not spread to other financial institutions; consumer views of the Federal Reserve are little changed from six months ago.

Consumer sentiment index

The Consumer Sentiment Index rose to 63.5 in the April 2023 survey, up from 62.0 in March and below last April’s 65.2. The Current Index rose to 68.2, up from 66.3 in March and below last April’s 69.4, while the Expectations Index rose to 60.5, up from 59.2 in March and below last April’s 62.5.

More information:

Report: drive.google.com/file/d/1BZivO … 1UmX0tC9GlcU7ym/view

Provided by

University of Michigan

Citation:

Report: Consumer sentiment unmoved amid persistent high prices (2023, April 28)

retrieved 28 April 2023

from https://phys.org/news/2023-04-consumer-sentiment-unmoved-persistent-high.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.