The window for interest rate cuts may be closing.

On the eve of the Federal Reserve’s two-day policy meeting, Wall Street forecaster Jim Bianco believes the central bank will likely stay on hold until next year.

“I’m in the camp that the Fed does not change policy in the summer of an election year,” the Bianco Research president told CNBC’s “Fast Money” on Monday. “If they don’t pull the trigger by June, then it’s November [or] December at the earliest — only if the data warrants it. And, right now, the data isn’t warranting it.”

For Fed Chair Jerome Powell to cut this spring, the economy would have to dramatically weaken, according to Bianco.

“The economy is too strong right now,” he said. “It’s in a ‘no landing phase’ as we like to call it. It’s not a Boeing plane. There’s no parts falling off of it, and it’s just continuing to move along at probably a 2.5% to 3% pace.”

This week’s Fed meeting comes almost exactly two years after policymakers started their rate hike campaign.

“It looks like we’re probably bottoming on inflation at around 3%,” he said. “That’s not 2[%], and the Fed has made it very clear that they need confidence for going to 2[%]. And, we’re not getting that.”

It appears Wall Street may be on notice. The CME FedWatch tool showed on Monday expectations for a quarter point rate cut in June dropped below 50%.

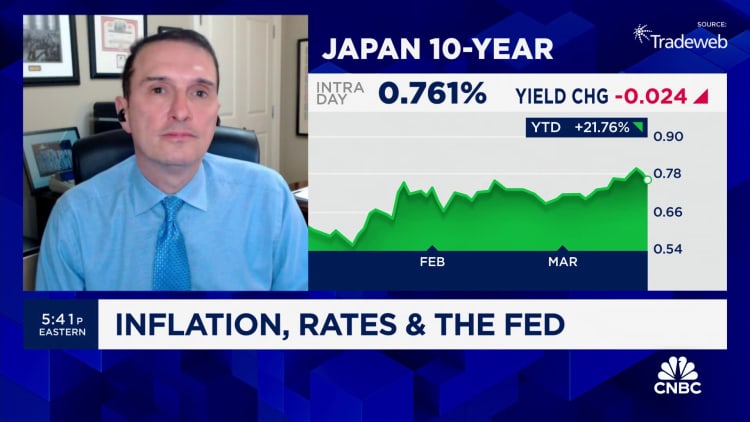

Plus, Treasury yields are climbing higher. The benchmark 10-year Treasury Note yield is yielding 4.328% —its highest level in a month and is inching closer to a four-month high.

“They may even go higher,” added Bianco. “It’s going to be the reality of inflation.”

In January, Bianco told “Fast Money” the 10-year yield would hit 5.5% this year. It’s a level not seen since May 2001.

He still believes the backdrop will keep the yield trending higher.

“I don’t think that is a consensus view in the marketplace,” Bianco said. “When we were at 5% in October, we were throwing up 3% growth rates in the economy, and it was able to handle that level of interest rates just fine.”

Disclaimer