Introduction: UK house prices drop 4.6% in year to August

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices have fallen at their fastest rate since the aftermath of the financial crisis, new data confirms this morning, as high interest rates cool the property sector.

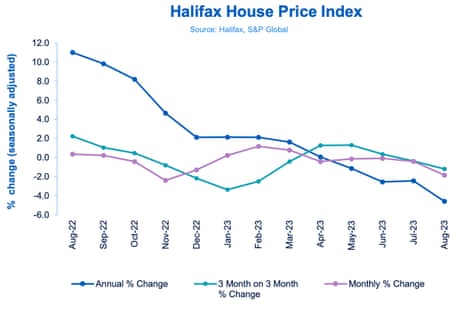

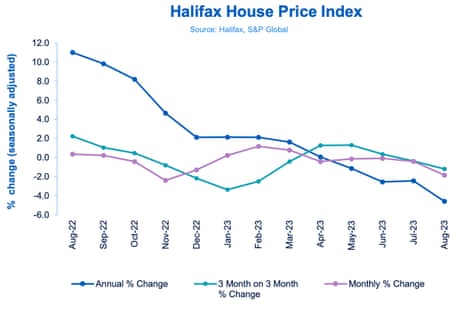

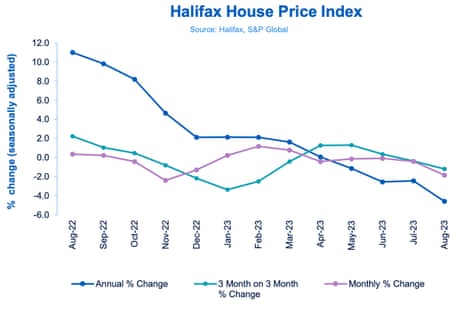

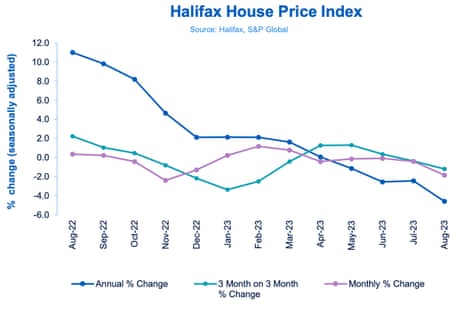

Halifax, the UK’s largest lender, has reported that the average property price fell by 4.6% on an annual basis in August, down from the record highs seen last summer. That’s the largest year-on-year decrease in house prices since 2009.

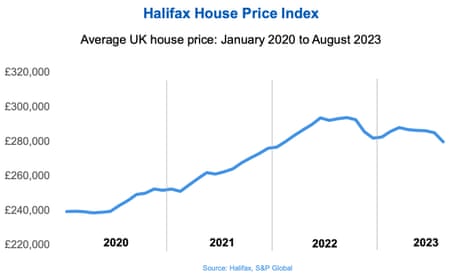

The price of a typical UK home dropped to £279,569, down by around £14,000 over the last year, back to the level seen in early 2022. It leaves average prices around £40,000 above pre-pandemic levels.

That’s a bigger fall than expected, with economists having predicted a 3.45% annual fall.

On a monthly basis, the average house price fell by -1.9% in August, the largest monthly fall since November 2022.

Halifax reports that Southern England and Wales are seeing most downward pressure on property prices, with Scotland showing greater resilience.

Rival lender Nationwide reported last week that UK house prices fell 5.3% in August, the fastest annual drop in 14 years.

But there are signs that UK borrowing costs could be close to their peak. Yesterday, Bank of England governor Andrew Bailey said interest rates are probably “near the top of the cycle”, and predicted there willl be a further “marked” drop in inflation this year.

But for now, higher rates are cooling the markets.

Kim Kinnaird, director at Halifax Mortgages, says:

“It’s fair to say that house prices have proven more resilient than expected so far this year, despite higher interest rates weighing on buyer demand. However, there is always a lag-effect where rate increases are concerned, and we may now be seeing a greater impact from higher mortgage costs flowing through to house prices.

Increased volatility month-to-month is also to be expected when activity levels are lower, though overall the pace of decline remains in line with our outlook for the year as a whole.

Kinnaird adds that some prospective buyers deferred their transactions in the hope of some stability in the markets, and greater clarity on the future direction of rates in the coming months.

The market will continue to rebalance until it finds an equilibrium where buyers are comfortable with mortgage costs in a higher range than seen over the previous 15 years.

The agenda

-

7am BST: Halifax house price index for August

-

10am BST: Eurozone Q2 GDP (second estimate)

-

1.30pm BST: US initial jobless claims

Key events

Estate agents report that potential buyers are negotiating house prices down.

Nathan Emerson, CEO of Propertymark, reports that more houses are selling below their asking price:

“House prices are thankfully adjusting to more sensible levels alongside increases to people’s earnings and the number of properties selling below asking price is increasing, offering homebuyers the opportunity to negotiate. These factors are all playing a part in increasing homebuyers’ affordability and softening the blow of rising interest rates.

“However, despite how this may look on the face of things, sellers are rightly still motivated to sell as they continue to make a healthy gain on their property price.”

Matt Thompson, head of sales at Chestertons, says:

“With higher interest rates impacting on UK households, property buyers are adopting a more strategic and flexible property search by adjusting their budget or widening their search criteria to find a suitable home.

Although some buyers took a break during the August holidays, others utilised last month to enter price negotiations or seal the deal by signing contracts.”

Avg house prices melt under the Aug heat, dropping -1.9% in a month & -4.6% annually, making the typical home now worth £279,569. Peeling back prices by £14,000 on last year but still up £40,000 on pre-pandemic levels @HalifaxBank pic.twitter.com/wQVckQi9ii

— Emma Fildes (@emmafildes) September 7, 2023

Jeremy Leaf, north London estate agent, warns that sellers who don’t accept price reductions may not get a deal:

“Prices continue to soften although they are supported to a degree by the shortage of stock and fewer but more serious buyers.

With so many rate rises, affordability is a concern, especially for those on tighter budgets, often buying smaller properties so the market remains price sensitive.

The penny has dropped for the majority of sellers who are recognising that they may not achieve what they originally anticipated. As many sellers are also buyers, they realise that although they may have to accept less than they initially wanted for their property, they will also pay less for their next home which is significant as many will be trading up.

Those sellers who refuse to recognise that prices are softening will remain on the market and may end up having to accept a lower price in order to make their move.’”

Prices fall fastest in South East, slowest in Scotland

House prices have fallen all UK nations and the nine English regions over the last year, Halifax’s house price index shows.

But the north of the country has proved more resilient than the south.

Prices are falling fastest in the South East of England, where a 5% fall in the last year has pulled the average house price down to £379,565.

Halifax says:

Buyers faced with the need to find larger deposits and fund bigger monthly repayments means the South East is experiencing the biggest drop.

London remains the most expensive place in the UK to purchase a home, with an average property price of £529,814. However with prices down by -4.1% over the last year, it has seen the biggest fall of any region in cash terms (-£22,777).

Prices have fallen by 4.7% in the last year in Wales, which had boomed in the pandemic race-for-space, with the average house price now £212,967.

In Northern Ireland property prices have fallen by -1.5% annually, to an average of £182,700.

But prices fell slowest in Scotland, where they are down just -0.6% over the last year, to an average of £201,932.

Halifax: We expect further downward pressure on property prices

Looking ahead, Halifax predicts there will be “further downward pressure on property prices” through to the end of this year and into 2024.

Kim Kinnaird, director of Halifax Mortgages, explains:

While any drop won’t be welcomed by current homeowners, it’s important to remember that prices remain some £40,000 (+17%) above pre-pandemic levels.

It may also come as some relief to those looking to get onto the property ladder. Income growth has remained strong over recent months, which has seen the house price to income ratio for first-time buyers fall from a peak of 5.8 in June last year to now 5.1. This is the most affordable level since June 2020, and will be partially offsetting the impact of higher mortgage costs.

Introduction: UK house prices drop 4.6% in year to August

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices have fallen at their fastest rate since the aftermath of the financial crisis, new data confirms this morning, as high interest rates cool the property sector.

Halifax, the UK’s largest lender, has reported that the average property price fell by 4.6% on an annual basis in August, down from the record highs seen last summer. That’s the largest year-on-year decrease in house prices since 2009.

The price of a typical UK home dropped to £279,569, down by around £14,000 over the last year, back to the level seen in early 2022. It leaves average prices around £40,000 above pre-pandemic levels.

That’s a bigger fall than expected, with economists having predicted a 3.45% annual fall.

On a monthly basis, the average house price fell by -1.9% in August, the largest monthly fall since November 2022.

Halifax reports that Southern England and Wales are seeing most downward pressure on property prices, with Scotland showing greater resilience.

Rival lender Nationwide reported last week that UK house prices fell 5.3% in August, the fastest annual drop in 14 years.

But there are signs that UK borrowing costs could be close to their peak. Yesterday, Bank of England governor Andrew Bailey said interest rates are probably “near the top of the cycle”, and predicted there willl be a further “marked” drop in inflation this year.

But for now, higher rates are cooling the markets.

Kim Kinnaird, director at Halifax Mortgages, says:

“It’s fair to say that house prices have proven more resilient than expected so far this year, despite higher interest rates weighing on buyer demand. However, there is always a lag-effect where rate increases are concerned, and we may now be seeing a greater impact from higher mortgage costs flowing through to house prices.

Increased volatility month-to-month is also to be expected when activity levels are lower, though overall the pace of decline remains in line with our outlook for the year as a whole.

Kinnaird adds that some prospective buyers deferred their transactions in the hope of some stability in the markets, and greater clarity on the future direction of rates in the coming months.

The market will continue to rebalance until it finds an equilibrium where buyers are comfortable with mortgage costs in a higher range than seen over the previous 15 years.

The agenda

-

7am BST: Halifax house price index for August

-

10am BST: Eurozone Q2 GDP (second estimate)

-

1.30pm BST: US initial jobless claims