Questions are mounting about how a young couple lost $90,000 after claiming it was due to a bungled bank transfer – with the Commonwealth Bank claiming they never even had the money to begin with.

Elli Houston, 21, and her fiancé Trae Murphy, 23, came forward this week to claim they had transferred $90,000 from their CBA account to a Bank of Melbourne account on June 30.

The pair saved the amount of money up to buy a patch of land in Yarrawonga, a town located near the NSW and Victoria border.

However, the couple have claimed that the money first bounced back into their account – and has since vanished altogether.

Ms Houston and Mr Murphy have now lodged a complaint about the bank with the Australian Financial Complaints Authority and say they’ve been left devastated by their prized savings seemingly disappearing into thin air.

But the couple’s version of events and that of the Commonwealth Bank are starkly at odds, with the bank claiming they never had anywhere near $90,000 in their account.

While it’s not suggested the couple have done anything wrong – simply that a stuff-up has seemingly occurred somewhere along the way – Daily Mail Australia takes a look at the key questions that remain outstanding about the saga.

Elli Houston, 21, and her fiancé Trae Murphy, 23, came forward this week to claim they had transferred $90,000 from their CBA account to a Bank of Melbourne account on June 30. However, they say the large figure has now vanished

What happened to the mystery $90,000?

Ms Houston said after she and her carpenter partner initially transferred $90,000 from a CBA account that had a total of $96,000 in it on June 30.

She then said it bounced back days later on July 4.

That same day, they tried to transfer the money again, and the following day they flew out to Bali for a holiday.

Ms Houston said the money bounced back for a second time on July 7, but because they were in Bali they weren’t able to transfer the money internationally.

The couple were then charged a $2,500 late settlement fee because, given the money was missing, the settlement fell over while they were overseas.

They returned from Bali on July 20 and went straight to a Commonwealth Bank branch to revolve the matter.

But they claimed after going into the branch, they were then told they just had 75c in their account.

‘In Bali we could see that ($90,000) figure sitting in our account again,’ Ms Houston told 3AW’s Neil Mitchell.

‘Then when we got home, nothing, 75c in our bank account.’

The young couple have been trying to get their money back but the Commonwealth Bank say they never had the money in their account to begin with

A spokesman for Commonwealth Bank (CBA) said it had investigated the claims and had since told Mr Murphy that the receipt numbers he provided ‘do not exist in CBA records’. The bank also said the couple have 75c in their account

However, the Commonwealth Bank has claimed the couple never had $90,000 in their bank account.

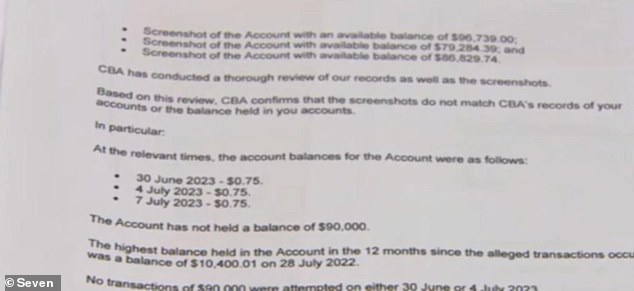

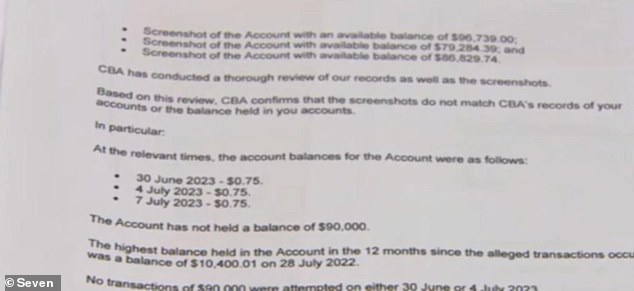

In a letter sent to the couple, the bank said on the dates they allegedly tried to transfer the money, their bank account only had 75c in it.

The highest balance their account had was $10,400 in July last year, the bank added.

Is something wrong with the couple’s receipts?

Ms Houston and Mr Murphy sent screenshots of their account to the Commonwealth Bank and receipts of the money being moved.

CBA said they conducted a thorough review of their records and the screenshots provided by the couple but that they did not match.

‘CBA confirms that the screenshots do not match CBA’s records of your accounts or the balance held in your accounts,’ the bank’s letter read.

‘No transactions of $90,000 were attempted on either 30 June or 4 July.’

A spokesperson for CBA added: ‘On examination of the images of the receipts provided, the documents differ from genuine CBA receipts and the receipt numbers do not exist in CBA’s records.’

CBA said they conducted a thorough review of their records and the screenshots provided by the couple but that they did not match

How could they transfer the funds from their bank account?

Another complication is the funds allegedly sent from the couple’s bank account would not have been able to be directly transferred to the Bank of Melbourne.

This is because the money was in a NetBank saver account which can only transfer funds to other CBA accounts.

‘The account from which the transfers allegedly took place is a NetBank Saver which only permits transfers to another CBA account and is unable to process transfers to another financial institution,’ a CBA spokesperson said.

What does this mean for the couple?

Ms Houston has claimed the $90,000 had been in their CBA account while they were in Bali but when it came to transferring it to the Bank of Melbourne when they returned home, it had disappeared.

She and her partner took a day off work to sit in the office of a bank employee in the hopes of finding the deposit.

‘We were visibly distressed because we had lost so much money,’ she told 3AW.

‘They asked us if we were being held ransom because we were so upset. This was a whole day, then they took five weeks to come back with an answer.’

The couple said they waited five weeks to get a response from CBA, with the bank including a link to Beyond Blue, a suicide prevention hotline.

‘They said ”we’re really sorry, we’re still investigating this, here are some links if you need some help”,’ she recalled.

The couple have had to increase the amount of their existing loan to keep the land.

‘My partner and I have been together since we were 15 years old, we’ve saved for so long for this land and our goal was always to pay it off before we put a house on it so we could then travel,’ she said.

‘It feels like everything’s been taken from under us.’

The Bank of Melbourne declined to comment.

Daily Mail Australia sent written questions to Ms Houston and Mr Murphy but they did not respond.

Source: | This article originally belongs to Dailymail.co.uk