Key events

Fashion retailer Superdry is having a tough time: it asked for its shares to be suspended on Wednesday because of problems with its audit. It has released delayed results today, and they show losses jumping to £148m for the year to 29 April.

That compared to £22m in losses in the year to April 2022. The loss was partly driven by impairments on the value of its stores, and accounting changes related to tax.

Blame it on the weatherman: it said its spring/summer ranges have been hit by “extreme weather events across the UK and Europe”, but it added that its autumn/winter clothes have been selling more earlier this year.

But either way, the company is battening down the hatches: it does not expect “significant revenue growth as we focus on cost savings and margin improvement”, with £35m in cuts coming through in the year to April 2024.

Julian Dunkerton, Superdry’s founder and owner of a fifth of the company, took back control of the firm in a boardroom coup in 2019. It has not been an easy time since then, with pandemic lockdowns now replaced by the cost of living crisis.

Dunkerton said:

This has been a difficult year for the business and the market conditions have been extremely challenging, especially in wholesale. We’ve looked closely at how we operate and have taken decisive actions to improve our position, rebuild liquidity, and recapitalise our balance sheet, through careful preservation of cash and a re-engineered cost base.

The good news is that despite the external turbulence, the brand is in sound health and has momentum. Stores and e-commerce delivered a strong sales performance, and I’m excited by our collections for the autumn/winter ‘23 season. While wholesale remains very challenging, I believe the new team in place will recover this business in the medium term.

Stock markets are up and running for the first day of autumn: the FTSE 100 has gained 0.2% in the early trades.

Here are the opening snaps from across Europe’s stock markets, via Reuters:

-

EUROPE’S STOXX 600 FLAT

-

FRANCE’S CAC 40 DOWN 0.2%, SPAIN’S IBEX UP 0.1%

-

EURO STOXX INDEX DOWN 0.1%; EURO ZONE BLUE CHIPS DOWN 0.1%

-

GERMANY’S DAX DOWN 0.1%

UK house prices fall by 5.3% annually

Good morning, and welcome to our live coverage of business, economics, and financial markets.

UK house prices fell by 5.3% from their peak in August 2022 to this year, the fastest decline since 2009 when the financial crisis caused the housing market to seize up, according to new data from Nationwide.

The annual fall in prices was significantly faster than the 3.9% that economists had expected, according to a poll by Reuters and beat last month’s 3.8% fall. Prices dropped 0.8% month-on-month in August.

It means the average UK home – which costs about £259,000 – is about £14,600 cheaper.

Even if the pace of the downturn in prices is unexpected, precisely nobody is surprised that prices are falling: inflation is eating into disposable income, and the Bank of England has raised the cost of borrowing dramatically in order to counter further inflationary pressures.

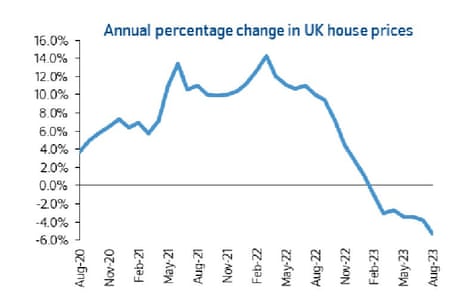

You can see the slowdown clearly here:

Andrew Wishart, senior property economist at Capital Economics, a consultancy, thinks there is more of this to come:

The large monthly fall in house prices in August confirmed that the further leg down in house prices that we have been forecasting has begun to materialise. With mortgage rates likely to remain around current levels for another 12 months, we expect prices to continue to fall until mid-2024, taking the total drop in house prices since their August 2022 peak from 5.3% now to 10.5%.

Robert Gardner, Nationwide’s chief economist, said the decline was “not surprising” given the rise in borrowing costs and the decline in mortgage approvals, but he is still hopeful that “a relatively soft landing is still achievable, providing broader economic conditions evolve in line with our (and most other forecasters’) expectations.” He said:

In particular, unemployment is expected to remain low (below 5%) and the vast majority of existing borrowers should be able to weather the impact of higher borrowing costs, given the high proportion on fixed rates, and where affordability testing should ensure that those needing to refinance can afford the higher payments.

While activity is likely to remain subdued in the near term, healthy rates of nominal income growth, together with modestly lower house prices, should help to improve housing affordability over time, especially if mortgage rates moderate once Bank Rate peaks.

It is quiet on British railways this morning. Most rail services in England will not run on Friday due to the Aslef train drivers’ union strike, with a further day of severe disruption on Saturday when train staff in the RMT will walk out again, in the long-running dispute over jobs and pay.

Unions are also protesting over the closure of ticket offices, with a government consultation closing today. The unions argue the closures will negatively affect passengers, but some rail companies argue they will be able to move staff into other parts of stations.

The agenda

-

9am BST: Eurozone HCOB/S&P Global manufacturing purchasing managers’ index (August; previous: 43.7 points; consensus: 43.7)

-

9:30am BST: UK CIPS/S&P Global manufacturing purchasing managers’ index (August; prev.: 42.5; cons.: 42.5)

-

1:30pm BST: US non-farm payrolls (August; prev.: 187,000; cons.: 170,000)