Introduction: UK house prices fall after mini-budget shock

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

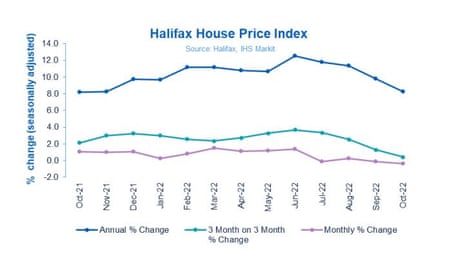

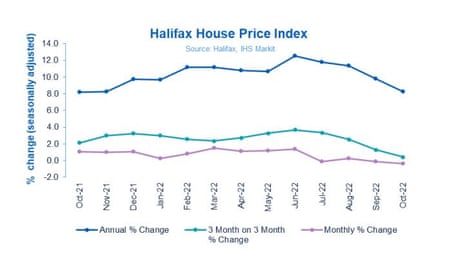

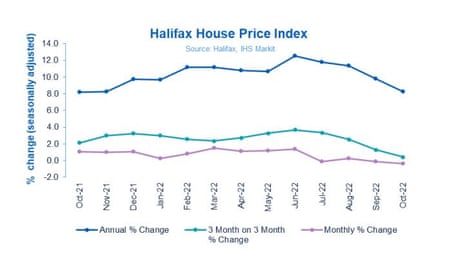

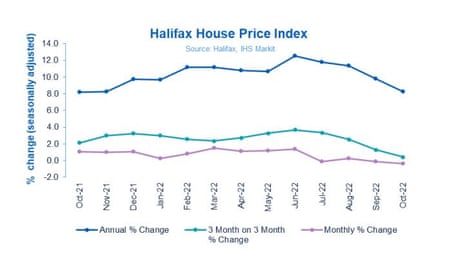

UK house prices fell in October at the fastest rate since early last year, as the market was rocked by the fallout from the disastrous mini-budget.

The average house price fell by 0.4% in October, figures just released by the Halifax building society shows. That’s the sharpest fall on Halifax’s index since February 2021, following a 0.1% drop in September.

That pulls the annual rate of house price inflation down to 8.3% from 9.8%, and means the typical UK property now costs £292,598, down from £293,664 last month.

The market cooled as hopeful housebuyers saw mortgage rates surge, with lenders removing thousands of offers as the cost of borrowing rocketed. The average two-year fixed-rate home loan jumped over 6.5% in October, from below 5% before the mini-budget.

Average prices remain near record highs, but the recent period of rapid house price inflation may now be at an end, warns Kim Kinnaird, director at Halifax Mortgages.

Kinnaird explains that the surge in UK costs following former chancellor Kwasi Kwarteng’s package of unfunded (and now abandoned) tax cuts was a ‘significant shock’:

While a post-pandemic slowdown was expected, there’s no doubt the housing market received a significant shock as a result of the mini-budget which saw a sudden acceleration in mortgage rate increases.

While it is likely that those rates have peaked for now – following the reversal of previously announced fiscal measures – it appears that recent events have encouraged those with existing mortgages to look at their options, and some would-be homebuyers to take a pause.

Annual house price growth slowed in every region of England apart from the North East, and also slowed in Northern Ireland, Scotland, and Wales.

Halifax’s survey matches a similar report from Nationwide last week, which also showed a fall in house prices last month.

Many economists have predicted that house prices could fall by around 10% next year, as the UK falls into recession and households are squeezed hard by surging energy and food prices.

Kinnaird predicts a ‘much slower period for house prices’, as Kwarteng’s successor, Jeremy Hunt, prepares a package of hefty tax rises and spending cuts.

“Understandably we have also seen consumer caution grow, as industry data shows mortgage approvals and demand for borrowing declining. The rising cost of living coupled with already stretched mortgage affordability is expected to continue to weigh on activity levels.

With tax rises and spending cuts expected in the Autumn Statement, economic headwinds point to a much slower period for house prices.

The agenda

Key events

Filters BETA

WSJ: Facebook parent Meta prepares large-scale layoffs this week

Josh Taylor

The job cuts hitting the tech industry could deepen this week, with Facebook’s parent company, Meta, reportedly preparing to let thousands of workers go, my colleague Josh Taylor reports.

On Sunday the Wall Street Journal reported that the cuts, to be announced on Wednesday, were expected to affect thousands of Meta’s 87,000 employees globally.

Meta declined to confirm the report but a spokesperson pointed to comments made by the Meta chief executive, Mark Zuckerberg, late last month.

In 2023, we’re going to focus our investments on a small number of high-priority growth areas.

So that means some teams will grow meaningfully, but most other teams will stay flat or shrink over the next year.

Here’s Josh’s story:

Elon Musk has shown the perils of sacking staff on mass, having laid off half of Twitter’s workforce on Friday.

Twitter is now reaching out to dozens of employees who lost their jobs and asking them to return, realising they are needed to implement Musk’s plans….

CONFIRMED: Twitter is now asking some fired workers to please come back

– Some were laid off by mistake

– Some were let go before management realized their experience is needed to build new features Elon Musk is planning

FFS 😆 https://t.co/WKdtokWHoH

— Matt Navarra (@MattNavarra) November 6, 2022

Rehiring staff isn’t as easy as firing them, though:

“One worker who Twitter asked to return rejected the offer because they felt “used, and think they will be fired again soon.” https://t.co/ARm22N7Bm4

— Matt Navarra (@MattNavarra) November 6, 2022

Londoners are particularly keen to buy their own properties to get out of the rental market, a new survey shows.

About two thirds of buyers in the capital want to move home within a year, according to a Bloomberg Intelligence poll of those planning to purchase a property in the next two years.

In London, some 35.6% of respondents to the survey cited a desire to stop renting as an important factor, compared with 21.6% for the UK average.

BI analyst Iwona Hovenko wrote in the report.

“It’s understandable, given the city’s frenetic rental market with significant shortage of rental properties, as well as double-digit rent rises.”

Average private rents in Britain have soared to record highs, and are expected to keep climbing as landlords pass on higher mortgage costs to tenants.

In a gloomy development, the eurozone’s construction sector has now shrunk for six months running.

Building firms reported a sharp decline in activity, led by housing sector, according to S&P Global Insight’s latest survey of purchasing mangers.

Business sentiment fell to among the lowest level on record, as construction firms saw the quickest downturn in new orders since May 2020, and another jump in prices.

This knocked the eurozone construction PMI deeper into contraction territory, to 44.9 in October, down from 45.3 in September (50 points = stagnation).

The survey painted a bleak picture of the overall health of the eurozone construction sector, says Laura Denman, economist at S&P Global:

Forward-looking indicators suggest that the current trends would likely continue into the future.

The 12-month outlook for activity sank to a level that was among the lowest on record and firms continued to trim buying activity in line with current and anticipated demand weakness.

As we head into the winter months, it will be interesting to see how eurozone’s construction sector fares in the face of the current economic landscape.”

FTSE 250 index up 1%

In the City, the UK-focused FTSE 250 index of medium-sized companies has started the new week on the front foot.

The FTSE 250 index has jumped 1%, with airline Wizz Air up 5.7% following Ryanair’s surge in profits, and luxury carmaker Aston Martin up 12% to a five-week high.

The bigger FTSE 100 index of blue-chip stocks is slightly lower, though. Retailers and supermarkets are rallying, but GSK is down 2.7% after its blood cancer drug Blenrep failed to prove it was better than an existing treatment on the market, in a late-stage study.

Victoria Scholar, Head of Investment, interactive investor says,

“Coming off the back of the best week in almost two years, the FTSE 100 is trading lower this morning after hopes were dashed that China could be set to ease its strict zero-tolerance to Covid approach, pushing the miners into the red.

Oil is also under pressure while gold has fallen from a three-week high.

The travel and leisure sector is outperforming thanks to strong results from Ryanair while Flutter is trading at the top of the UK index after Fox ended its legal battle with the gambling company over FanDuel’s price. Despite disappointing trade data from China with annual exports declining for the first time since May 2020, the Hang Seng continues its ascent from Friday, rallying another almost 3%.

Jasper Jolly

Ryanair has reported a surge in profits to a record €1.4bn (£1.2bn) for the first half of its financial year.

The budget airline said it was seeing no letup in the demand for air travel going into winter after record summer passenger numbers.

Ryanair reported greater traffic at higher fares than the same period in 2019, before the coronavirus pandemic, the first time that has been achieved since the first Covid-19 lockdowns.

In better news, German industrial production rose in September, despite output falling at the most energy-hungry factories.

Manufactuting production rose by 0.6% month-on-month, following a 1.2% drop in August, as factories managed to lift output despite fears Germany was sliding into recession.

But there was a 0.9% drop in output from the most energy-intensive branches of industry, where some factories have slowed or paused production because surging energy prices made it uneconomic.

On an annual basis, German industrial production was up by 2.6%.

German Sept. industrial production outperforming consensus. Clever economists collectively anticipated slowing from 2.1% to 2.0% y/y. Instead ramp of 2.6% y/y from 1.6%. Also beat dire 🇩🇪 PMI “feeling”. Nicht surprised.https://t.co/4qgQw6Enp1 pic.twitter.com/TKNMj8FPkL

— Τάκης Χριστοδουλόπουλος (@takis2910) November 7, 2022

Carsten Brzeski of ING says Germany’s industrial production held up well in September, showing the economy stumbled but didn’t fall in the third quarter:

Global supply chain frictions as well as the impact of low water levels on logistics combined with high energy prices continue to weigh on German industry.

Industry didn’t fall off a cliff in the third quarter but stagnated.

Several factors will push down on the UK housing market, warns Karen Noye, mortgage expert at Quilter:

She says there’s no doubt we’ll see a further drop in house prices, following October’s 0.4% fall, as demand falls and more people try to sell.

“Ultimately, costs are rising across the board and as the winter draws in and the real impact of rising energy bills hits, people’s finances will be stretched even further.

With mortgage rates rising, many people will need to reconsider moving home and could opt to stay put to ride out the cost-of-living crisis instead, while others will need to move into cheaper properties.

Halifax survey shows “house prices are on the turn”

Average UK house prices will fall between 5-10% over the next 12 to 18 months, predicts the EY ITEM Club.

Martin Beck, their chief economic advisor, predicts the drop in house prices in October will be repeated in the coming months:

Although mortgage rates have retreated from the highs seen just after the mini-Budget, they remain elevated compared to early-mid September. For example, the current standard variable rate on a Halifax mortgage is 5.74%, compared to 3.74% pre-mini-Budget.

House prices are still very high on most metrics with average property prices having risen more than £22,000 in the past 12 months, and by almost £60,000, or just over a quarter, over the last three years.

Cost of living pressures remain significant, and household incomes face an added challenge due to tax rises and public spending restraint in November’s Autumn Statement, while consumer confidence remains depressed.

House prices fall as ‘affordability hurdle’ rises

The “growing affordability hurdle” is stopping the UK’s runaway housing market in its tracks, warns Myron Jobson, senior personal finance analyst at interactive investor.

Jobson explains that rising interest rates and the cost-of-living crunch are hitting buying activity and purchase prices, leading to the 0.4% drop in house prices month-on-month in October.

And he fears this affordability problem will get worse:

“Soaring mortgage rates have become a particular pain point for buyers. The housing market was buffeted by the mortgage market turmoil last month in the aftermath of the ill-fated mini-Budget, which sent rates soaring and lead to the withdrawal of some products temporarily from the market.

This has pushed many wannabe homeowners to the sidelines. While the mortgage marketplace is on a sturdier footing, the likelihood of further interest rate rise to rein in rampant inflation means things could get worse before they get better from an affordability perspective for buyers.

It’s a particularly rough time for first-time buyers, Jobson adds:

Both home prices remains high compared to yesteryear and mortgage rates have risen, while soaring inflation is eating into disposable incomes – making it harder to save for a deposit.

China’s trade unexpectedly shrinks as demand slows

China has suffered its first contraction in international trade since May 2020, early in the pandemic, in a sign that the global economy is slowing.

Exports and imports unexpectedly contracted in October, as Chinese firms were hit by Covid-19 curbs at home and the global slowdown.

Exports fell by 0.3% year-on-year, a stark reversal on the 5.7% growth in September, and the biggest drop since May 2020. Economists had expected a small slowdown, to 4.3% growth.

This tumble in exports comes as the energy crisis threatens to push Europe into recession, while the UK economy could also already be shrinking.

Inports of goods fell 0.7%, suggesting China’s domestic economy was fragile.

SINGAPORE—China’s exports to the rest of the world shrank unexpectedly in October, a big sign that global trade is in sharp retreat as consumers and businesses cut back spending in response to central banks’ aggressive moves to tame inflation. https://t.co/CmgKlAvLSf

— Bryn Stole (@brynstole) November 7, 2022

Exports to Europe (-9% year-on-year) and to the US (-13% y/y) both fell, but there was an annual rise in shipments to Southeast Asia.

Zhang Zhiwei, president and chief economist of Pinpoint Asset Management, explains (via Bloomberg):

“The weak export growth likely reflects both poor external demand as well as the supply disruptions due to Covid outbreaks.

“I expect export growth to remain weak in the next few months as the global economy slows.”

China’s exports growth has fallen for the first time in more than two years in October, as demand weakens on rising risks of a global recession https://t.co/9gjY4JULvB

— Bloomberg (@business) November 7, 2022

Iris Pang of ING says:

Covid cases started to climb in October but have affected factory activity only slightly, and there were no cases found in ports. So we can rule out shipment delays as a factor in the contraction.

Inflation in Europe and the US continued to be high, which could be a factor. Slower imports of electronic products paint a similar picture.

If this is the reason for the contraction in China’s international trade in October then we should expect the contraction to continue as our economists covering Europe and the US project a recession in these two economies.

Apple warns of iPhone shipments delays due to Covid restrictions

Apple is warning customers they’ll have to wait longer to get its latest iPhone models after anti-virus restrictions were imposed on a contractor’s factory in central China.

The company announcement on Sunday gave no details but said the factory operated by Foxconn in the central city of Zhengzhou is “operating at significantly reduced capacity.”

Apple said:

“We now expect lower iPhone 14 Pro and iPhone 14 Pro Max shipments than we previously anticipated. Customers will experience longer wait times to receive their new products.”

Last week, Chinese authorities announced a seven-day coronavirus lockdown in the area around Foxconn’s plant – the world’s largest iPhone factory – as China continues with its ‘zero-Covid’ policy.

Elliott Benson, mortgage broker at Sett Mortgages, predicts house prices will fall over the next year.

Last week’s interest rate rise, from 2.25% to 3%, will also weigh on the market, Benson adds:

“The mini-Budget, or at least what happened after it, hit sentiment like a sledgehammer. And even though we all knew last week’s interest rate rise was coming, it will still have proved a further shock to many homeowners, especially those who took out sizeable mortgages at record low rates.

Higher rates mean people won’t be able to borrow as much, which in turn means they won’t be able to offer as much for property. House prices will invariably head south during the next 12 months as people adjust to the new rate environment.

North London estate agent Jeremy Leaf says some prospective buyers have returned to the market, since mortgage rates stabilised:

‘These comprehensive figures are particularly interesting as the modest monthly fall in house prices shows on the one hand the resilience of the market in the period leading up to the mini-Budget, as well as the uncertainty which followed.

‘Since then, we’ve seen on the ground a combination of those trying to take advantage of attractive mortgage offers and new buyers slowly emerging now mortgage rates are steadying and even starting to fall.

But we are not seeing any collapse in pricing or sales agreed.

Avinav Nigam, cofounder of real estate investment platform, IMMO, is seeing signs of a housing slowdown:

‘We are seeing property listings falling by 15 to 20 per cent in some parts of the UK, as uncertainty encourages property owners to delay transaction decisions.

That will put more pressure on the rental market, Nigam adds:

‘As it becomes harder and more expensive to buy, demand for rental properties is expected to grow. Meanwhile, many smaller private investors are exiting due to higher finance and regulatory compliance costs.

There’s a clear opportunity for professional providers of safe, quality and affordable rental housing for the UK.’

House prices have probably peaked following the boom in the pandemic, says Tom Bill, head of UK residential research at Knight Frank:

Bill expects prices will fall back to last summer’s levels:

“There was a sharp intake of breath in the UK housing market last month due to the impact of the mini-Budget but that doesn’t mean prices are now on a steeper downwards trajectory. We expect mortgage rates to calm down in the short-term as financial markets respond to the new government but it’s a fair assumption that house prices have peaked following growth of more than 20% during the pandemic.

After 13 years of ultra-low borrowing costs, anyone buying a house or re-mortgaging will recognise the ground has shifted, which is the reason we expect prices to fall back to the level they were at in summer 2021.”

Back in August 2021, the average house price was £262,954, which is around 10%, or £30,000, below the £292,598 recorded in October.

First-time buyers drive house price slowdown

Property price inflation weakened across all buyer types during October, led by first-time buyers.

People taking their first step on the housing ladder paid 7.5% more than a year ago for their property, on average, sharply down on 10.1% in September.

Annual price growth among existing homemovers fell to +8.9% from +10.3%.

The relatively faster slowdown in prices for first-time buyers is not surprising, Halifax says, given the challenge raising a deposit in the current economic slowdown, and tighter requirements for higher loan-to-value mortgages.

AVG house growth goes into reverse. Reducing to 8.3% whilst AVG house prices fall – 0.4 to £292,598 in Oct. First time buyers thou are hit the most as they struggle to get into ‘funding’ gear with annual growth falling to +7.5% in October from +10.1% in September @HalifaxBank pic.twitter.com/qQKJdZ4knI

— Emma Fildes (@emmafildes) November 7, 2022

Average house prices fell by -0.4% in October, compared to -0.1% in September, says @HalifaxBank

Annual rate of growth dropped to +8.3%, down from +9.8%.

A typical UK property now costs £292,598 (down from £293,664 last month) pic.twitter.com/xPPmK32Yt1— simon read (@simonnread) November 7, 2022

FTSE 100 CEO pay jumps by a quarter

Pay restraint for thee, but not for me.

That’s the mantra in UK boardrooms, it seems, after top bosses enjoyed another year of strong earnings growth.

FTSE 100 chief executives’ pay soared by an average of 23% this year, according to research from PwC, at a time when workers are seeing real terms pay cuts (and now seeing falling house prices too).

The jump in average pay, to close to £4m, was driven by record bonus payouts – as CEO’s aced lower targets set during the pandemic.

The Financial Times has the story, and explains:

Many companies bounced back strongly as Covid-19 lockdowns ended, leading to an average CEO bonus of 86 per cent of the maximum available, up from 58 per cent last year and against a long term average of 70 to 75 per cent, according to PwC.

The higher bonuses took overall average pay up from pre-pandemic levels of £3.6mn in 2018-19 and £3.7mn for 2017-18.

Andrew Page, executive compensation leader at PwC UK, reckons CEOs will face greater scrutiny from shareholders at the next AGM season.

Such large pay rises for multimillionaires are “far from ideal at a time when their lower-paid colleagues are denied a pay rise that keeps up with inflation,” points out Luke Hildyard, director of the High Pay Centre think-tank.

Introduction: UK house prices fall after mini-budget shock

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices fell in October at the fastest rate since early last year, as the market was rocked by the fallout from the disastrous mini-budget.

The average house price fell by 0.4% in October, figures just released by the Halifax building society shows. That’s the sharpest fall on Halifax’s index since February 2021, following a 0.1% drop in September.

That pulls the annual rate of house price inflation down to 8.3% from 9.8%, and means the typical UK property now costs £292,598, down from £293,664 last month.

The market cooled as hopeful housebuyers saw mortgage rates surge, with lenders removing thousands of offers as the cost of borrowing rocketed. The average two-year fixed-rate home loan jumped over 6.5% in October, from below 5% before the mini-budget.

Average prices remain near record highs, but the recent period of rapid house price inflation may now be at an end, warns Kim Kinnaird, director at Halifax Mortgages.

Kinnaird explains that the surge in UK costs following former chancellor Kwasi Kwarteng’s package of unfunded (and now abandoned) tax cuts was a ‘significant shock’:

While a post-pandemic slowdown was expected, there’s no doubt the housing market received a significant shock as a result of the mini-budget which saw a sudden acceleration in mortgage rate increases.

While it is likely that those rates have peaked for now – following the reversal of previously announced fiscal measures – it appears that recent events have encouraged those with existing mortgages to look at their options, and some would-be homebuyers to take a pause.

Annual house price growth slowed in every region of England apart from the North East, and also slowed in Northern Ireland, Scotland, and Wales.

Halifax’s survey matches a similar report from Nationwide last week, which also showed a fall in house prices last month.

Many economists have predicted that house prices could fall by around 10% next year, as the UK falls into recession and households are squeezed hard by surging energy and food prices.

Kinnaird predicts a ‘much slower period for house prices’, as Kwarteng’s successor, Jeremy Hunt, prepares a package of hefty tax rises and spending cuts.

“Understandably we have also seen consumer caution grow, as industry data shows mortgage approvals and demand for borrowing declining. The rising cost of living coupled with already stretched mortgage affordability is expected to continue to weigh on activity levels.

With tax rises and spending cuts expected in the Autumn Statement, economic headwinds point to a much slower period for house prices.