Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Who didn’t go overboard on takeout during the pandemic and now wants to shed the resulting excess weight? Just Eat Takeaway this week announced a long-anticipated sale of the US subsidiary, Grubhub. The sale valuation is a mere mouthful at $650mn, made up of $500mn of attached debt and just $150mn in cash paid to Just Eat.

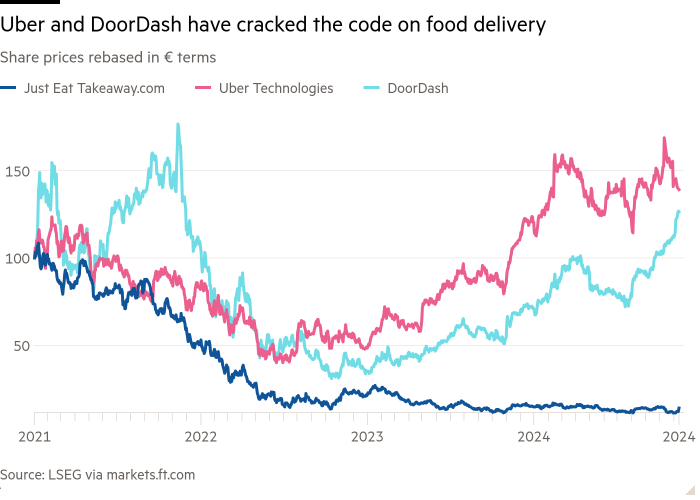

Grubhub had been acquired during the 2020 frenzy at a $7.3bn valuation. Just Eat gave up a nearly a third of the company’s overall shares as consideration to Grubhub shareholders. Since the day the deal was announced, Just Eat shares have fallen nearly 90 per cent and its equity value today is just above €2bn. Pandemic-era miscalculations are proving to be very expensive and investors are showing little mercy in punishing 2020-era profligacy.

Just Eat created what was a “quad” strategy. It had already established food delivery businesses in the Netherlands, UK and Germany with the huge US marketplace as its fourth “profit pool”. The US economics, however, were not very good, pandemic boost aside.

For 2023, Grubhub generated €2bn in revenue but just €125mn in ebitda. Free cash flow is similarly scant. Worse yet, North America gross market volume — the total dollar value of orders — shrunk 14 per cent compared with the year before. The company had been trying to unload Grubhub for some time and even presented group results excluding North America to avoid tainting the European operations.

Yet in the US, rivals DoorDash and Uber Eats are thriving. Meanwhile, Grubhub has disproportionate exposure to New York City, through its Seamless brand, where the municipal government has capped delivery fees and even sought to crack down on e-bike battery usage.

True, Just Eat deciding to use its inflated share price and valuation multiple in 2020 to acquire Grubhub was a better call than relying on debt and cash. Still, the dilution remains painful. Just Eat shares rallied 15 per cent on Wednesday on the prospect of an end to this saga.

Grubhub’s buyer is Wonder, a New York-based ghost kitchen chain founded by the billionaire entrepreneur Marc Lore. In conjunction with the Grubhub buyout, Wonder said it was raising $250mn in private funding. It can only hope that is enough to fix this dodgy takeout order.