Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

We’ve written a lot about the US election in recent days, so it’s time for some Anglocentric overcorrection.

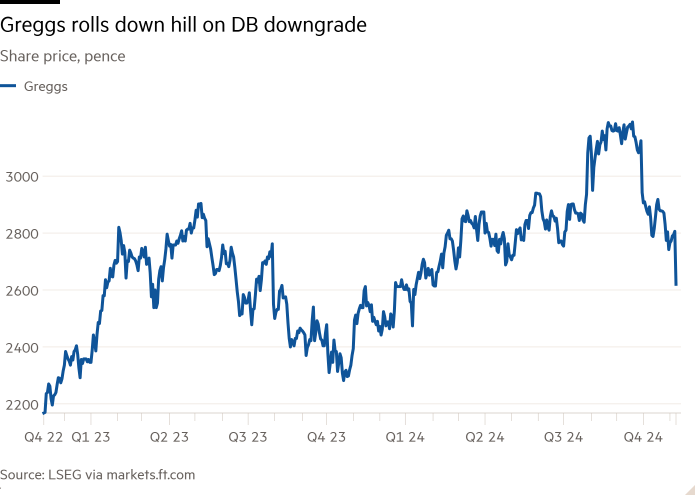

To wit: Deutsche Bank has initiated a sell rating on Greggs, dragging shares in the UK’s vaunted sausage roll maker down 6.3 per cent to a nine-month intraday low:

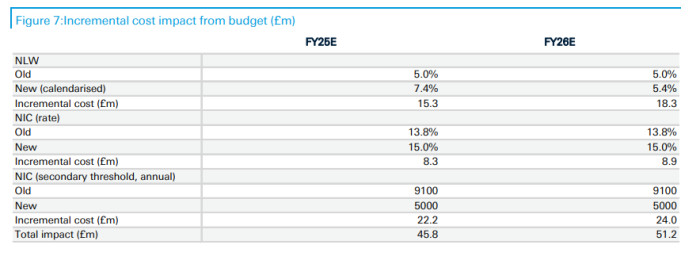

In a note published this morning, DB analysts Tim Barrett and Richard Stuber said they expect UK chancellor Rachel Reeves’ plans to raise the UK’s minimum hourly wage by 6.7 per cent to £12.21 — and increases to employer national insurance contributions — to cost Greggs about £45mn in 2025 and £50mn in 2026. That translates into a 23 per cent profit-before-tax downgrade for both years.

The pair trimmed their target price from £26 to £24, distinguishing themselves in so doing as the only analysts out of 15 tracked by Bloomberg who no longer think investors should buy or hold the stock.

[High-resolution version]

How might Greggs respond to rising costs? Probably by raising prices and slashing the bonus they distribute to employees, team DB write:

Most obviously, Greggs could pass this additional cost on through price rises. With approximately £2bn of sales, this would require approximately 2.5% increase to offset this cost alone. We already had assumed 5% increase in company-managed LFL sales in FY25 and FY26. Price rises are easier to pass through if competitors either act ‘rationally’, ie all raise their prices, or if there is rising/higher general inflation.

On the former it is difficult to be confident others will price-up. In theory, Greggs should outperform (lower price point, greater scale etc) but we see this as upside risk rather than a base case. On the latter, the recent CPI prints and forecasts are actually slowing. We have seen this reflected in slowing quarterly LFLs. These slowed from +17.0% in 1Q23 to +5.5% in 3Q24 and growth was largely price driven. Management confirmed that during 2023 volume trends were relatively stable throughout the year.

Greggs distributes 10% of profits to employees, equivalent to £17.6m in FY23 (£19.6m total cost including additional NIC). This is equivalent to nearly half of the total impact and therefore management could decide to be less generous to employees.

DB notes that Greggs had slipped 13 per cent from its September high in the lead up to its third-quarter trading update, when the food-to-go retailer announced rising sales, a flurry of new shop openings and — crucially — the rollout of a new pumpkin spice doughnut to compliment the return of its seasonal drinks range.

But neither pumpkin-flavoured pastries and lattes nor Greggs’s new all-day breakfast baguette and Mexican bean & spicy cheese flatbread seem to excite DB’s Tim and Rich. There’s no accounting for taste (which, to be fair, has worked in Greggs’s favour in the past).

Further reading:

— London Greggs ‘bans’ customers from wearing headphones or using mobile (Evening Standard)

— Greggs on a roll as low prices and savvy marketing aid rapid expansion (FT)