Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

European defence chiefs expect the bloc’s governments to face renewed pressure from Donald Trump to meet their contributions to Nato.

“As Europeans we are fully aware, without Trump having to tell us, that we need to step up contributions [to Nato], after all it is not in our interest to be the minority partners,” Roberto Cingolani, chief executive of Italy’s Leonardo, told the Financial Times.

Although Cingolani expects Trump to proceed with efforts to broker peace between Ukraine and Russia, the rise in conflicts close to Europe meant it was in the region’s interest to “invest more in security and forge alliances among the bloc’s 27 countries in order for our defence industry to become more competitive”.

European defence groups are likely to be beneficiaries of a new Trump presidency if, as some analysts have suggested, his second presidency leads to the end of an era where the US was regarded as Europe’s security guarantor.

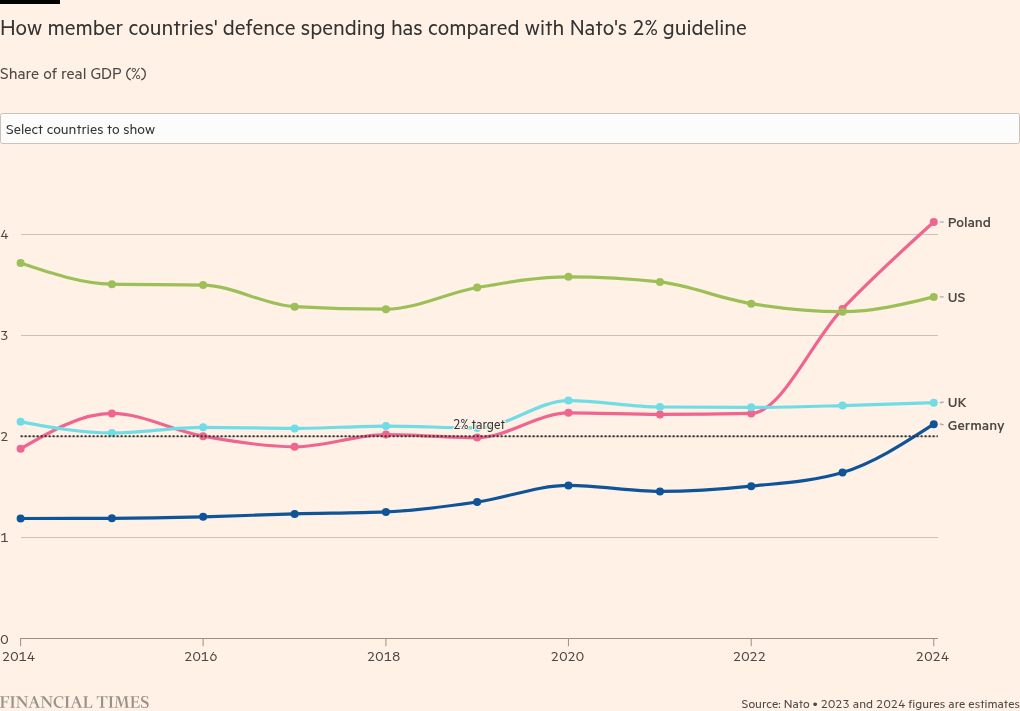

Armin Pappeger, chief executive of Germany’s largest defence contractor Rheinmetall, said President Trump “will prep the Europeans to be more independent”, adding that there will be big pressure from the US to increase spending beyond the designated 2 per cent of GDP.

Cingolani’s focus has been on increased co-operation with Leonardo’s European rivals since he took the helm of the Italian group in 2023.

“We can’t be surprised if much of the EU’s defence spending ends up benefiting US companies . . . our industry is fragmented and our focus is to develop products and technologies that will allow us to be competitive with much larger countries that spend much more than we do on defence,” he said.

This year, Leonardo and Germany’s Rheinmetall entered a joint venture to build tanks for the Italian army.

Meanwhile, this month the defence ministers of Japan, Italy and the UK agreed to accelerate the joint development of a next-generation fighter jet which will be built by Japan’s Mitsubishi Heavy Industries, Britain’s BAE Systems and Leonardo.

The Rome-based defence major, whose single largest shareholder is Italy’s finance ministry with a 30 per cent stake, said its net profit in the first nine months of the year was up 136 per cent to €730mn compared to 2023.

The net profit figure included a €366mn one-off gain related to the assessment value of Telespazio Group, a satellite operator it co-owns with France’s Thales. The company reported an 8 per cent rise in new orders and an order backlog of €43bn. Net debt dropped by 19 per cent to €3.1bn.

Rheinmetall’s Papperger said the company’s recent $950mn deal for Michigan-based military vehicle parts maker Loc Performance was not at risk under the new US presidency.

“President Trump wants to make America great again and if you create jobs in the US he will be happy and protect [you],” he said.

The company said a surge in munition and military vehicle orders boosted revenues 36 per cent year-on-year to €6.3bn in the first nine months. Operating profit rose 72 per cent to €705mn. The company’s order backlog totalled more than €52bn.

Data visualisation by Alan Smith