This article is an on-site version of our Energy Source newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday and Thursday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Hello, and welcome back to Energy Source, coming to you today from London.

Donald Trump’s election victory sent renewables shares tumbling yesterday, given concerns he will pull the plug on the US’s nascent offshore wind sector and roll back green tax credits.

US renewable energy shares were hit hard. NextEra Energy, the country’s largest renewable energy developer, slumped 5 per cent, hydrogen developer Plug Power shed a fifth of its value and solar developer Sunrun’s stock was down almost 30 per cent.

Our main piece delves into what his presidency might mean for renewables in the US and beyond.

Meanwhile, it’s been a big week for UK energy, with officials publishing their long-awaited plans for how the relatively new Labour government can meet its target of decarbonising Britain’s power system by 2030.

Their report was seized on by Ed Miliband, the energy secretary, as “conclusive proof” that his plan was achievable. But can he actually do it? More on that also below. — Rachel

Clean energy sector braces for Trump

The chief executives of Danish wind energy giants Ørsted and Vestas sounded sanguine when quizzed about the impact of a potential second Trump presidency alongside their quarterly results on Tuesday as US voters went to the polls.

Trump has pledged to end offshore wind in the US on “day one” and stop doling out subsidies under President Joe Biden’s Inflation Reduction Act designed to boost renewables across the US. His campaign has also said he will take the US out of the Paris Agreement on climate change.

But Ørsted’s chief executive, Mads Nipper, highlighted the renewable industry’s strong economic logic, ranging from demand for “green” power to robust job creation in Republican states.

“We are convinced that no matter what happens [in the election] there will be a strong role for renewables, both onshore and offshore at least in parts of the country,” he said.

“Sometimes comments are comments made in political statements, and then we will see what actually comes out of it,” added Henrik Andersen, chief executive of Vestas, the wind turbine maker.

Shareholders were less sanguine as markets in Europe opened on Wednesday morning to news of Trump’s victory. Ørsted’s and Vestas’s shares fell almost 13 per cent by Wednesday afternoon UK time.

Spanish utility Iberdrola fell more than 4 per cent, while EDPR fell almost 11 per cent. Copper — a critical electricity conductor — was also down almost 5 per cent, pushed also by the stronger dollar. The S&P Global Clean Energy index was down almost 6 per cent in the UK afternoon.

“The world has changed in the past 24 hours,” said Rob West, analyst and chief executive at Thunder Said Energy, a research consultancy, in a note on Wednesday morning.

“Momentum behind many energy transition themes has been slowing in 2024. It is now harder to see a re-acceleration.”

The question now is whether Trump’s bark turns out to be worse than his bite after he takes office in January — and whether the shift to renewables has taken too deep a root to reverse.

Several analysts point to the growth in renewables during Trump’s first presidency and agree the economic benefits of the IRA in Republican states are likely to give it some protection. Cancelling offshore wind projects under construction might be legally challenging, they add.

But others argue that even a partial repeal of the IRA or modifications would have a large impact. “We don’t anticipate the IRA is going to go away entirely,” says Michelle Davis, head of global solar power research at Wood Mackenzie. “But we anticipate elements of it will be significantly modified.”

Modelling by Wood Mackenzie indicates that if all potential modifications — such as reducing tax credit bonuses or changing eligibility timelines — are made, about one-third less renewable energy capacity will get built in the US over the next decade.

Meanwhile, the “permitting process for future [offshore wind] projects might be halted by federal government agencies”, analysts at RBC warned on Wednesday.

Beyond those immediate potential changes, Trump’s plans for new import tariffs and other protectionist measures could push up the costs of developing renewables in the US, slowing their rollout, analysts add.

The US’s retreat from climate initiatives is likely to “slow momentum to combat climate change unless other parts of the world step in to fill the gap”, warns Nazmeera Moola, chief sustainability officer at investment firm Ninety One.

However, she added: “We do think that countries like China and India will continue to focus on energy transition-related investments — as these investments have been driven by their positive financial benefits and impact on growth to date.”

With so much at stake, executives on Wednesday were trying to make the right overtures to the new man soon to be in the White House.

“The International Energy Agency looks forward to working closely with your new administration,” said its executive director Fatih Birol, whose predictions on the future of oil and support for the energy transition has irked fossil fuel executives.

“We will work with the new administration, Congress and officials at the state and local levels to help meet these critical economic needs and energy demands,” added David Hardy, head of Ørsted’s Americas business.

The new year will tell how effective their overtures have been.

UK power play

As darkness arrived on a chilly day in London on Tuesday, Britain was getting more than 60 per cent of its electricity from gas-fired power plants.

They aren’t needed that much all of the time: in a typical year, gas supplies about one-third of Britain’s electricity. And the relatively new Labour government want to slash that figure further — and fast.

Under its manifesto pledge of delivering a clean power system by 2030, it wants gas to fall to below 5 per cent of the electricity mix over the next five years.

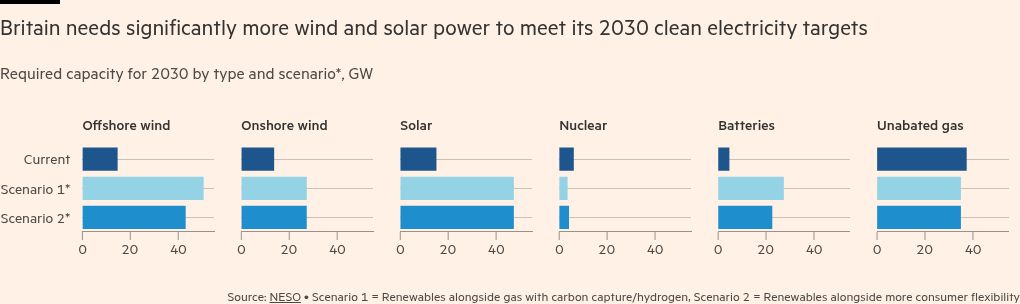

Many in the industry are sceptical about whether it can be done. This week, Britain’s state-owned National Energy System Operator delivered its 80-page verdict on what would be required for the challenge.

In summary: a “Herculean” buildout of electricity cables, wind turbines and solar panels along with an overhaul of consumer behaviour and rapid speeding up of bureaucracy.

That is a tall order for a country where planning applications can bog companies down for years, and where the smart meter rollout — required for consumers to start using electricity more flexibly — is lagging.

The task is potentially now even harder given a growing political divide in the UK over the energy transition.

Claire Coutinho, the shadow energy secretary, said this week that NESO’s report posed “very difficult questions” for Labour and involved “wildly optimistic” assumptions.

Meanwhile, Kemi Badenoch, elected on Saturday as the new leader of the opposition Conservative party, describes herself as a “net zero sceptic”. Her elevation erodes the previous broad political consensus on the country’s plans to decarbonise.

With Trump soon to take office across the Atlantic, that divide in the UK could grow. (Chart by Janina Conboye)

Power Points

-

Big Oil’s dirty legacy in Nigeria: who will clean up the environmental mess when Shell and others pull out of the Niger Delta?

-

Spain’s political leaders have turned on each other over the country’s deadly flood catastrophe.

-

Elon Musk’s gamble on Trump paid off as he is set to become one of the incoming president’s most influential political and business advisers.

Energy Source is written and edited by Jamie Smyth, Myles McCormick, Amanda Chu, Tom Wilson and Malcolm Moore, with support from the FT’s global team of reporters. Reach us at [email protected] and follow us on X at @FTEnergy. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Moral Money — Our unmissable newsletter on socially responsible business, sustainable finance and more. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here