Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

Healthcare spending may not have taken centre stage as an issue during this year’s presidential campaign. But for US health insurers, Donald Trump’s victory means a sharp switch in the sector in terms of likely winners and losers.

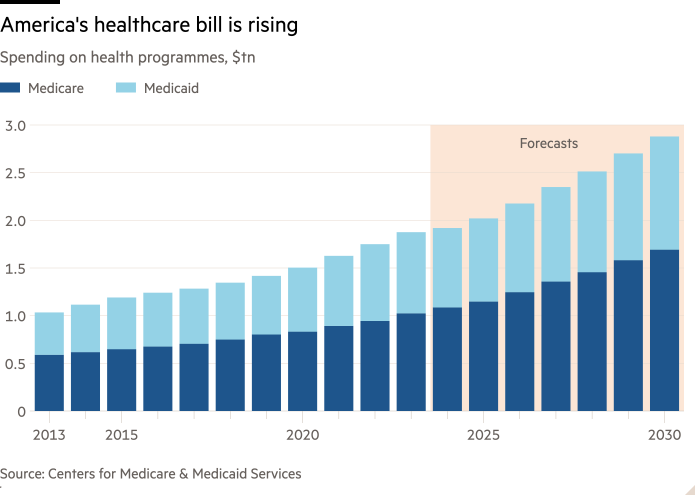

The US government is the single biggest payer of healthcare services in the country. Spending on Medicare, which provides health insurance for the elderly, and Medicaid, a federal-state programme for low-income and disabled people, combined to top $1.8tn — or about 40 per cent of total spending — last year.

The government relies on insurers to help provide coverage through private Medicare Advantage plans. However, insurers that bet big on these programmes over the past decade have suffered a sharp reversal of fortunes this year. The Biden administration — in response to complaints that Medicare Advantage cost taxpayers more than traditional Medicare — changed billing rules and lowered reimbursement rates, just as medical costs for seniors spiked.

Trump’s victory could change all that. Republicans favour further privatising Medicare through Medicare Advantage. A Trump administration will probably try and make it more appealing for insurers to continue offering Medicare Advantage plans by raising payment rates. A more radical — but not implausible move — would be to make Medicare Advantage the default option for Medicare enrolment.

Whether that results in better care for seniors is debatable. But companies with large Medicare Advantage businesses such as Humana, UnitedHealth, and Aetna owner CVS would benefit, with their shares set to open up sharply on Wednesday morning. Humana, the only large US health insurer that is focused almost exclusively on Medicare, had lost nearly half of its market value this year. CVS shares are down by a third. UnitedHealth, despite its diversified business model, has only managed to eke out a 5 per cent gain.

A second Trump term creates a problem for Molina Healthcare and Centene, however, with both stocks set to fall on Wednesday. Those companies are heavily focused on the Medicaid market. The introduction of the Affordable Care Act in 2010 greatly expanded Medicaid coverage for lower-income families. Between 2013 and 2022, Medicaid saw its membership grow by more than 50 per cent to almost 91mn, according to the Centers for Medicare & Medicaid Services. Trump, a vocal critic of Obamacare, could try and roll back the programme.

Even given uncertainty about Trump’s policies, or how much will be achieved, his decisive victory turns the tables in US health, opening up a new schism between the sector’s haves and have-nots.