Boeing ranks fifth in the list of America’s biggest cumulative stock market compounders in history. But these days, it’s among the US’s foremost corporate dumpster fires — and could become the biggest “fallen angel” in history.

Here’s what a quick scan of some recent MainFT headlines yields: Karma comes for Boeing’s shareholders. Can things get worse at Boeing? Boeing factory workers reject latest contract offer. Boeing reports $6bn loss as chief faults ‘serious performance lapses’. Boeing to cut 17,000 jobs and delay 777X jet as revenues fall short. Boeing seeks up to $35bn to bolster its balance sheet. Can anyone fix Boeing?

And that’s just since October.

However, at least it has managed an absolutely MASSIVE capital raise. From MainFT yesterday evening:

Boeing has clinched one of the largest stock sales in history, raising $21.1bn as its new executive team races to shore up its balance sheet and avoid its credit rating being downgraded to junk.

The struggling aeroplane maker sold 112.5mn shares of common stock at $143 apiece, raising $16.1bn in equity for the company, which has been haemorrhaging cash and been buffeted by a strike that has ground several operations to a halt. It raised another $5bn through a sale of securities that hold interests in convertible preferred stock.

The deal marks the largest equity fundraising by a US company ever and the fourth-largest globally, excluding deals where no new shares were issued, according to Bloomberg data. The capital raise, completed late on Monday, could swell by a further $3.2bn if banks led by Goldman Sachs exercise certain options tied to the offering, which is expected to happen in the coming days.

This comes after agreeing a $10bn credit line, and helps stave off worries over financial accidents, at least for the next year or two. Despite the massive dilution, shareholders have cheered the move. Boeing’s stock has jumped 13 per cent this week, lifting its market cap back above $100bn.

However, the investment grade credit rating that the recapitalisation is intended to secure remains precarious.

S&P, Fitch and Moody’s all rate Boeing at BBB, the lowest-possible investment-grade rung, with a negative outlook. Even when the headline details of the capital raise were made public, analysts at JPMorgan said that they still thought there was an even chance Boeing still falls into junk territory.

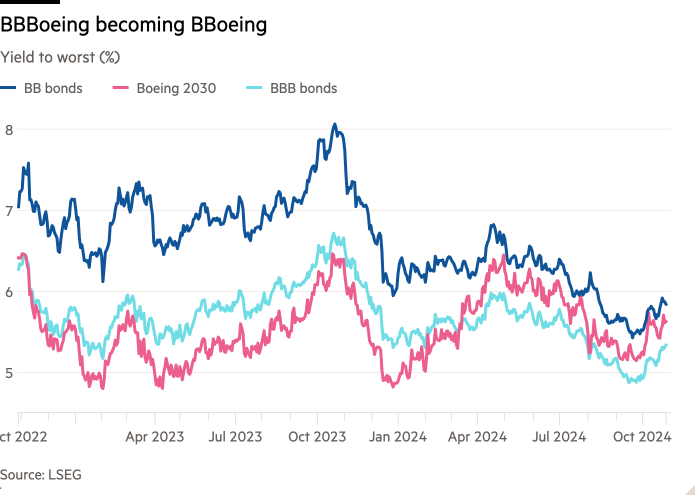

Investors certainly seem to still think it’s possible. Here’s a chart showing the yield of Boeing’s February 2030 bond (in maturity the closest to the broader high-yield market) climbing over the average BBB-yield in March, and now it’s trading closer to the junk BB average.

In fact, Boeing’s March 2025 bond is trading at a yield of 5.94 per cent even after the balance sheet repair. That the bond maturing in less than half a year is yielding more than its medium-term bonds is a pretty stark signal that many investors remain worried about the immediate rating outlook.

After all, the company remains in trouble, and it only requires two of the three credit rating agencies to downgrade Boeing for it to be ejected from all the major investment grade bond indices and enter the junkier ones.

This matters, because Boeing has issued bonds with a face value of $53bn (and overall debts of about $58bn). If it gets relegated from investment grade territory it would be the biggest “fallen angel” in history, surpassing the downgrade of Ford’s $52bn of debts in March 2020.

It would instantly make it the single biggest high-yield bond issuer. Moreover, given that some investors have concentration limits, Boeing’s large probable weighting — 3.6 per cent of JPMorgan’s index, about 4 per cent of the iBoxx and 7 per cent of S&P’s index — could make it a tricky holding.

That kind of splash could cause ripples through the corporate bond market, as rating-constrained investors are forced to dump Boeing, and others ratchet back existing holdings to make way for Boeing paper.

However, to the immense sadness of financial news editors who love headline plays on “fallen angels”, it’s unlikely to have a major impact on the broader market. Or probably even a minor one.

First of all, although big in isolation, a Boeing downgrade would not be coming at a time of broader tumult, which was the case with the Ford downgrade in 2020. This is a slow-moving train wreck, and credit markets are on fire at the moment. Many junk-bond funds would probably be grateful for the extra supply.

And it wouldn’t be the biggest junk bond market adjustment either. On May 5, 2005 both General Motors and Ford were relegated to junk, with aggregate debt burden of $87bn — at a time when the high-yield bond market was much smaller.

These days, market is much larger, and despite years of worries over liquidity, trading conditions are pretty healthy, JPMorgan’s credit analysts note:

While liquidity in the high yield market can fluctuate based on market conditions, it has also grown significantly over the years. Year to date in 2024, high yield bonds’ daily trading volume averaged approximately $15 billion. The new issue market is also large with ~$246 billion bonds (78% refinanced; 22% new money) issued in high yield and $923 billion (87% refinanced/repriced; 13% new money) in the loan market year to date in 2024. In 2023 $176 billion of bonds (66% refinanced; 34% new money) and $370 billion of loans (78% refinanced/repriced; 22% new money) priced in the non-investment grade market. Our view is, while there may be some volatility, Boeing bonds (existing and new issue) can be absorbed in high yield with limited market disruption.

Ford, Kraft Heinz, and Occidental Petroleum were the largest downgrades to high yield in the last ten years. Upon downgrades, the transition to high yield was generally orderly. While these three companies’ debt was significant, they were relatively small compared to the overall high yield market. Boeing’s debt at ~$58 billion is larger than Ford’s, Kraft Heinz’s, and Occidental Petroleum’s debt ($52 billion, $23 billion, and $32 billion, respectively). At about 3.5% of the high yield market, we think the total market size and daily liquidity is adequate for an orderly transition of Boeing’s debt from investment grade to high yield.

Finally, does it actually matter to Boeing itself? The company’s management has certainly made it clear that keeping an investment-grade rating is a priority.

After all, some of its bonds have interest rate step-up clauses should it get downgraded to junk. This would immediately increase Boeing’s annual interest rate expenses by about $200mn, to $2.9bn, according to JPMorgan. Future refinancings — of which there will unavoidably be plenty — would become more expensive as well.

However, Boeing doesn’t really need to be investment grade. Plenty of companies live permanently and perfectly happily in the junk bond universe. As JPMorgan concluded in its report even before the balance sheet repair:

The high yield market is a large and mature asset class with many high quality issuers. We are reminded Huntington Ingalls, the only aircraft carrier builder and one of two nuclear submarine builders for the United States was high yield when it was spun out of Northrop Grumman in 2011.

Our point here is raising equity/capital and de-risking the balance sheet is important to make sure Boeing is well positioned for long term growth. Perhaps fighting the battle to remain investment grade should not be the main objective but rather having ample liquidly and pushing out maturities to position the company for long term success even if this means raising some capital in the high yield market.

We hold the view if Boeing is downgraded to high yield it will likely move back to investment grade in 3 years or less. Rolls-Royce was in high yield for about four years following its downgrade during COVID. We think Boeing will likely improve its metrics to investment grade quicker than Rolls-Royce.