Evan Spiegel is battling to convince Wall Street that he can revive the fortunes of Snap, with the social media company’s value having fallen to just 1 per cent of the market capitalisation of long-standing rival Meta.

The growing strength of Mark Zuckerberg’s empire threatens Spiegel’s ambitions to put Snap at the forefront of augmented reality, which he sees as the future of computing.

Snapchat, a platform popular with Generation Z users, has over the past three years been hit by an advertising market downturn and privacy changes from Apple that have made it more difficult for apps to target ads to iPhone users.

Investors are eagerly awaiting the company’s latest quarterly results, due on Tuesday, for signs as to whether the company’s ad revenues are recovering.

Failure to show progress could further hit Snap’s share price, which has plummeted almost 90 per cent since its pandemic peak in late 2021, wiping more than $110bn from its market capitalisation.

Meanwhile, the value of Meta has risen about 60 per cent, adding around $455bn over the same period, as Zuckerberg has embraced artificial intelligence.

Snap has been plagued by management mis-steps, high turnover of senior staff and a volatile share price that has unsettled employees, according to interviews with a dozen current and former staffers and analysts.

Spiegel’s bold and costly bet on developing augmented-reality headsets — part of a race against Meta to build the next computing platform — is also dividing insiders, some of whom question whether the cost is justifiable when Snap’s core advertising business is struggling.

Snap is now valued at $17.7bn, just over 1 per cent of Meta’s $1.5tn market capitalisation.

For Spiegel, the fight is personal. In 2017, he took Snap public at a $24bn valuation, after rejecting Zuckerberg’s attempts to buy his company in the years before it floated. Meta has since cloned many of Snapchat’s features to great success on Instagram, such as disappearing “Stories”, vertical video and cute camera filters.

Spiegel promised last month to turn around its advertising business with a number of new changes. This includes a redesign that shifts the app closer to a TikTok-like focus on short-form video, in the hope of boosting engagement and better positioning Snap to benefit if the Chinese-owned app is banned in the US later next year.

Meanwhile, Spiegel has led restructuring efforts, cutting 20 per cent of its workforce in 2022 and a further 10 per cent earlier this year, around 2,000 jobs in total.

Insiders say Snap’s once playful start-up culture has also changed, with Spiegel walking the office floor in the evenings to check on staff, and employees called back into the office four days a week.

“[There] were strategic mistakes,” a former senior executive said. “Now you see the focus going to the right places . . . There’s potential for a bit of a turnaround story. The question will be execution.”

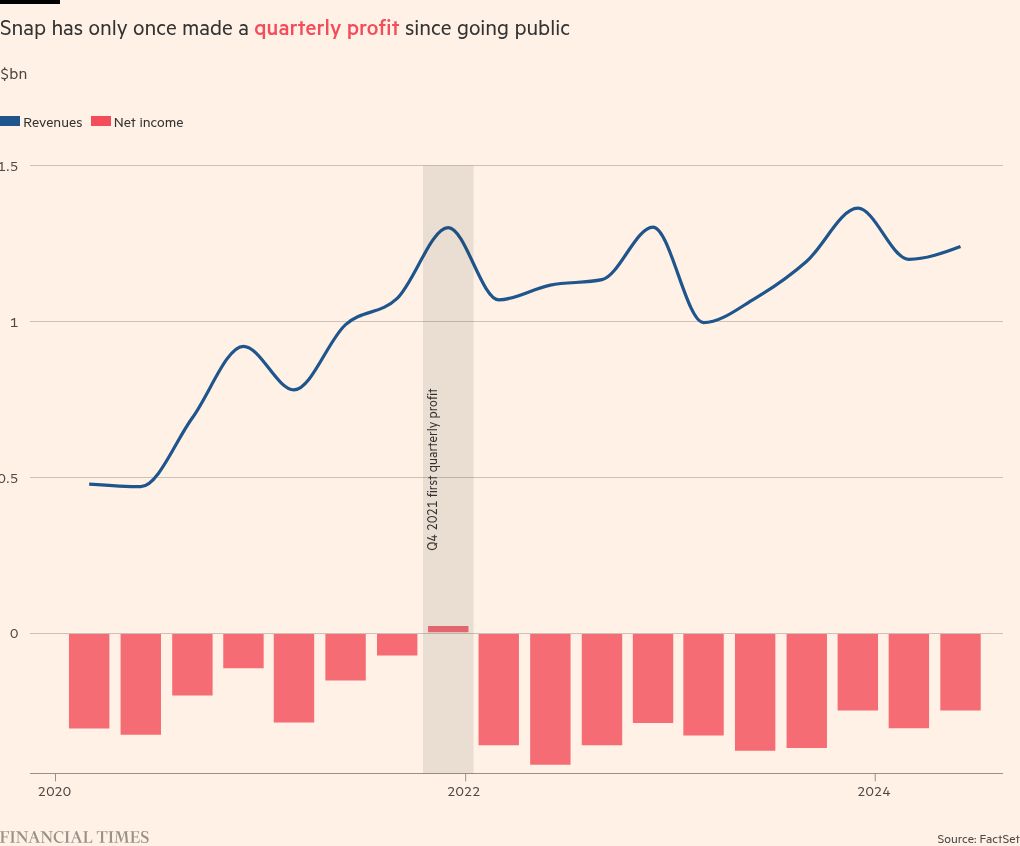

Snap’s audience has continued to grow steadily, hitting a record 850mn monthly active users in August, where Meta has around 3bn daily users across its apps. Revenue growth during the pandemic led to Snap posting its first quarterly net profit at the end of 2021.

Losses subsequently ballooned in 2022 and annual revenues were flat year-on-year in 2023 at $4.6bn as tough macroeconomic conditions hit the market alongside the Apple privacy changes.

Snap has argued that its revenues were disproportionately affected because the make-up of its advertiser base skewed towards big-brand advertisers hardest hit by global headwinds. The explosive growth of TikTok, which also targets a teen audience, hurt the business too.

Critics argue that Spiegel underestimated the risk of the Apple changes to Snap’s business. In early 2023, a late effort to revamp Snap’s advertising systems caused further issues. Some changes were designed to drive more so-called ‘click-through conversions’ such as purchases and downloads, as opposed to views or impressions.

But this in turn prompted Amazon, one of its big advertisers, to pull back its spending, according to five people familiar with the matter. This was because the ecommerce group did not want to share proprietary sales data with social networks, one former staffer said. The move was previously reported by US technology publication The Information.

“They were trying to mimic what Meta did — and as a result they lost some of their larger, sophisticated advertisers,” said Benjamin Black, co-head of internet equity research at Deutsche Bank. The Amazon relationship has since improved and spending is returning, according to several people familiar with the matter.

Turnover has also been high among Snap’s senior ranks, including around a dozen high-profile departures over the past two years. Rob Wilk, hired from Microsoft in April last year as its president in the Americas, left after six months.

Several people close to the company said that some had disagreed with Spiegel over strategic direction or felt unable to challenge him.

One current staffer said that some of the shake-up was due to Spiegel shifting priorities, describing the changes as “positive for the company,” adding: “The overall mood is a mood of impatience. We are working hard and would love to see the results of that in [the share price].”

Insiders said its chief is taking bolder action. In particular, the company is focusing on beefing up its advertising offering to small and medium-sized businesses as well as its performance advertising business, which aims to generate immediate sales.

Analysts have welcomed the introduction last month of ‘Simple Snap’ — a redesign that simplifies the user interface and improves content personalisation.

The company is also embedding sponsored advertising into its chat and maps functions. “[It’s] a necessary if not long overdue move from the company”, said Jasmine Enberg, principal analyst at Insider Intelligence.

Meanwhile, Speigel’s obsession with AR continues to cause ructions. He told the Financial Times last month the company’s track history of innovation means it can “get out in front” of competition such as Meta, and Apple with its Vision Pro mixed-reality headset.

“A credit to him is that Evan was saying a decade ago that AR would become the next computing platform, and the world is now proving him right,” said Imran Khan, an investor and former executive who helped build Snap’s ads business.

Last month, Spiegel launched the latest iteration of its AR glasses to a mixed reception. A week later, Zuckerberg unveiled a prototype of Meta’s first AR glasses to fanfare, showcasing a video featuring glowing praise from Nvidia chief executive Jensen Huang and Reddit chief Steve Huffman.

“Snap is so outgunned here,” one former senior Snap executive said. “Meta is going to spend tens of billions of dollars [on AR]. It is hard to argue that Snap has a right to win here.”

Sterling Crispin, a design engineer who worked at Snap in 2022, wrote on X last month that the “product speaks for itself and is obviously bad”. Snap said that Crispin had “departed before key hardware and software design decisions for this version of Spectacles had been made.”

Frustrated investors are agitating for the spending on augmented reality to be split out from the rest of the business in its earnings to gain a better sense of the costs involved and if Snap’s core advertising business is profitable, according to multiple people familiar with the matter.

“I think Evan’s earned the right to dream of the future,” said Rich Greenfield, partner and analyst at New York technology research firm LightShed Partners.

“[But] Snap needs to prove that they can grow the core business fast enough to get enough investor faith and confidence that they will not be upset by the investment in the future — 2025 becomes a big proving year for them.”