Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Paper and packaging is crumpling on all sides. Finland’s UPM last week warned on profits as a result of lower demand and pulp prices. Rival Stora Enso temporarily delayed weekly supplier payments in a bid to improve cash flow. Then London-listed Mondi reported weaker demand, with the paper and box maker falling far short of expectations for its third quarter.

Paper and packaging cycles through the upturns and downturns, tracking consumers. Less demand for bags and boxes reflects reduced appetite for the things that go in them, from cement to flat-pack bookcases to shampoo.

Come the upturn, this should be a sector poised to perform. Consolidation is under way, with a pair of big deals boxed up in the past 12 months or so. Ireland’s Smurfit Kappa and WestRock of the US joined forces to create the world’s biggest boxmaker by sales. US-based International Paper trumped Mondi’s offer to acquire UK competitor DS Smith in a £7.8bn deal.

But the latest stumbles are not just a cyclical tale. Mondi’s miss — with ebitda of €223mn was down on both the previous quarter and the “challenging” year ago — relays some company specifics, including a revaluation of forestry assets. Its vertically integrated model (it even owns trees in South Africa) means it cannot cash in on low pulp prices. Indeed, it sells pulp surplus to its own requirements.

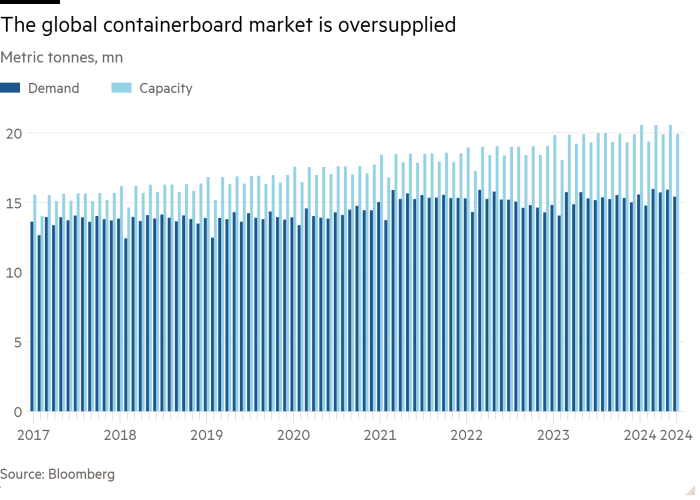

There are industry-wide concerns too. Prices for containerboard, while elevated from last year’s levels, are still well below the Covid-19 boom years when homebound shoppers bought everything online.

There is also excess capacity in the system: the two deals straddled continents rather than eliminating production. A long tail of specialist players remains, ripe for consolidation. More capacity is set to come online. Mondi’s €1.2bn organic capex spending, a five-year programme that kicked off in 2021, will improve its environmental footprint but also add to production.

The bright spot of sorts is that demand for packaging is as unlikely to disappear as demand for consumer goods. Stress on sustainability puts the US behind Europe. In the corrugated market, about 80 per cent of containerboard is recycled versus about half that in the US.

It is debatable whether that reflects the clout of US legacy manufacturers of virgin production or — more charitably — the need for ultra-robust boxes thanks to long-haul journeys. Europe shows how the industry is evolving towards sustainable packaging: boxes can be recycled six to seven times and in some cases more than twice that. Only those well positioned for this shift will be able to package up a good investment story when the cycle turns.