Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Increasingly motorists are comparing car insurance to highway robbery. The average price of a new quote rose by nearly four times as much as inflation in the three years to June 2024. The government has pledged to tackle the problem. But are insurers really taking customers for a ride?

Some pricey policy add-ons fuel that perception. This week the UK financial watchdog launched an investigation into whether people are being overcharged to pay for car and home insurance in instalments. If the Financial Conduct Authority ends up imposing a 15 per cent annual percentage rate ceiling on premium finance, it could deliver an 8 per cent hit to the earnings of Admiral and Direct Line unless prices increase to replace the lost income, according to Abid Hussain of Panmure Liberum.

The FCA will also probe the puzzle of why motor insurance has risen by so much in the UK. Yes, costs have been driven up by supply chain disruption, energy costs and labour shortages. As cars use more sophisticated technology, they are more expensive to repair. Fraud — including “crash for cash” scams — and inefficient claims handling arrangements are piling on expenses. But why have rates risen by four times as much in the UK as the EU? They are up by 82 per cent compared with 19 per cent in the three years to June.

One explanation is that these statistics overstate the problem. They measure quotes to new customers which appear to have risen particularly steeply following a 2022 ban on “price walking” — the practice of offering better rates to new customers than existing ones. Using a broader measure that includes renewals, premiums are at present £12 lower than inflation-adjusted peak prices in late 2017, according to the ABI. Moreover, UK prices fell more than EU ones in the pandemic, accentuating the subsequent rise.

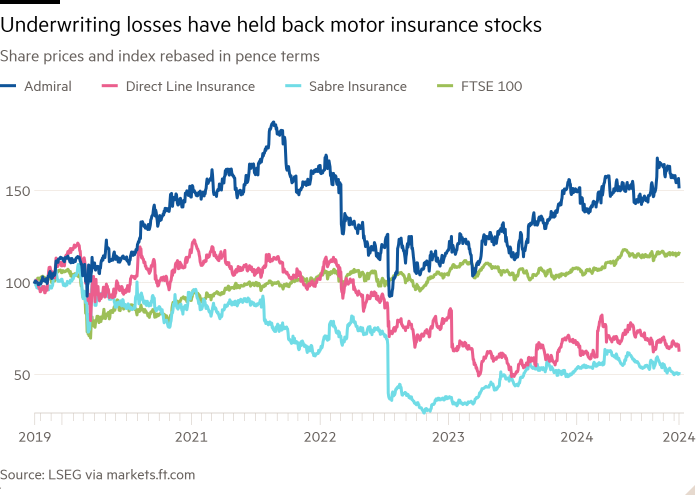

Another possibility is that motor insurers are making excessive profits from underwriting. But that does not stand up to scrutiny. The sector reported an underwriting loss in both 2022 and 2023.

Some of the pressure is easing. Premiums edged downwards between the first and second quarter of this year. But they have already risen enough to return insurers to profit. EY forecasts a net combined ratio — claims and costs as a percentage of premiums — of 96 per cent this year.

Even so, a concerted push to improve efficiency and drive down costs is vital. This is a multi-faceted problem that is not for the industry alone. Some of the remedies — from policing thefts to repairing potholes — are in the hands of the government. Just leaning on insurers will not move the dial.