Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

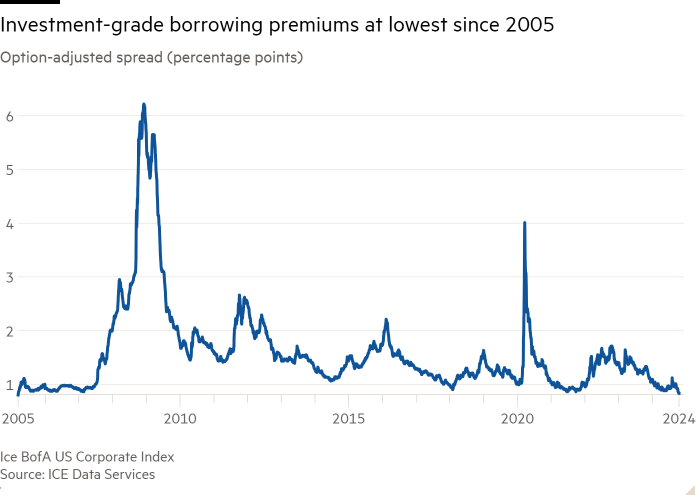

The gap between corporate bond yields and US Treasuries has narrowed to its lowest in almost 20 years, as investors pile into bets on a “soft landing” for the world’s largest economy.

The spread — or additional borrowing cost — paid by investment-grade companies relative to the US government fell to just 0.83 percentage points this week, the smallest gap since March 2005.

The spread for borrowers in the high-yield or “junk”-rated bond market is now just 2.89 percentage points, according to ICE BofA data — the lowest since mid-2007.

The narrowing spreads — a proxy for the risk of default — reflect investors’ belief that the US Federal Reserve will succeed in taming inflation without triggering a recession in which some companies would struggle to repay their debt.

But some fund managers fear the $11tn US corporate bond market is too complacent about lingering economic risks or possible turbulence after November’s presidential election.

“Broadly speaking, the market is entirely priced for a soft landing,” said Mike Scott, head of global high yield at asset manager Man Group.

Prices of both corporate and government debt, which move inversely to borrowing costs, have risen on expectations that the Fed will cut interest rates further after making its first reduction since 2020 last month.

The resilient economy is boosting corporate bonds, which are riskier than US Treasuries, in particular.

Bill Zox, portfolio manager at Brandywine Global Investment Management, said hunger for corporate debt was outstripping new supply. “You’re seeing tremendous demand for anything credit-related,” he added.

Markets have rebounded from a sell-off in August triggered by weaker than expected US jobs data.

But Ruben Hovhannisyan, a portfolio manager at TCW, said that episode showed “how overbought the market is” and “how little, if any, room there is for error”.

He added: “Those who are simply buying the bonds with the belief that everything is rosy and groovy . . . might be in for a surprise.”

Although spreads over US Treasuries have tightened to multi-decade lows, companies’ overall borrowing costs remain higher than the average in the decade and a half of near-zero interest rates that followed the financial crisis.

The average junk bond yield, which moves inversely to price, is 7.29 per cent, up from less than 5 per cent three years ago.

Some fund managers warn that buyers are ignoring the wafer-thin protection against a rise in defaults provided by the current level of spreads because they are focused on higher overall yields.

Lauren Wagandt, portfolio manager at T Rowe Price, said yield-based buyers were flooding the market for bonds of all kinds. However, she warned that valuations were high: “You need to have dry powder in case you hit that volatility.”