Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Foreign takeovers of UK-listed companies have given rise to much hand-wringing in the City of London. The phenomenon is now spreading to the continent. “Deutschland im Ausverkauf” is the phrase used to describe this by some observers. Germany, it would appear, is on sale.

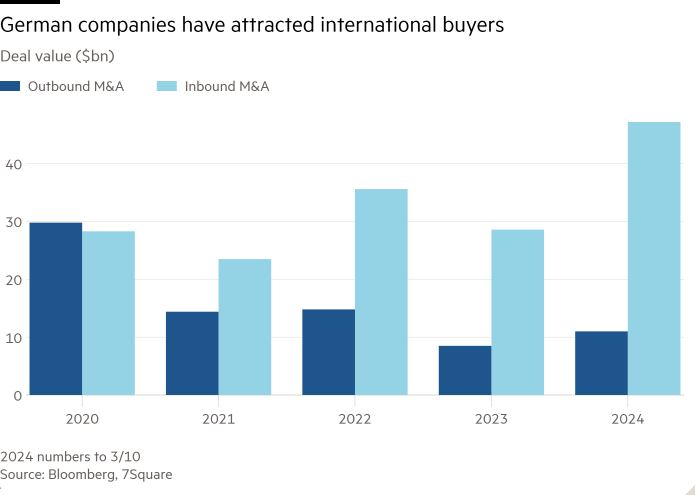

Deal volumes are inherently lumpy. But the numbers show a trend. So far this year, international companies have been on a $47.2bn German shopping spree, according to Tim Winkel of 7Square. That’s nearly 70 per cent higher than the value of inbound M&A in the whole of 2020. It includes high profile megadeals such as Adnoc’s bid for chemicals company Covestro and Danish group DSV’s swoop on Deutsche Bahn’s logistics business — together worth about $32bn. Concerns will not have been assuaged by would-be suitors stepping into more sensitive sectors such as banking. UniCredit’s frenemy hug on Commerzbank, which has raised politicians’ hackles, is not counted in the numbers.

Adding to concerns, German companies are not out and about doing some shopping of their own. The volume of outbound M&A has dropped to $11bn — down two-thirds since full-year 2020. The paucity of domestic private equity funds is part of the reason why. Financial buyers, meanwhile, accounted for over a quarter of inbound M&A in 2024.

These trends reflect the fact that German companies have become relatively small and relatively cheap.

That is in part due to the country’s well-documented economic ills. Only last week, it downgraded its 2024 economic forecasts and envisaged a second year of contraction. High energy costs and sluggish demand have affected its industrial base, pushing the likes of Covestro into the arms of deep-pocketed suitors. Giant conglomerates such as BASF are responding to the pressure by putting businesses on the block, suggesting this trend has further to run.

As well as suffering from economic drag, German companies are often exposed to lower growth, traditional industries such as car manufacturing. Sizeable companies in the jazzy tech sector or pharma companies, which have spawned many of the new global behemoths, are few.

The upshot of all of this is that German companies are now smaller players on the global corporate landscape. The banking sector has been especially hard hit. The country’s largest bank, Deutsche Bank, was the 10th-largest in the world by assets in 2013. It is now the 26th. In terms of market value, corporate Germany accounts for 2 per cent of the MSCI all countries index, down a third compared with a decade ago.

True, that is not as poor a performance as the UK’s, whose weighting has more than halved. But it is worse than other European countries. Denmark and the Netherlands have seen their weightings rise thanks to the performance of homegrown giants Novo Nordisk and ASML respectively.

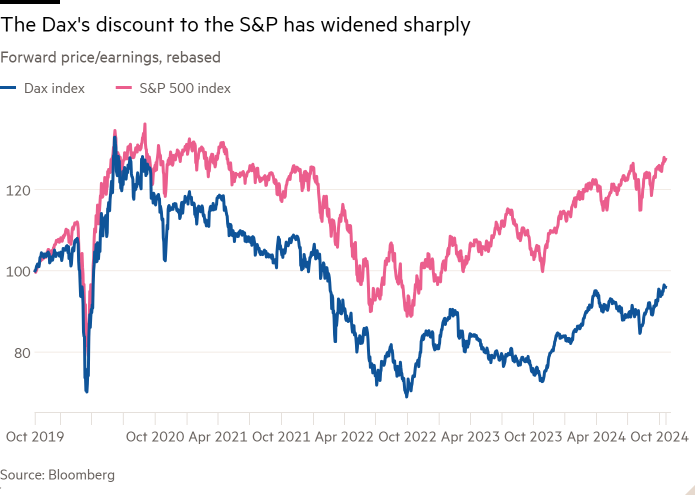

To look at it another way, the Dax — which was valued at a 20 per cent discount to the S&P 500 on a price/earnings basis just before the pandemic — now trades at a 40 per cent discount. Solving Germany’s economic malaise is a long-term endeavour. In the meantime, it remains attractive to global punters on the lookout for a bargain.

This article has been amended after publication to correct the name of Danish group DSV