Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

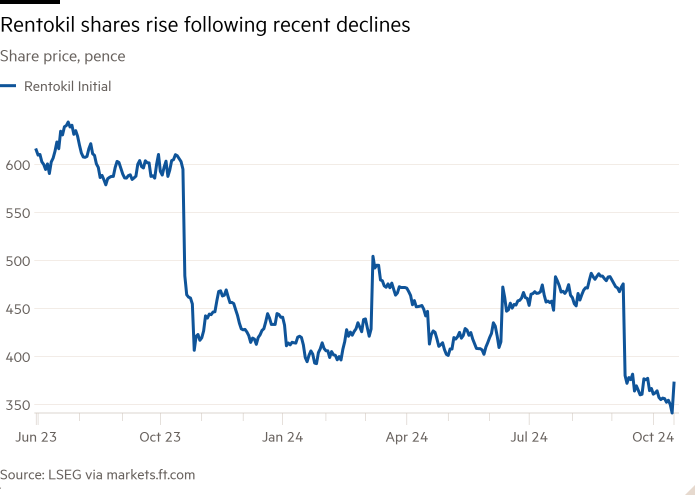

Rentokil Initial reported progress in cutting costs and restoring growth in its struggling North American business on Thursday, sending the pest control group’s shares up 9 per cent.

The FTSE 100 company has come under the spotlight after activist investor Nelson Peltz’s New York-based Trian partners took a seat on its board last month. The group announced on Thursday it would deliver annual cost savings of about $22mn after cutting 250 sales, services and administrative jobs.

Shares in Rentokil, a provider of pest control chemicals and technicians globally, have shed about half their value since mid-2023 as it has grappled with the integration of its US business, which has underperformed since the $6.7bn acquisition of US-based Terminix in 2021.

On Thursday, the group said that revenues rose 4 per cent during the three months to September, supported by sales growth in its North American unit.

It added, however, that demand had still been lower than expected as the group struggled with a “weaker termite season”. It also warned that costs in North America had been higher than anticipated and that a planned integration of its businesses next year would come up to three months later than previously hoped, following a review of its branch network and pay plans.

Rentokil’s expectations for full-year profit remained unchanged from last month’s reduced estimate of £700mn.

Trian’s involvement has suddenly drawn attention to the company, whose headquarters are in Crawley, West Sussex, and its unglamorous business of exterminating insects and rats.

The activist group, founded by US billionaire Peltz, secured a seat on Rentokil’s board for its head of research Brian Baldwin following a profit warning last month.

Rentokil, which has welcomed Trian’s intervention, warned at the time that annual profits would be lower than expected due to a poorly executed turnaround plan, including the integration of its US branches, immediately sending its shares plunging by a fifth and wiping £2bn off its market value.

Analysts at Peel Hunt said that “the heavy lifting phase of the branch integration of Terminix [had] only recently started” and that Rentokil must “reinvigorate sales growth at the same time”.

But they added that more immediate risks were now compensated by longer-term opportunities “and a highly regarded activist on the board”.