This article is an on-site version of our Energy Source newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday and Thursday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning, and welcome back to Energy Source, coming to you from New York.

The International Energy Agency released its annual world energy outlook yesterday, declaring a new “age of electricity” as the world uses more air conditioning, switches to electric vehicles and builds new data centres.

The energy watchdog expects global power demand to rise at an annual rate of 1,000 terawatt hours, equivalent to adding another Japan to electricity consumption each year.

The FT has a deep dive into the downfall of European battery start-up Northvolt this morning. Once a symbol of Europe’s comeback against China in a crucial technology, the company is now at risk of turning into a tale of hubris.

Today’s Energy Source looks at an exclusive report from Wood Mackenzie, tracking the US expansion of data centres. Announcements for these facilities that contain our digital lives have more than tripled since last year, presenting a challenge to the US grid.

Thanks for reading,

Amanda

Join 300+ CEOs, politicians and investors at the Energy Transition Summit on 22-24 October in London or online. Discover how to navigate geopolitical challenges, boost energy security and capitalise on the green economy. As a premium FT subscriber, you can save 15% on your in-person pass here or register for a free digital pass here.

Tracking the US data centre boom

The US’s ambition to lead the world in artificial intelligence has sparked a frenzy among developers to build data centres across the country.

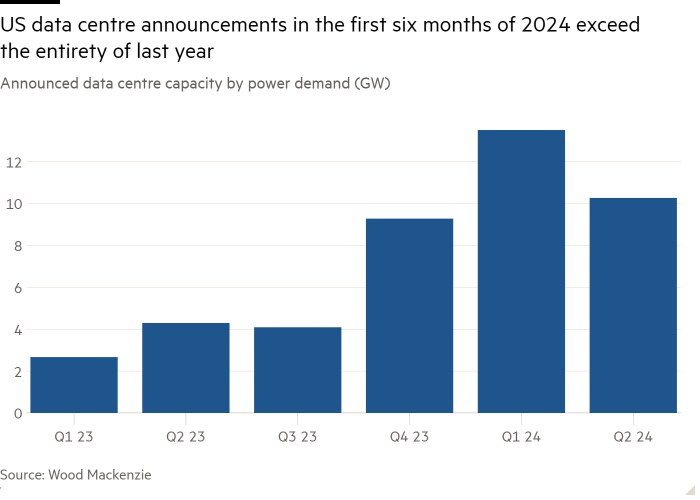

In the first half of 2024, new data centres totalling nearly 24GW were announced by companies, more than triple the same period last year and already exceeding the entirety of 2023, according to a new report from Wood Mackenzie.

“A large load like this has never really existed in history,” said Chris Seiple, vice-chair of Wood Mackenzie’s power and renewables group.

“It’s clear that there is a race going on across America to secure land and interconnection to energy to be able to build as much data centre capacity as possible.”

Virginia, Texas and Georgia lead in announced data centre capacity, exceeding 18GW since January 2023. Virginia is home to Loudoun County, nicknamed “Data Centre Alley”, where more than 3,500 technology companies have operations.

Spending on data centre construction at Amazon, Meta, Google and Microsoft is expected to reach $178bn in 2025, up 11 per cent year over year. Amazon’s $11bn project announced earlier this year in northern Indiana marks the largest capital investment in the state’s history.

Data centres are also getting bigger. Since January 2023, the capacity of announced data centres have grown an average of 8MW per month, according to Wood Mackenzie.

The backbone of the internet, data centres house the servers and computers that power our digital economy, from storing the photos we upload to the cloud to crypto mining to training generative AI.

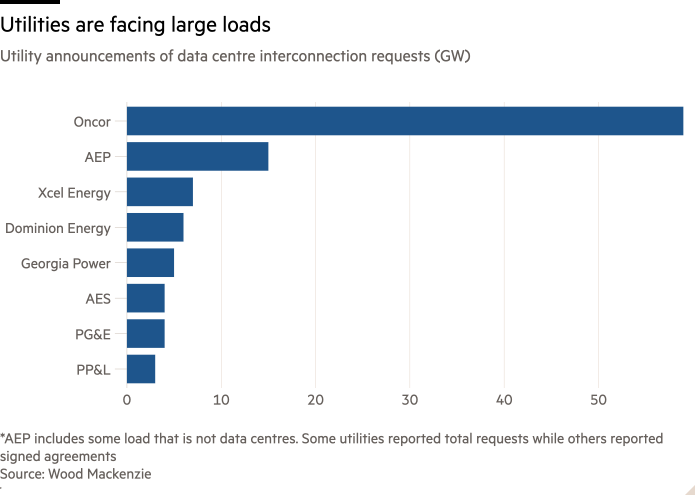

The rise of AI is behind the latest boom in data centres, and along with it, the rush to source enough clean and reliable power. US utilities face a backlog of more than 100GW of data centre capacity waiting to connect to the grid, Wood Mackenzie found.

The proliferation of data centres is expected to bring a surge in electricity demand, with numerous groups warning the US could face a shortfall of power and risk slowing its energy transition as a result.

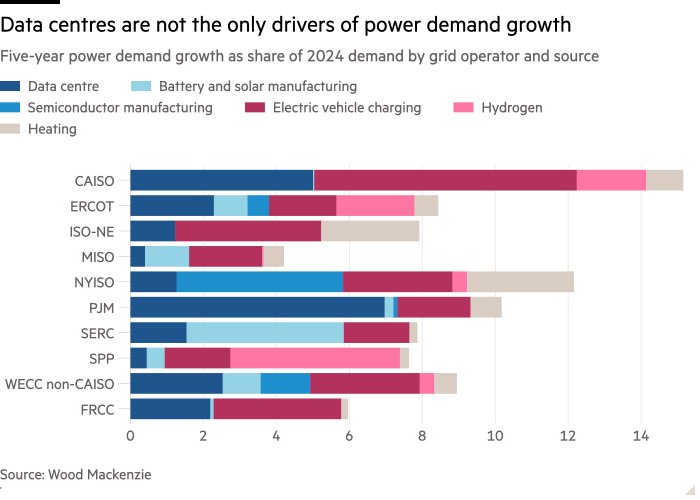

But data centres can’t take all the blame.

The data centre construction is concentrated in energy markets such as PJM Interconnection in the mid-Atlantic and CAISO in California and is just one driver of power demand. Power consumption from electric vehicle charging is expected to jump in the north-east and California, and US efforts to build new battery, solar panel and semiconductor factories are expected to create 15GW of power demand in the next few years.

What Energy Source is watching is whether the boom in data centres will pose a risk to President Joe Biden’s plans to onshore manufacturing as competition grows for limited supplies of power and industrial sites.

“Manufacturing facilities are at the centre of one political issue, which is creating jobs and reducing our dependence on China for critical components within our supply chain,” said Seiple. “Having all the large language models . . . the centre of the boom in artificial intelligence technology on US shores is another important political priority as well.”

“It really puts utilities in the crosshairs,” Seiple added.

Job moves

-

Ahmed El-Hoshy is stepping down as chief executive of OCI Global. Hassan Badrawi, chief financial officer of the chemical and fertiliser group, will succeed El-Hoshy as CEO.

-

Phillips 66 has appointed Grace Puma Whiteford to its board of directors. Puma Whiteford previously served as chief operations officer at PepsiCo before retiring in 2022.

-

Elkhan Mammadov is moving to senior vice-president of production at BP. Mammadov currently serves as the oil major’s VP of production for the Azerbaijan, Georgia and Turkey region.

-

Paul Harris, chief executive of NEO Energy, is stepping down and will be succeeded by Andy McIntosh. Martin Rowe, chief technology officer of the UK oil and gas company, is also departing.

-

Nuclear start-up NANO Nuclear Energy has appointed John Vonglis, former chief financial officer of the US Department of Energy, as chair of its executive advisory board for strategic initiatives.

Power points

-

Abu Dhabi’s national oil company wants to be one of the last companies pumping crude even as it diversifies its business.

-

Amazon is buying a stake in US nuclear developer X-energy to provide low-carbon electricity to power its data centres.

-

Australia’s largest oil and gas developer Woodside Energy will delist its shares from the London Stock Exchange in the latest blow to the UK market’s status as a natural resources hub.

Energy Source is written and edited by Jamie Smyth, Myles McCormick, Amanda Chu, Tom Wilson and Malcolm Moore, with support from the FT’s global team of reporters. Reach us at [email protected] and follow us on X at @FTEnergy. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Moral Money — Our unmissable newsletter on socially responsible business, sustainable finance and more. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here

: