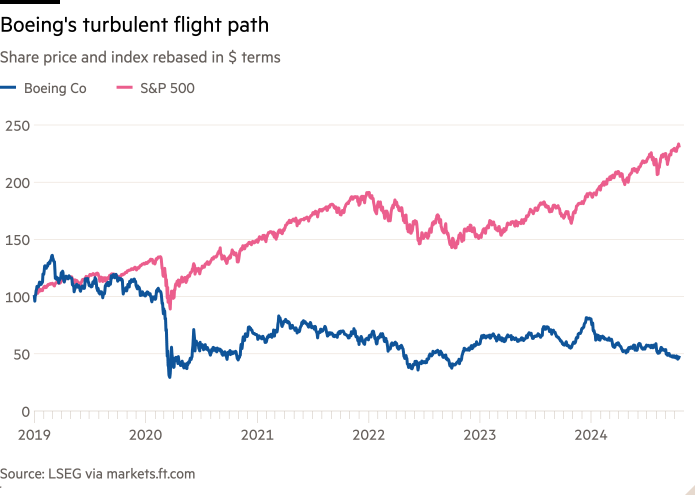

Boeing’s announcement on Tuesday that it plans to shore up its finances with up to $35bn in new funding is the latest response to a crisis that has engulfed the US plane maker over the past five years.

Fatal crashes of its 737 Max aircraft in 2018 and 2019, followed by the Covid-19 pandemic and January’s mid-flight blowout of a door panel on one of its planes, had already severely stretched the company’s finances.

Boeing, which last reported a profit in 2018 and has consolidated debt close to $58bn, is burning through an estimated $1bn a month as a strike by its largest labour union has halted production at its main factories in Washington state since last month.

With the strike showing little sign of ending any time soon, the pressing question is whether the company has done enough to preserve its investment credit rating.

Has Boeing done enough to please bondholders?

Bondholders the Financial Times spoke to broadly welcomed Boeing’s plan to raise up to $25bn in equity and debt and its agreement of a $10bn new credit facility, with one saying that “it was needed, expected and more importantly wanted by the markets”.

“The debt facility is a bridge with no intended purpose of being a long-term financing. If it is, that’s a larger problem,” the bondholder added.

Another called it a “smart strategy by management” to reassure the market while Boeing negotiated with the machinists’ union.

Significant uncertainty, however, remains over the size of a potential equity issuance, with concerns that Boeing may have to raise more at a later date if it does not raise enough now.

“To me, I would expect and/or hope that any equity issuance raised would be closer to $15bn and not $10bn,” the bondholder said.

Boeing is “too big to fail in the eyes of the US government”, said a second bondholder.

“However, it’s not too big to become high-yield. Our major concern is that the longer this goes, the [more likely it is that] rating agencies will be forced to take some action.”

The company, the bondholder added, had a “very luxurious position in that the credit markets have lost their minds at the moment and are giving anybody money. We’re stunned at how tight the credit spreads are for Boeing given everything it’s dealing with.”

Will Boeing avert a credit downgrade?

Boeing’s investment-grade rating is crucial to its operations and losing it would be a serious blow. The company could face a big increase in borrowing costs given its hefty debt burden.

Rating agency S&P Global Ratings warned earlier this month that a downgrade of Boeing’s debt into junk territory was possible in light of the strike at its main factories, which it estimated could cost the company $1bn a month.

Boeing said last week that it had $10.5bn in cash and marketable securities at the end of September — close to the minimum it has said it needs to operate — after burning through $1.3bn in cash during the third quarter.

“Ultimately, the company has to resolve the strike and really be on a path to building planes again in order to maintain the rating,” Ben Tsocanos, aerospace director at S&P Global Ratings, said on Tuesday. For now, “they have bought themselves some time”.

Whether Boeing had done enough to avert a possible credit downgrade would depend on the “execution” of its fundraising, including whether it featured less traditional forms of capital, such as hybrid or preferred equity, he said.

The company was also constrained in how much it can raise by its valuation, according to Tsocanos. Raising more than $10bn in equity would in effect require issuing more than 10 per cent of its $94bn market capitalisation, he noted.

Boeing’s rating had, until this point, also been supported by its market position in a duopoly with Europe’s Airbus, Tsocanos added.

“Ultimately, they need to make and deliver aeroplanes. They would have a lower rating if they didn’t have the market positioning in a duopoly.”

What are Boeing’s workers saying?

Boeing factory workers were showing little sign of returning to the negotiation table, holding a large rally in Seattle on Tuesday afternoon to put pressure on the company.

The industrial action by 33,000 members of the International Association of Machinists and Aerospace Workers, which began on September 13, has halted production of the 737 Max, 767 and 777 aircraft at Boeing’s factories in Washington.

The company earlier this month withdrew its second offer to the workers, saying the union had not seriously considered its proposals. Both sides have filed charges accusing the other of unfair labour practices during negotiations.

Acting labour secretary Julie Su flew to Seattle on Monday to meet company and union representatives in a bid to break the deadlock.

What does this mean for Boeing’s airline customers?

Airlines are increasingly worried about the crisis engulfing Boeing, which has led to significant delivery delays and exacerbated a global shortage of new planes.

The crisis has rippled across the world. Europe’s largest airline, Ryanair, lowered its growth plans for the next two years because of delays receiving 737 Max planes, while Southwest Airlines’ reliance on Boeing forced it to reduce capacity earlier this year.

Dubai’s Emirates, the largest customer for Boeing’s repeatedly delayed 777X aircraft, has made “significant and highly expensive amendments to our fleet programmes as a result of Boeing’s multiple contractual shortfalls”, president Sir Tim Clark said this week.

“I fail to see how Boeing can make any meaningful forecasts of delivery dates . . . we will be having a serious conversation with them over the next couple of months,” he said.

Carriers with orders at the US manufacturer, however, have limited options. Its arch-rival Airbus has a full order book and is suffering its own production delays.

Demand for planes remained “very robust due both to travel growth and replacement,” said a portfolio manager at a big asset manager, who echoed Toscanos’ belief that the industry’s duopoly was a positive for Boeing.

“We think the challenges they face are fixable; it’s going to take a while but ultimately the underlying assets here are quite high-quality,” the bondholder said, adding that even if Boeing were to fall into junk territory, high-yield investors “would be very interested in having this kind of risk”.