Stay informed with free updates

Simply sign up to the UK companies myFT Digest — delivered directly to your inbox.

The gambling industry generates excitement by advertising long-odds possibilities rather than expected outcomes. For example:

Ministers are considering a tax raid of up to £3bn on the gambling sector as Rachel Reeves casts around for funds to shore up the public finances.

Treasury officials are understood to be weighing up proposals, put forward by two influential thinktanks and backed by one of the party’s top five individual donors, to double some of the taxes levied on online casinos and bookmakers.

Measures could be included in this month’s budget, Labour’s first in 14 years, as the chancellor tries to plug the £22bn “black hole” that she claimed to have found in the nation’s finances after taking office.

Sources familiar with the discussions said the Treasury had yet to make a decision but appeared receptive to tweaking the UK’s complex regime of betting and gaming duties to raise extra funds of between £900m and £3bn, despite opposition from industry lobbyists.

The Guardian story above is by Rob Davies, author of one excellent book and several hundred stories about UK gambling. It’s safe to assume his sources are very well-informed.

Nonetheless, perspectives seemed to shift between the Guardian’s report late on Friday and Monday’s London market open. Per today’s FT:

[O]ne government figure told the Financial Times that ministers are not planning such a tax raid on the gambling industry in the Budget on October 30.

That’s after gambling industry types mobilised over the weekend to voice their well-rehearsed arguments about how higher levies would kill HMRC’s golden goose, drive the industry underground and/or towards unregulated markets, displease The Palace, etc. There’s a Betting & Gaming Council press release from Friday that lists all the main talking points, which means we don’t have to.

Reactions from the sellside have been similarly feverish. Here’s Jefferies’ analyst James Wheatcroft:

The proposals apparently being considered would all but wipe out bookmaker profitability in the UK, per our estimates. The headlines highlight that changing tax (and regulation) is a legitimate concern when investing in gaming companies, but the extent of these proposals seems unrealistic.

And here’s Barclays’ Brandt Montour:

While the article appears credible, the proposed changes (a doubling of most tax rates within one of the proposals) seem egregious to us, and will likely raise realistic concerns over anti-competitive impacts (most small operators would likely close-down) as well as giving a substantial boost to the black market.

The Guardian report refers to two think-tank papers. The Institute for Public Policy Research has suggested doubling the general betting duty levied on high-street bookmakers from 15 per cent to 30 per cent and raising online gaming duty to 50 per cent. The Social Market Foundation proposes a flat 42 per cent duty for online wagers, which are currently charged at 21 per ent for casino games and 15 per cent for sports betting.

Yikes, say JPMorgan analysts Estelle Weingrod and Karan Puri:

We view both these recommendations as excessive and detrimental to the overall regulated UK gaming market. Moves of such magnitude would not only lead to operators exiting the (unattractive) UK market, but would also lead to overall less favorable terms for the players as licensed operators will (i) offer less attractive pricing/odds and, and (ii) reduce their bonusing/promotions spend in order to preserve some level of profitability for their UK business. In return, this would drive players to the black market, which, to a large extent, defeats the purpose of having a regulated market in the first place, given inability to protect the players who choose to play with illegal offshore operators, especially at a time when the UK Gambling white paper was about to be finally implemented (expectations towards early ‘25). Also worth noting that generally, more stringent regulation typically offers the opportunity for scale operators to consolidate the industry further as small/sub-scale operators struggle to mitigate the adverse impact as effectively, eventually exiting the market.

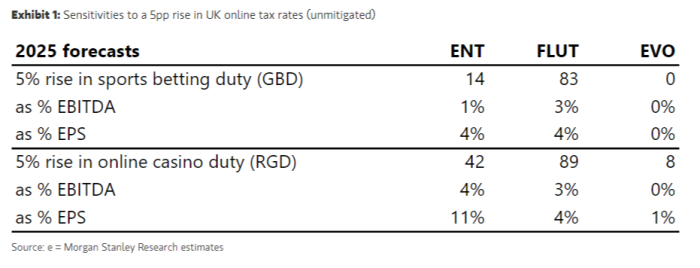

Flutter, Entain and Evoke (formerly known as 888) are the bookmaker stocks most exposed to UK politics. Flutter takes 19 per cent of its revenue from the UK, nearly all of which is online. Entain’s 29 per cent UK by revenue, the small majority of which is from the Ladbrokes Coral estate. Evoke is 68 per cent UK by revenue, of which 39 per cent is online.

JPMorgan forecasts that for Flutter, doubling the remote gaming duty would knock 62 per cent off its UK online Ebitda. At a group level that cuts 2025 Ebitda by 18 per cent, it says.

Reduced advertising spend, worse odds for punters, shop closures and job losses might mitigate the effect, while the closure of small bookies should ultimately benefit the big ones. These mitigation measures can cut the annual Ebitda hit to 10 per cent for Flutter and 17 per cent for Entain, says Citi.

Morgan Stanley’s numbers are similar:

Most analysts don’t bother running detailed forecasts, however, because they don’t see the point. Here’s Goodbody analyst David Brohan:

While it is clear the focus will now be on tax increases for the sector in the upcoming budget, we expect any increases to be moderate in line with the economic importance of the industry. The last tax increase in the UK was in 2019 when the rate of Remote Gaming Duty increased from 15% to 21%, and the UK tax rates are at the lower end of International peers. Our base case assumption is that sports betting duty is likely to remain unchanged (given the emotive issue of horse racing funding, and the challenges associated with increasing this duty). Remote Gaming Duty appears to be an easier target, however we would expect a much more moderate level of increase (3-5%) is a realistic expectation. In terms of impact to operators within our coverage, we estimate every 1% increase in Remote Gaming Duty to impact Adjusted EBITDA by 0.6% for Flutter, 0.7% for Entain, 1.6% for Evoke and 2% for Rank. These estimates are on a pre-mitigation basis with operators having several levers to pull including reduced promo/marketing to mitigate some of the impact.

It’s familiar territory. All the same arguments about protecting jobs and horseracing were aired after bumf accompanying the 2023 autumn statement mentioned a consultation on remote gaming taxes. Efforts to restrict UK fixed-odds betting terminals rumbled on for years and involved many of the same appeals to the greater good. More recently, French gambling stocks dropped on a report of duty reforms similar to these latest UK proposals that appears to have been quietly forgotten.

Gambling regulation does change, but the power of the lobby all-but-guarantees that it won’t change quickly or unexpectedly. And it plays straight into the industry’s interests when every suggestion for reform can be framed from the off as an existential threat.

Further reading:

— Shed no tears for bleating bookmakers (FT)