When Britain’s oldest private equity firm 3i purchased an obscure Dutch discount retailer early last decade, even those involved in the deal had little inkling it would become one of the most successful leveraged buyouts in history.

One former executive who worked on the 2011 takeover of Action, which sells cheap products from towels to toilet cleaner out of retail parks, remembers looking around its warehouses and seeing piles of “very dusty old stock”.

But the takeover of an unassuming chain of bargain stores has proved 3i’s redemption trade, rescuing a storied buyout firm from growing irrelevance after a painful restructuring and making eye-watering returns for its shareholders in the process.

The firm, which in recent years has added to the majority stake it bought in 2011 for £114mn, now values its investment in the retailer at almost £15bn.

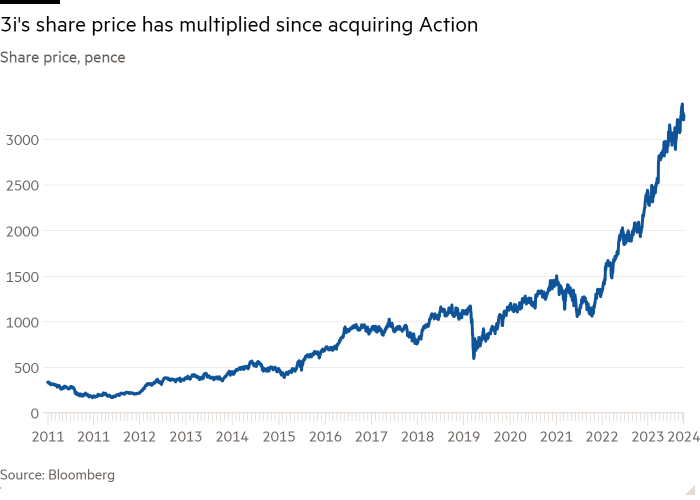

Action has driven a more than 1,000 per cent rise in 3i’s shares as the retailer’s value has ballooned to account for 66 per cent of the firm’s portfolio by value, and has returned at least £2.9bn in cash to its controlling shareholder.

“It’s the gem in their portfolio,” said a former 3i partner.

However, not everyone thinks the rally is deserved. ShadowFall, the hedge fund that shorted the now-defunct fraudulent German fintech Wirecard, has built a multimillion-pound position against the firm because it believes its valuation of Action is too high.

The debate around Action’s valuation has underlined how 3i’s future, and that of its chief executive Simon Borrows, are intimately linked to the retailer’s success and raised questions over what the buyout firm might become — with or without its star asset.

“Shareholders are now essentially buying 3i as a proxy for Action,” said Haley Tam, senior equity research analyst at UBS.

3i declined to comment.

By the time Borrows was promoted from chief financial officer in 2012, the FTSE 100 company, which was founded in 1945 at the request of the UK government to support war-stricken businesses, had 124 investments in small to medium-sized companies and offices across the world.

“When I first joined, 3i was completing a transaction every working day of the year,” said the former executive, who joined the firm in the 1990s. “It was just an extraordinary volume machine.”

But Borrows, a former investment banker who advised on 3i’s initial public offering in 1994, whittled the group down, closing offices from Barcelona to Hong Kong, cutting more than a third of staff and restricting new deals to northern Europe and Brazil.

Within three years the number of companies in 3i’s portfolio had almost halved to 65, with some sold at a loss, while the group’s credit business was sold in 2016.

In 2015 Borrows put an end to third-party fundraising because the firm’s aim of investing in up to seven new targets a year left it with “no compulsion” to seek money from outside investors.

Meanwhile 3i had been growing Action, which had operated 250 stores across the Netherlands, Belgium and Germany when the group bought it. Sales at the retailer, which now operates more than 2,300 stores in 12 European countries, rose from €1.2bn to more than €11bn in the decade to March 2023.

Action’s returns to the investment firm have largely been funded by the retailer taking on additional debt. The Financial Times reported this summer that 3i was set to receive another payout of at least €1.1bn as Action worked to raise new leveraged loans worth more than €2bn.

The buyout group recently increased its stake in the retailer from 55 per cent to 58 per cent.

Executives at 3i last year received £735mn in carried interest solely relating to the group’s investment in Action.

On top of carried interest, Borrows received more than £7.5mn in bonus and long-term incentives as well as a £700,000 salary for the financial year.

3i now values its stake in Action at £14.8bn.

But Matthew Earl, managing partner of ShadowFall, told the FT he believed the implied Action valuation of 18.5 times operating earnings before interest, tax, depreciation and amortisation was too high. He added the price of 3i’s shares implicitly attached an even higher multiple to the retailer.

Earl said he believed the retailer had benefited disproportionately from high inflation because it buys half its inventory months in advance — an advantage that would fade as price rises subsided.

He also questioned how much the chain could further expand in France, a “saturated market”.

Many remain bullish, and are not convinced by the thesis of ShadowFall’s short position. Clive Black, head of consumer research at Shore Capital, said Action was a “formidable business and it hasn’t gained the valuation it has through market manipulation, it has done it through exceptionally strong sequential growth”.

The discount chain may have benefited from “a short-term tailwind in [profit] margins from inflation”, Black added, but “it’s not just Action, inflation has been everywhere, Action used it well”.

Citi, which increased its price target for 3i days before ShadowFall’s position became public, subsequently argued that the valuation was “cheap when factoring in faster-than-peer growth” and that most of Action’s store growth was expected to be outside of France.

But regardless of Action’s valuation, the more important question for some is what 3i’s purpose is, whether it keeps or exits the asset.

Michael Sanderson, director in equity research at Barclays, said shareholders in 3i were “buying a business that is heavily exposed to Action’s development”, whereas 10 years ago it was “building value by . . . buying companies and growing them and selling them on after a short time period”.

He was positive about 3i and Action overall, but added there were “undoubted questions about what the long-term plan is, given [Action] is such a large part of 3i right now” and that the retailer had “got to such a scale now, there are very few options” for exiting it.

For the former 3i executive, the group’s non-Action portfolio “is now not of a scale that it probably survives on its own”. They added that 3i had “become a victim of Action’s success”.

The need to diversify appears not to be lost on 3i, whose executives have pointed to other portfolio companies that could be their next success story.

3i designated Royal Sanders, a European producer of personal care products, to its “longer-term” assets last year. It has also highlighted Netherlands-based bread and snack producer, the European Bakery Group, as a strong performer in recent years.

“A number of assets have the potential to become longer-term compounders like Action,” Borrows said in May.

“We’ve obviously learned the benefits of holding things for longer,” he said last month, adding that the group’s 2015 sale of global material-testing laboratory network Element had been too early because it had “continued to grow significantly” since.

The buyout group is also looking to make two or three investments a year in software and services companies, to add to an overall “non-Action portfolio” that it recently said had both strong and weak-performing assets.

Despite Action’s continued growth, the former 3i partner suggested the group would keep Action “as long as they can”, but questioned just “how much of the juice is left” in the retailer.

As for what the firm would be without Action, the person suggested 3i might regret selling the credit arm given the private debt market boom.

“Simon’s probably looking at Action as his swan song,” they said. “After that he goes off. There isn’t anything else.”

3i still manages third-party capital in its infrastructure strategy but the former executive said the decision to stop raising more third-party funds in private equity might also hinder its pursuit of the next Action.

“If you can’t raise third-party funds, it’s very difficult to be a private equity firm these days,” they said.

Borrows has, however, pointed to the lack of pressure to return cash to external investors as a strength that will allow 3i to hold portfolio companies for longer.

Some observers, though, do not hold much faith in it repeating its success with Action.

“Being the next Action is really, really hard,” said Sanderson at Barclays, adding that the prospect of another investment doing as well was “almost impossible”.