Stay informed with free updates

Simply sign up to the UK companies myFT Digest — delivered directly to your inbox.

Last month, we wrote of THG’s plan to “demerge” its ecommerce division into private ownership: “the word for this is usually ‘disposal’”. This was incorrect. The correct phase is “hostage situation”.

Per RNS, post London close:

Ingenuity to be demerged into a standalone independent private entity

Target c.£75 million equity raise to facilitate the demerger, by way of a Placing and Subscription, with additional proceeds from a Retail Offer

[ . . . ]

These funds, in conjunction with appropriate standalone debt issuance plans for Ingenuity, are expected to provide Ingenuity with sufficient medium-term funding as the business approaches positive cash generation on a standalone basis

Here’s the cunning plan. Ingenuity will be hived out of the listed group and each THG shareholder will be given a choice. They can elect to take shares in unquoted Ingenuity that are more, less, or equal to the proportion of THG currently owned; or they can not.

The £75mn+ being kicked in by THG shareholders supports an equity valuation on Ingenuity of “up to £100mn”. Spinco will also be wearing net debt up to a £307mn enterprise value, including lease liabilities, while “appropriate standalone debt issuance plans” are finalised.

However!

However, in determining the definitive Valuation, the Board anticipates also taking into account fluctuations in the market capitalisation of THG such that if, at the latest practicable date prior to the publication of the Demerger Circular, the market capitalisation of THG is:

• equal to or greater than the market capitalisation of THG at the time of completion of the Fundraise [ . . . ] then the Valuation to be used in establishing the entitlement of THG shareholders to elect to receive their respective pro rata entitlements to shares in IngenuityCo in connection with the Demerger would be expected to be £100m; or

• less than the Post Placing Market Cap, then the Valuation to be used in establishing the entitlement of THG shareholders to elect to receive their respective pro rata entitlements to shares in IngenuityCo in connection with the Demerger would be expected to be reduced from £100m proportionately to the percentage by which the Post Placing Market Cap has declined.

The placing is an institutional overnight bookbuild, with THG founder Matt Moulding and friends already committed to put in £33mn of the £75mn to be raised. Retail shareholders can apply to buy new shares on the same terms via PrimaryBid, with their allocation capped at €8mn.

Ingenuity’s biggest customer by far will of course be THG, with which it shares staff and office space. Other than an assurance that Ingenuity senior management will remain, there’s no information provided on how that might change. But THG’s internal checks and balances are strong enough for that not to be a concern, apparently. From the statement:

Further work is ongoing to design the appropriate governance framework for IngenuityCo. Separately, THG’s now well-established related parties committee chaired by Sue Farr, Senior Independent Director of THG will, following the Demerger, be responsible for overseeing transactions between RemainCo and IngenuityCo. Arms-length contracts between Ingenuity and each of Beauty and Nutrition have been in place since 2022, and will be expected to continue to operate post separation in the same manner as they do today. Ingenuity would have no recourse to THG post demerger.

And obviously . . .

Whilst at this stage no certainty can be provided on the exact timescale of the Demerger, the current intention is that publication of the Demerger Circular would be in or by early November with the distribution of IngenuityCo shares being completed at or before the end of 2024.

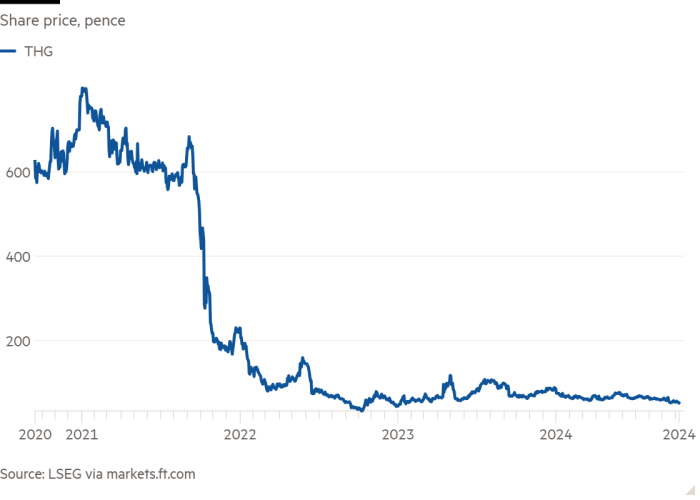

The last complex deal involving Ingenuity put a $6.3bn valuation on the subsidiary, but didn’t quite work out. Depending where the placing is priced, this new package implies an pre-fundraise standalone value for Ingenuity three years later of between £25mn and zero. The value inside THG is, by implication, much less than zero.

Still, it’s been quite a journey: