Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Demand for electric vehicles is slowing. But how long will that trend last? Earnings at LG Energy Solution, a key battery supplier for global carmakers, suggest the outlook will remain weak for some time.

Profit at the South Korean battery maker fell almost 40 per cent in the third quarter, to $332mn according to preliminary results on Tuesday. The main concern is that this drop, an indicator of future EV demand, has come even before the US presidential elections.

President Joe Biden’s aggressive EV push has been backed with billions of dollars of investment through the 2022 Inflation Reduction Act. The act’s energy tax credits are estimated to cost more than $1tn over 10 years and EV battery makers are among the biggest beneficiaries. Excluding these credits, LG would have made an operating loss in the latest quarter.

It is not all bad. Global EV sales are still growing, albeit at a slower rate. LG is a key supplier to automakers that make higher-end EV models including Tesla, Porsche and Audi. New deals are still coming through with LG signing one this week to supply EV batteries to a Mercedes-Benz affiliate in markets including North America.

Longer term, there should be upside in new markets. The rapid rollout of renewable energy around the world, especially in the US, requires new and upgraded power grids to support that capacity. LG Energy’s energy storage system business should take advantage of this demand, and the unit turned profitable last year. Growing demand for power transmission and distribution facilities as well as back-up power systems should also help.

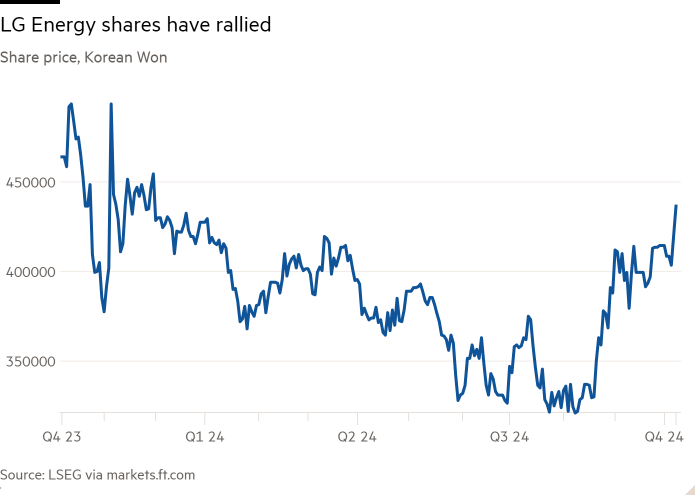

But the problem is that investors may have become too optimistic in recent months. Shares of LG Energy are up 35 per cent from an August low, and trade at historically expensive levels of more than 110 times forward earnings, double the levels it traded at the end of last year and at a significant premium to global peers.

That means that the slowing pace of EV sales growth cannot be ignored. Sales of fully electric cars fell 44 per cent in August in the EU, with Germany recording a drop of 69 per cent. EVs also still remain a small portion of most companies’ total sales. At GM, for example, a key client for LG Energy, they accounted for less than 5 per cent of the company’s total third-quarter sales.

Coupled with overcapacity risks in the battery market, with China using less than 40 per cent of its maximum cell output last year, more investor caution is needed.