Stay informed with free updates

Simply sign up to the Gig economy myFT Digest — delivered directly to your inbox.

Companies that rocketed in value by facilitating online gig work and recruitment during Covid-19 lockdowns are putting a new focus on profitability amid slowing growth, as workers migrate back to the office.

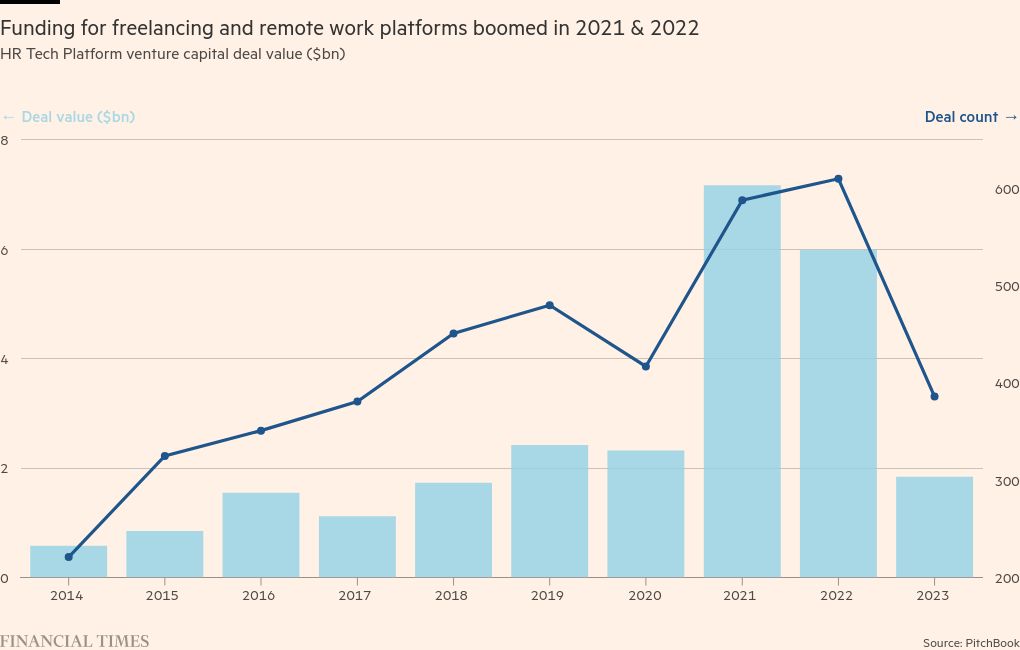

The world’s largest digital freelancing websites, Fiverr and Upwork, are both trading at less than a fifth of their pandemic peaks. Meanwhile, annual venture capital funding for digital recruitment and outsourcing companies has tumbled more than two-thirds since 2022, according to figures from PitchBook.

“When you experience incredible growth during a period of time like the pandemic . . . there’s a lapping effect,” said Micha Kaufman, chief executive of Fiverr. “If you fast-forward, then you’re going to see slower growth afterwards.”

As a result, $853mn Fiverr and $1.43bn Upwork, which offer online marketplaces for everything from ghostwriters to virtual assistants and software developers, are pushing to demonstrate profitability to investors.

“In this environment, we know that we need to continue to be laser-focused on our profitability goals,” Upwork chief executive Hayden Brown said at an investor conference in September.

These platforms have sought, in particular, to increase their “take rates” — the amount of money they make on every transaction — in order to offset an overall decline in the amount of individual services being bought and sold.

Both sites have increasingly promoted subscription-based services and premium listing placements, leading Fiverr to report a record “take rate” of 33 per cent in the three months to June. Upwork’s rate was 18 per cent, also a record for the company.

“These were growth-at-all-costs companies during the pandemic,” said Bernie McTernan, an analyst at Needham & Company. “Now, as growth has pulled back, they have really focused on driving margins.”

They have also pushed for higher-end clients and larger projects, with new features aimed at fostering long-term relationships with business clients.

Fiverr in July launched a new hourly-pay option, in addition to its previous task-based payment system, in order to enable vendors with a premium subscription “to tackle bigger, long-term, and ongoing projects”. The company said its new features were part of a transition from a “services-based marketplace into a hiring platform”.

Brown said Upwork was pushing to promote new “value-added services” and subscription programmes, including access to its artificial intelligence chatbot, with a goal of reaching a profit margin of 35 per cent by 2029.

But despite last year reporting their first net profits since going public, shares in both Fiverr and Upwork remain down.

“Those vendors were in such dramatic growth — and they got so much attention in the immediate aftermath of the pandemic — that anything less feels like a shock to them, and to their investors,” said Rania Stewart, an analyst at Gartner.

Private companies are facing a similar battle to prove the sustainability of their business models post-pandemic.

VC funding for digital recruitment and outsourcing companies more than tripled between 2020 and 2021, according to PitchBook, before tumbling back below pre-pandemic levels in 2023.

The rise of AI has also spooked some investors, who believe that tools such as ChatGPT could take jobs from freelancers and hit revenues at platforms like Fiverr and Upwork, according to McTernan.

Both Brown and Kaufman insisted that AI, at least for now, was helping to expand their businesses. Brown said Upwork was receiving an influx of demands for freelancers to add “the human layer” on top of AI-generated outputs that are “not yet ready for primetime”. Kaufman argued AI was, as yet, only replacing “small and cheap work”.

But the biggest challenge might be less technically advanced.

Online gig-work platforms are still competing with traditional staffing companies and office workers, and Fiverr’s Kaufman acknowledged that the pandemic-era working habits that propelled his company’s growth in 2020 and 2021 had not been as durable as he hoped.

“It’s hard to change people’s minds,” he said. “Work is just one of these very old systems that are hard to change.”