Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

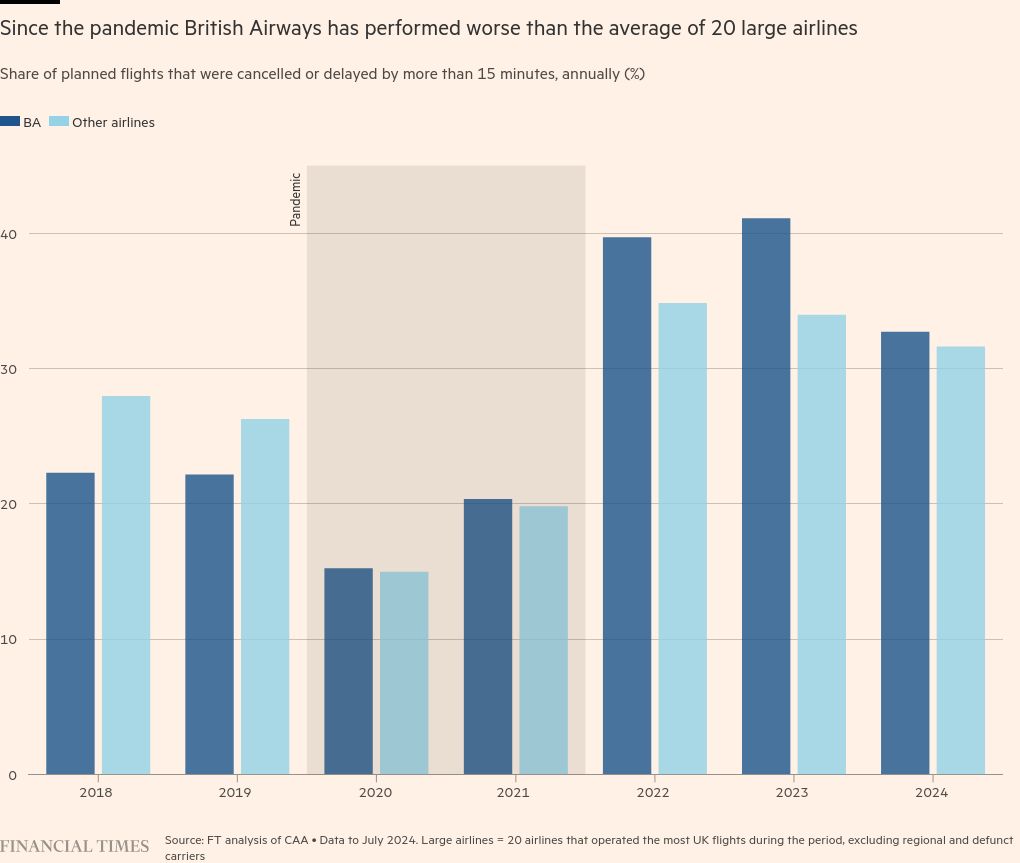

British Airways’ customers have suffered a doubling of flight delays and cancellations to and from the airline’s London’s hub Heathrow since the Covid pandemic, a Financial Times analysis shows.

The airline, which has been grappling with operational problems including air traffic control delays and engine shortages, saw 9 per cent of its Heathrow flights cancelled or delayed by more than 61 minutes in the 12 months to July this year, compared with 4.5 per cent over the same period in 2019.

Other airlines flying via the hub saw disruptions increase by less than a fifth over the same period to 7.5 per cent.

BA’s senior management told staff last week that the airline had faced a “difficult” summer, mainly because of disruption caused by air traffic control restrictions.

They also warned of further problems to come because of delays receiving engines and other spare parts from Rolls-Royce for its Boeing 787 long-haul aircraft. Around five of BA’s 40-strong fleet of 787s is currently grounded.

“BA is facing significant external challenges creating both poor punctuality and high cancellations,” said John Strickland, an aviation consultant. “It needs to make this an overriding internal focus to get back to the performance which should be expected”.

Strickland added he believed BA’s management, including its chief executive Sean Doyle, are aware of the problems and giving them “the required focus”.

As the UK flag carrier wrapped up in the history of British aviation, BA faces unique public scrutiny, particularly after a turbulent decade from IT meltdowns to staff cuts during the pandemic.

It has performed worse than the average of 20 top airlines operating out of UK airports since the start of 2022.

British Airways owner IAG in March unveiled a £7bn investment in the airline, aimed at both improving its operational reliability and bringing the brand more upmarket.

The modernisation programme — which pledges to create a “better BA” — includes new aircraft, improved IT systems and some new cabins, including in first class.

But the ambitious plans will be deemed a success or failure by the simple question of whether BA can get its planes into the air on time.

The omens from this summer are bad.

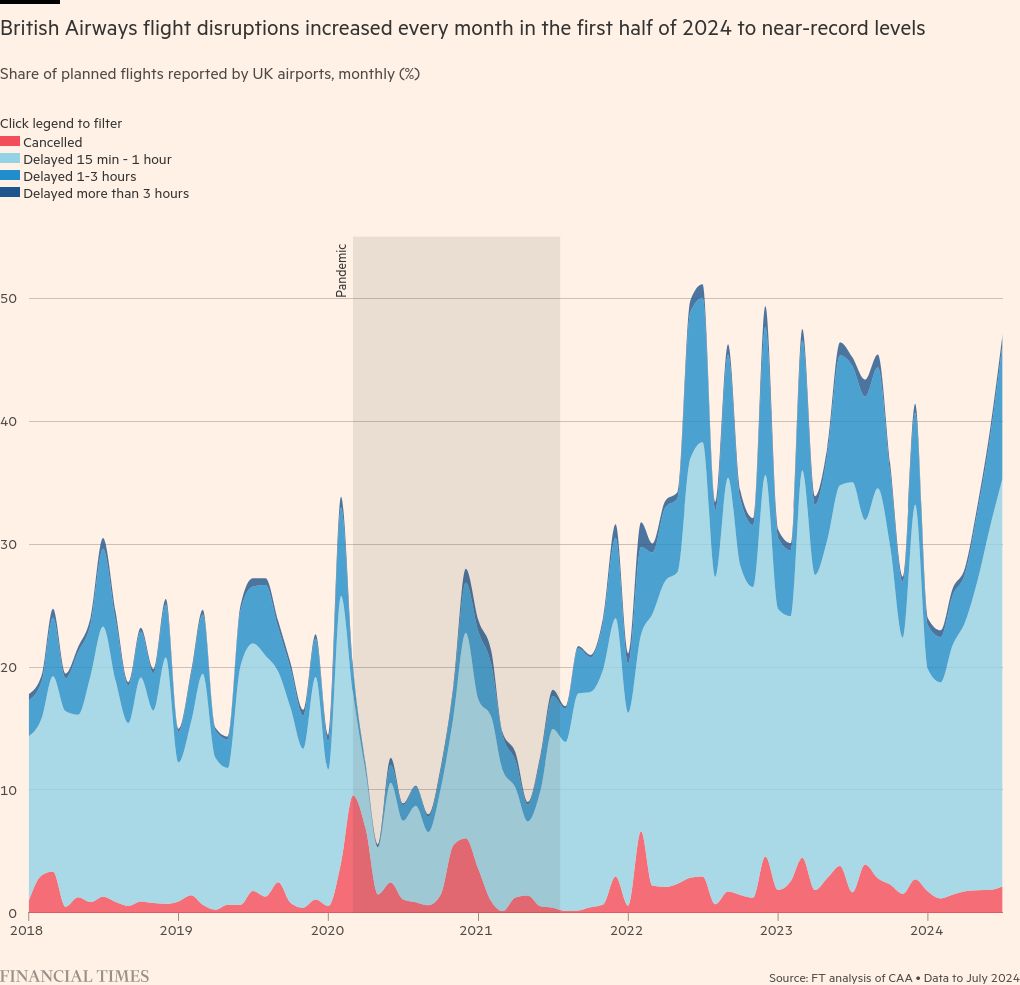

The share of flights delayed or cancelled increased every month until July, when nearly half were affected. The data showed it was the fifth-worst month since 2018, when the CAA started publishing cancellation figures.

BA bosses accept they have to find a way to improve the airline’s reliability. But the airline said they had little direct control over many of the problems which have combined to knock its operations.

The biggest is air traffic control, which has disrupted carriers across Europe this year because of problems including staff shortages, bad weather and the closure of some European airspace because of the war in Ukraine.

BA is hit hard because its operations are based at London’s Heathrow airport, which is virtually at capacity. The last day that BA did not face an air traffic control restriction on its flights at Heathrow was June 1, a person familiar with the matter said.

On top of this, the airline flies from Heathrow to many other congested airports across Europe, leaving it exposed to delays building up across the region. This leaves little leeway to recover, with disruption cascading through BA’s operations.

“They are ending up with planes, crew and luggage scattered all over the place when there is disruption,” one industry executive said.

The poor summer has come even after BA put extra resources and resilience into this summer’s operations at Heathrow, including hiring 600 extra staff and increasing the number of crew and aircraft it has on standby.

Industry executives and analysts said this summer has shown the extra resourcing has not been enough, and BA will have to do more, even at the expense of financial returns.

“It is definitely the trade-off BA has to decide on now,” Strickland said.

BA said the “vast majority” of its passengers travelled without any issues, and its cancellation had reduced this year compared with 2023, “despite the incredibly challenging environment” it is operating in.

“Whilst these matters are entirely out of our control, we share the frustration of our customers and are working with our industry partners to improve and reduce disruption to all passengers.”

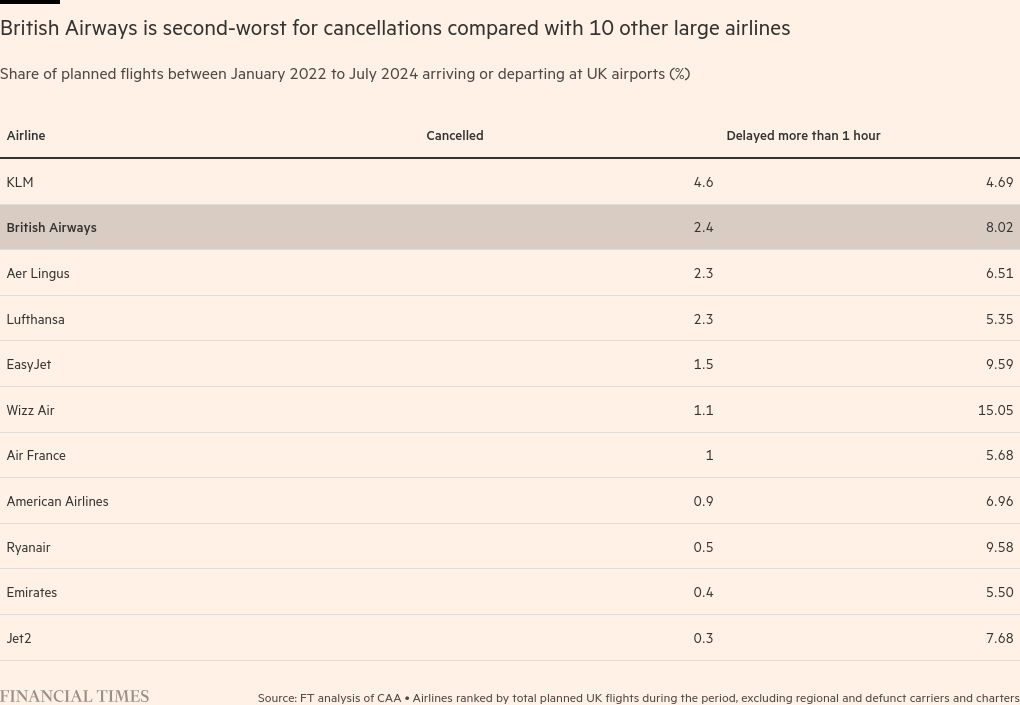

BA is not alone, and Europe’s other major full-service airlines have also suffered a difficult year.

The airlines have complex “hub and spoke” operations which knit together short and long-haul flights at their airport hubs, leaving them less flexible than point-to-point low-cost airlines such as easyJet or Ryanair.

Industry data shows BA is performing better from its hub airport than its two direct peers, Air France and Lufthansa, at theirs. On Thursday KLM, the Dutch flag carrier, announced a “painful” restructuring and conceded it needed to “structurally improve” its performance.

The £7bn investment plan was a vote of confidence in Doyle’s four years managing the airline from owner IAG. But IAG’s CEO has also indicated that passengers are growing impatient for improvement at the airline.

“People talk about BA because they like BA. And they associate BA with a country, with British culture. And what they want is to have a company that they can be proud of,” Luis Gallego, CEO of BA’s owner IAG, told the FT in August. “We can do it much better,” he added.