Stay informed with free updates

Simply sign up to the Retail & Consumer industry myFT Digest — delivered directly to your inbox.

Back in 1967 Goldman Sachs’ Gus Levy orchestrated a record smashing $26.5mn block trade in Alcan Aluminum that made his name on Wall Street. But we may now have one of the all-time worst block trades in history.

On August 21, Walmart ditched its entire 144.5mn share stake in JD.com, which had been first initiated through the sale of its Chinese online grocery store to JD.com in 2016, and later increased to over 10 per cent.

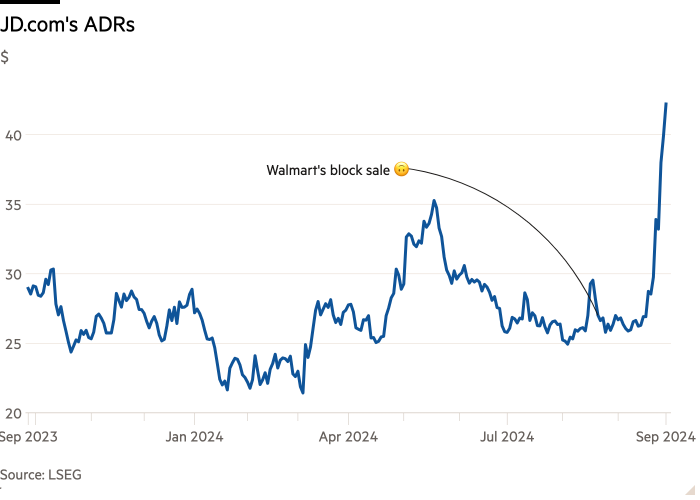

The divestment happened through a huge block trade of JD.com’s US-listed American depositary receipts conducted by Morgan Stanley at $24.95 a share — an 11.5 per cent discount to the market price. This netted about $3.6bn for the US retailer. Alphaville understands that some people involved in the trade were proudly touting that it was the largest-ever single ADR block placement.

However, with the benefit of Alphaville’s favourite resource (perfect hindsight) the timing now looks awesomely, hilariously terrible.

Having notched up another gain yesterday — thank you Beijing — JD.com’s ADRs closed at $40, up 60 per cent since the August block sale. This means that Walmart in effect has lost out on about $2.2bn.

To be fair to Walmart, JD.com’s ADRs had lost nearly three-quarters of their value from their 2021 peak, and were by August 20 trading at approximately the same level as they were a decade ago. Just getting out and focusing on its own Chinese operations still might make perfect strategic sense. Block trade timing is always hostage to fate, and selling such a big JD.com chunk back in August at a reasonable discount probably rightly felt like a feat for Morgan Stanley at the time.

FTAV is admittedly more familiar with another type of block-trade-gone-awry: when underwriters bid far too aggressively for the deal and are left holding the bag on a big share sale.

For example, back in 2012 Morgan Stanley inadvertently became one of the biggest players in Danish telecoms company, after being stuck with a $450mn, 7.2 per cent share in TDC. Perhaps the most famous example of a hung block trade is when Goldman Sachs and Deutsche Bank were stuck with a chunk of Vivendi in 2002, pretty much ruining the entire year for their equity departments.

The JD.com block trade is just a matter of terrible timing, rather than banks doing dumb stuff for league table credit. But still, looking just at the money that Walmart left on the table, in dollar terms this might be one of the worst block trades in history?