Stay informed with free updates

Simply sign up to the European companies myFT Digest — delivered directly to your inbox.

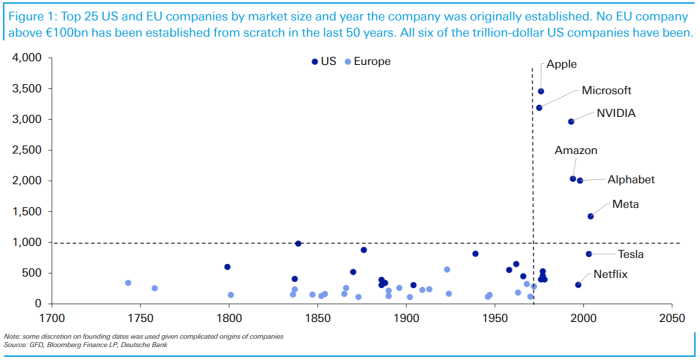

Here’s an unsatisfying chart:

Deutsche Bank says it was inspired to run the numbers by the European Union’s Competitiveness report released a couple of weeks ago. Here’s the relevant bit of Mario Draghi’s foreward:

First – and most importantly – Europe must profoundly refocus its collective efforts on closing the innovation gap with the US and China, especially in advanced technologies. Europe is stuck in a static industrial structure with few new companies rising up to disrupt existing industries or develop new growth engines.

In fact, there is no EU company with a market capitalisation over EUR 100 billion that has been set up from scratch in the last fifty years, while all six US companies with a valuation above EUR 1 trillion have been created in this period.

This lack of dynamism is self-fulfilling.

Note the careful phrasing. “Set up from scratch” excludes the likes of AstraZeneca (founded 1999 by the merger of Astra and Zeneca).

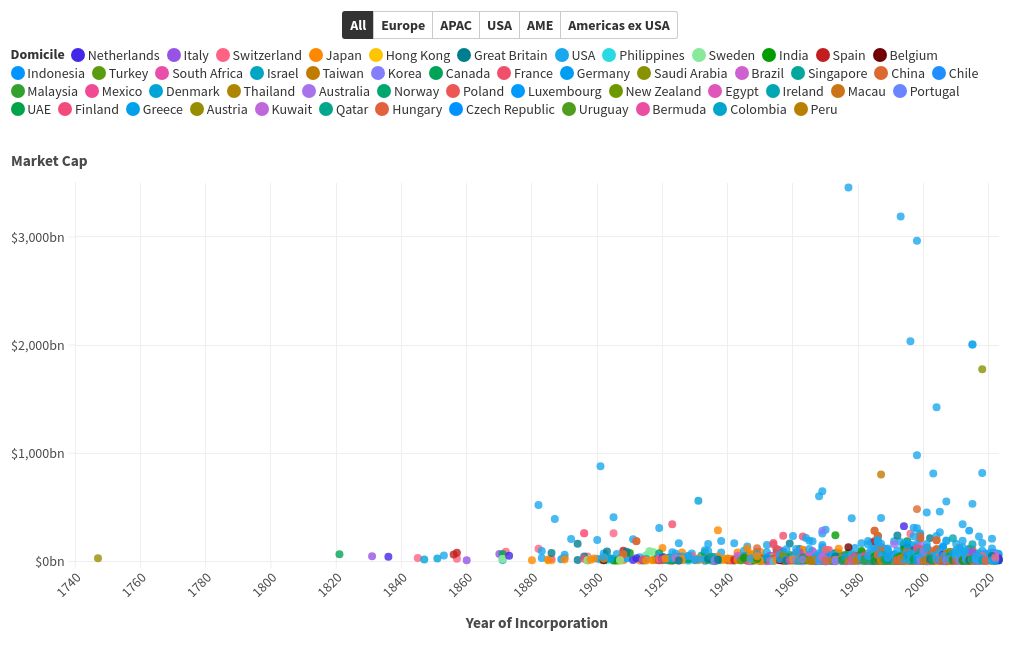

Nevertheless, Draghi’s wrong and so is Deutsche Bank. Here’s a different chart:

It shows all the constituents of Bloomberg World Large and Mid-Cap Index organised (where available) by date of incorporation. Countries and territories are all clickable.

Obviously, incorporation dates are even weaker than Deutsche’s finger-in-the-air approach when trying to estimate when companies were founded. Lots of things happened to make Saudi Aramco, for example, before its commercial registration was filed in 2018. Shell, clearly, wasn’t created in 2002.

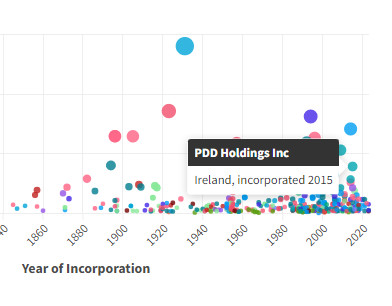

Still, incorporation dates are enough to run a quick fact-check. Here’s the dot that matters:

PDD Holdings, the US-listed owner of the Temu and Pinduoduo e-retail platforms, moved its corporate registration from China to Ireland in May 2023. It was founded nine years ago and on current standings has a market cap equivalent to €140bn, so fits both of Draghi’s criteria.

All hail PDD, the future of European Union innovation.

Further reading:

— The mysterious rise of the Chinese ecommerce giant behind Temu (FT)