Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

For all the (metaphorical) buzz they generate, alcohol-free beverages are still small beer. But there are signs that this trend has legs. Brewers and distillers should be rushing to join the party.

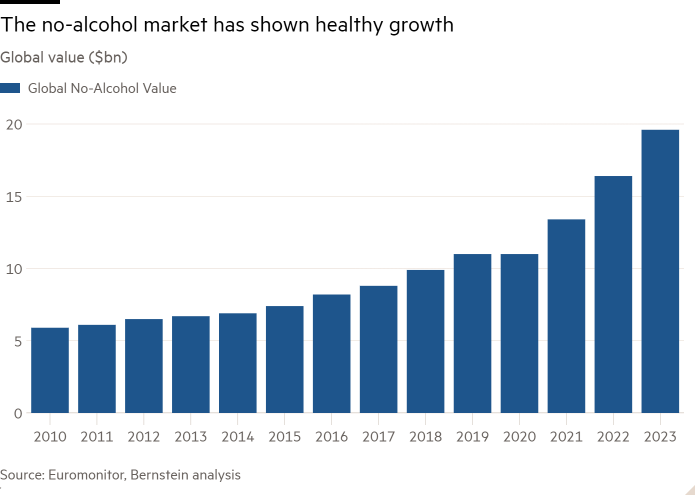

The market is in its infancy. No alcohol beverages only amount to around 1 per cent of global alcohol sales, for a total of around $20bn according to Bernstein Research. Of this, the vast majority is beer.

Producers haven’t cracked the recipe for delicious alcohol-free wine. Spirits are a mixed bunch. Those that rely on herbs and berries for flavour, like gin, can be reproduced with some degree of accuracy. Making a zero-alcohol vodka that is not just water is a harder proposition. Technologies, too, are still evolving. Making alcohol-free beer stable enough to survive in draught form is a challenge.

For all that, there are signs that the zero-alcohol trend is taking off. Growth is healthy, with average annual volume growth of 9 per cent expected between 2022 and 2026, according to IWSR, compared to a flattish outlook for beer, wine and spirits.

Zero alcohol beer accounts for more than 10 per cent of sales in Slovakia, Germany and Spain — countries with a serious beer-drinking culture. Industry giants Carlsberg and Heineken have released zero-alcohol versions of their flagship brands, which account for around 3 per cent of turnover. Campari’s Crodino — a native no-alcohol aperitif — is standard fare in Italy and has appeared on UK shelves.

No-alcohol options allow companies to reach new groups, rather than simply cannibalise existing drinkers. The vast majority of those who consume them also drink traditional beers and spirits. Younger generations, in particular, use alcohol-free alternatives to moderate overall intake. But the zero-alcohol trend also means brewers and distillers can go after those consumers who would otherwise have stuck to orange juice.

In terms of profitability, too, zero alcohol beverages are attractive. They are costlier to make, given the complicated techniques required to remove alcohol and leave behind as much of the flavour as possible. But the products sell at prices comparable to their alcoholic counterparts, and pay no excise duty, which in the UK starts at £21 per litre of alcohol in the product. That should mean a boost to margins.

The ingredients are falling into place. The combination of better products and trend towards more moderate alcohol consumption suggest the time has come for alcohol-free drinks. Expect beverage companies to put some heft behind them.