Clearlake Capital reaped nearly $1bn in profit selling car parts maker Wheel Pros in 2021, which it acquired just three years earlier in a buyout worth just over $400mn.

But now Wheel Pros has filed for Chapter 11 bankruptcy protection, collapsing under more than $1.7bn of debt. Its current equity holders will recover nothing. Included in that group being walloped: Clearlake.

The Los Angeles-based private equity firm, which has rocketed to prominence in the past decade and now oversees more than $80bn in assets, took advantage of an increasingly popular structure known as a continuation vehicle, which allowed it to effectively sell Wheel Pros to itself while also locking in profits.

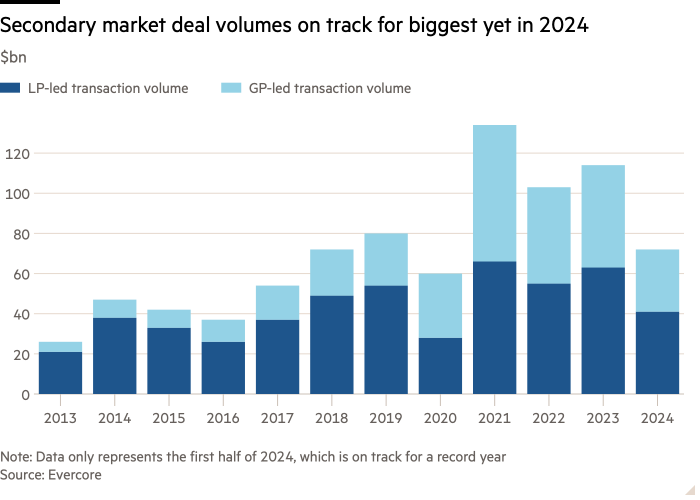

Such funds have become an increasingly popular financial engineering option for private equity firms to have their cake and eat it too: the groups are able to largely cash out, return money to investors, but still hold on to the asset for future upside and management fees. And often, they must invest some of their lucrative carried interest in the new funds, to show other investors they still have skin in the game.

The precise contours of Clearlake’s profits, and everyone else’s losses, on the Wheel Pros deal could not be determined. But its failure illustrates the inherent conflict and risk of these funds, which put a private equity firm on both sides of a transaction. And if the latter deal goes bad, the most recent outside investors will be left wondering how it went wrong, even as the buyout group had theoretically aligned interests by rolling some of their previous winnings alongside.

The implosion of Wheel Pros, which sells rims, suspension systems and external lighting for trucks and off-road vehicles, underscores the potential pitfalls when a deal goes badly with a private equity shop that is both a buyer and seller of an asset.

“They made a ton of money and then they lost it,” one person involved in the deal said. “But they didn’t lose all their money.”

The person noted the investors who wagered on the continuation fund alongside Clearlake, however, were wiped out. “It’s not like a [traditional buyout] fund where other investments can bail it out.”

The collapse is at least the second known continuation fund to have failed in 2024 — the first known blow-ups in the industry, according to bankers and investors. Earlier this year renewable energy company Enviva, backed by private equity group Riverstone, filed for bankruptcy. Riverstone used such a fund in 2020 to cash out some investors, while bringing in new ones including Mubadala and Goldman Sachs.

In the 2018 leveraged buyout, Clearlake invested about $130mn of equity through two of its funds to acquire Wheel Pros, said a person familiar with the deal. Wheel Pros went on to borrow more than $800mn to fund about a $150mn dividend to the firm. Just a few years later, the CV transaction netted Clearlake just under $1bn in profits.

According to a public presentation shared with the Pennsylvania State Employees’ Retirement System in 2023, Wheel Pros’ sale represented one of Clearlake’s biggest asset sales since 2020, worth well above five times invested capital, among more than a dozen transactions.

Wheel Pros had been an active acquirer, buying up more than half a dozen car parts-related companies. By 2021, the original funds that had executed the first Wheel Pros acquisition had reached the end of their lifespan. Clearlake then set up a so-called “single asset” continuation vehicle it called Icon Partners III to acquire the company, with the hope Wheel Pros would continue to grow and prosper.

The Icon Partners III vehicle purchased Wheel Pros for about $2.4bn. Alongside Clearlake, the equity investors included the likes of Blackstone, Pantheon and ICG. The deal was heavily leveraged, as S&P estimated the company’s debt-to-earnings ratio at nearly eight times. The rating agency predicted at the time that Wheel Pros’ strong profits and free cash generation would allow it to pay off debt quickly.

Clearlake, ICG and Blackstone declined to comment.

Pantheon, which declined to comment on its investment in Wheel Pros, pointed to Morgan Stanley research that showed loss rates on continuation vehicles between 2018 and 2023 were lower than traditional buyout funds.

“While no asset class has a 100 per cent success rate, [continuation vehicles] as a whole have displayed strong historic performance, robust alignment with sponsors and high levels of resilience,” said Amyn Hassanally, Pantheon’s global head of private equity secondaries.

How the equity in Icon III was divided between Clearlake and the other co-investors is not known.

But profits began to slide, and the company’s debt levels proved crushing. The company was spending $170mn a year on interest costs, according to Financial Times calculations, while a court filing said operating profit slid to $69mn in 2023.

The car parts maker made one final attempt to stay afloat last year with a complex refinancing referred to as a “double dip”. While the deal raised fresh cash it also sealed off existing loopholes in the loan agreements. Once it was clear in 2024 that Wheel Pros would not recover quickly, its only remaining option was a bankruptcy filing.

The risks of recent CVs “are that you are often putting more leverage on the company with floating interest rates”, said Steve Kaplan, a professor at the University of Chicago. “Since 2021, interest rates have increased markedly which has put particular pressure on deals done in 2020 and 2021.”

Last week, lawyers for Wheel Pros told the bankruptcy court that, after spiking during the pandemic, spending on custom car accessories collapsed by 2023. That, combined with rising interest rates, left the company with obligations that proved “insurmountable”.

Icon III agreed to hand over control of Wheel Pros to its senior lenders which include distressed credit investors Strategic Value Partners, Bain, Nut Tree and Centerbridge.

“Obviously the Clearlake guys are in the centre of this storm around Wheel Pros right now,” said one investor familiar with the situation. “But for what it’s worth, they’re not alone. This is going on all across the leveraged landscape.”