After his speech to last month’s Democratic National Convention, President Joe Biden flew off for a holiday near Santa Barbara, California. His host was Joe Kiani, a billionaire medical device entrepreneur whose flagship pulse oximeter designs were good enough to win a recent patent infringement case against Apple.

However, Kiani, like his houseguest that week, may soon be leaving his job after losing the support of his longtime backers. Shareholders of Masimo, the $6bn public company where Kiani is chief executive and board chair, will vote at its annual meeting on Thursday whether to keep the founder on the board or replace him with a candidate aligned with Quentin Koffey, the veteran activist investor. Koffey’s campaign comes as Masimo’s revenues have declined and its share price has collapsed.

Koffey’s $1.65bn Politan Capital has been tangling with Kiani for two years. Should its two board candidates get elected, the hedge fund will control the majority of the board while owning just 9 per cent of Masimo. In an interview with the Financial Times, Kiani reiterated he would resign as chief executive and sell his shares, worth about $500mn, should shareholders depose him.

The conflict between Kiani and Koffey, who cut his teeth at Elliott and DE Shaw, has been one of the ugliest boardroom brawls in recent years with lawsuits between the sides spanning both coasts and duelling accusations of dirty tricks and treachery.

It is also an extremely rare instance where a founder could be jettisoned at an annual meeting.

Shareholders often prefer when an activist takes a minority position on a board to infuse new ideas but current management stays in charge as a safety net, Yaron Nili, a law professor at Duke University, told the Financial Times.

“Hedge funds asking for a change of control is a much bigger commitment and a riskier proposition,” he said.

Legions of law firms, investment banks, proxy solicitors and crisis PR agencies are involved. That has made the boardroom showdown one of the costliest in history, with estimates of the two sides’ spending easily reaching into the tens of millions of dollars. Among its nine advisers, Masimo identified in a court filing is Greg Schultz, a former top Biden aide.

According to Kiani, his plight has echoes of that of the co-founder of Apple, the company he once fought. “When Steve Jobs was thrown out, his company fell apart,” he said.

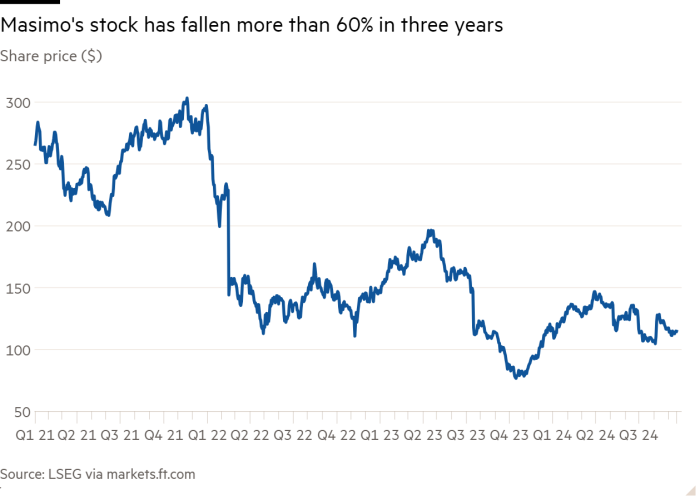

Kiani arrived in California in the 1970s from Iran as a child. After earning two electrical engineering degrees from San Diego State University, he founded Masimo with a $40,000 bank loan in his Orange County garage 35 years ago. The company went public in 2007 at $17 a share, eventually touching $300 per share and a $17bn market capitalisation.

But since reaching its valuation highs three years ago, Masimo shares are down more than 60 per cent. In 2023, Koffey and another Politan nominee won two board seats, arguing that Kiani had repeatedly missed on operating targets, made poor acquisitions and assembled a board too cosy with him.

Tension between the sides never really diminished after Koffey came into the Masimo tent. Both parties have blamed each other for attempting to undermine the other from the moment the “onboarding” process began.

In late January, Kiani and Koffey met for a fateful dinner at Fasano, an Italian restaurant in midtown Manhattan. At the end of the evening Kiani believed the two both thought they had cleared the air and found a way to move forward: Masimo would split into two companies with the smaller consumer wearables business to be run by Kiani, who would get super voting shares and would also get paid a change in control package valued at more than $400mn.

But by March, the spin-off was off. An independent board committee, which included Koffey, largely rejected the commercial and financial terms Kiani believed he had secured in the aftermath of the dinner. Koffey then filed his two nominations to the board which would, if successful, give him four of six seats. A final bruising showdown between the pair was set in motion.

Each side traded increasingly inflammatory allegations over the spring and summer. Masimo sued Politan in a California federal court claiming its proxy solicitation filings wilfully misstated its motivations and tactics in violation of securities laws. Among several accusations the health tech group made, it accused the hedge fund of secretly aiding employees who had sued the company.

A federal judge last week declined Masimo’s request to keep Politan out of the proxy contest, ruling such relief was too extreme a remedy and that Masimo’s accusations were either unsupported by evidence or cured by the many corrections the hedge fund made to its proxy filings.

Yet, what seemed like bad news for Masimo suddenly turned into a modest publicity victory when the judge late last week found Politan in contempt of court, for trumpeting its legal victory in a press release before the final ruling had been unsealed to the public.

But a sense of fatigue around Kiani is apparent. People close to Masimo and Kiani admitted to the FT that shareholders had become exasperated by the founder’s aggressive 2023 proxy campaign tactics against Politan, even if they also believe giving up control to the hedge fund was the wrong move.

Both the major proxy advisory firms, Institutional Shareholder Services and Glass Lewis, have thrown their support behind Politan with ISS writing: “Masimo has continued to display a dangerous lack of accountability to shareholders that will require additional board change to rectify.”

In a statement to the FT, Koffey said: “Masimo’s wild antics in this campaign are actually entirely consistent with the board’s past entrenchment actions. Our goal has never been to fight, it has been to refocus the business and reallocate capital in a way that drives growth and ultimately unlocks shareholder value.”

Amid the legal manoeuvring, a surprise peacemaker emerged in recent months. Bob Chapek, the former Disney chief executive, joined the Masimo board earlier this year as an independent director (he had briefly met Kiani at a 2019 social event). Chapek attempted to craft a compromise with Koffey where Politan got one board seat but Kiani remained. That overture only earned a threat from Koffey, according to a Chapek court filing.

“During one of those calls, he warned that he would make me a media target because of my prior roles at the Walt Disney Company, and told me to think carefully about how strongly I should defend [Masimo],” Chapek wrote.

A spokesperson for Politan said: “Mr Koffey categorically denies this version of events, and the record shows that at no point in the campaign was Mr Chapek personally targeted.”

Koffey has said he is not opposed to Kiani remaining but that directors independently selected of the founder must constitute a board majority.

Kiani insists Koffey’s actions have been in bad faith and that the hedge fund’s financial backers include Apple, which he is spoiling to sell the company to cheaply.

Apple did not immediately respond to a request for comment.

“Koffey is trying to make a name for himself and sell to Apple . . . I can’t work for these people,” Kiani said.

The Politan spokesperson said: “The absurdity of Mr Kiani’s allegations and actions speak for themselves.”

On Thursday, shareholders will decide for themselves.