Stay informed with free updates

Simply sign up to the Fintech myFT Digest — delivered directly to your inbox.

When designing a survey, a person can reference the huge body of academic research on best practices, or they can not.

Here’s a demonstration of one of those approaches:

Yes, OK. We’ve already had one pop at Deutsche Bank’s consumer survey of opinions on crypto, but since its findings are back in our inbox today, here’s another.

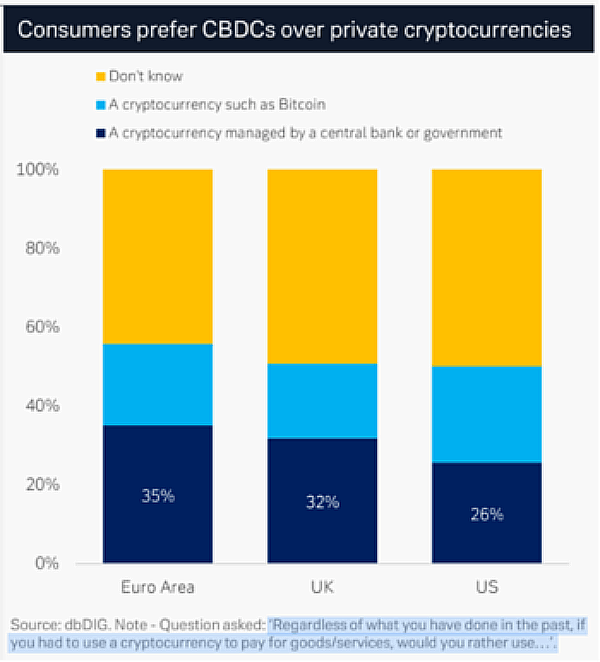

Relative to previous examples, the above methodology is not bad. There’s a “don’t know” opt-out, and an attempt to mitigate the respondents’ bias when comparing acceptance of something that exists (crypto) with something that doesn’t (central bank crypto). The survey size, 4,850, is decent.

That question tho:

Regardless of what you have done in the past, if you had to use a cryptocurrency to pay for goods/services, would you rather use a cryptocurrency such as bitcoin [or] a cryptocurrency managed by a central bank or government?

If there were no alternatives, would you rather be kicked in the head or the crotch?

The number of people using crypto today to buy things is a rounding error. The Reserve Bank of Australia’s 2023 survey found that no more than 2 per cent of adults said they were using crypto as a payment instrument. The US Fed’s 2023 banking and credit survey arrives at a figure of 1 per cent, down from 2 per cent in previous years. Sweden, an extremely online and cashless nation, also registers crypto-usage at 1 per cent. And none of these surveys asks a follow-up question about whether crypto payment was by choice (which is rarely offered when the good/service is ransom, extortion, guns, drugs or murder).

It’s reasonable to conclude that the consumer appetite for crypto transactions is currently limited, which makes an either/or expressed preference pretty much irrelevant. The biggest surprise from the survey is that only half of people replied “don’t know” — though maybe nulls would have registered higher with a “don’t care” option.

Central-bank digital currencies are, nevertheless, A Thing. The EU Governing Council started proper work on a digital euro last October and the UK Treasury has until next year to decide on its CBDC strategy, having launched a public consultation last February. The Bahamas, Nigeria and Jamaica have launched retail CBDCs, as has China, whose e-CNY is issued via authorised wholesale distributor banks including Alipay and Tencent.

Deutsche finds that 94 per cent of central banks are exploring CBDCs, albeit with the majority at the proof-of-concept stage.

However, even in countries with relatively young and/or unbanked populations, where peer-to-peer payments are commonplace and mobile phone ownership is high, adoption has been unexpectedly slow. Nigeria’s population is 233mn and nearly three years after launching the eNaria had created only 13mn wallets.

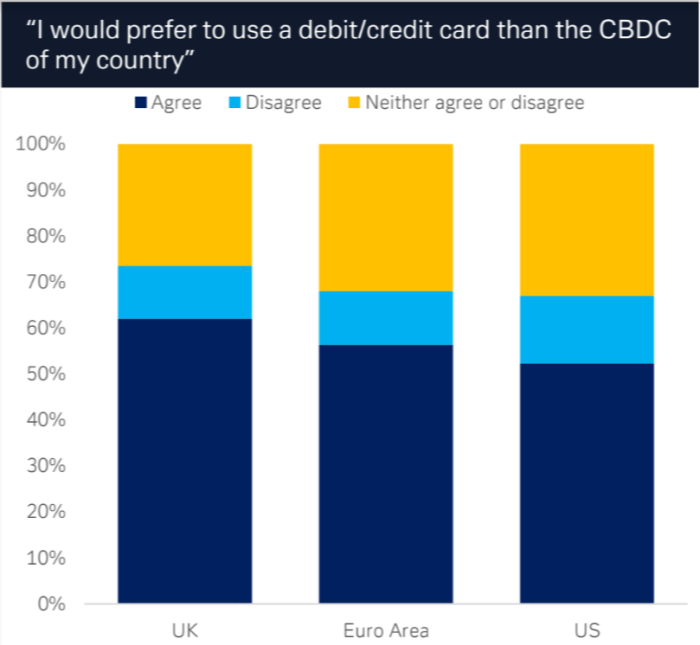

Is there pent-up demand elsewhere? Survey says no:

Why? Are people worried about privacy?

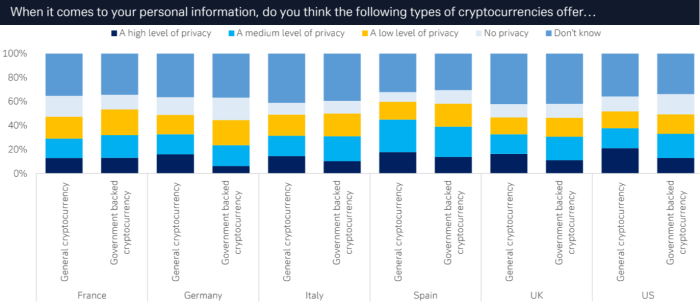

Yes and no. The vote between “crypto offers medium or high privacy” and “crypto offers little or no privacy” is pretty evenly split — though once again, “don’t know” wins by a landslide:

[Zoom]

Ignorance and apathy are in no way deal-breakers. It’s not the job of customers to know what they want, as Steve Jobs may or may not have said. If a CBDC’s advantages around costs, control and monitoring can be squared with trade-offs like weaker monetary policy transmission and potential to destabilise the banking system, consumers’ lack of enthusiasm for a non-existent case can be overlooked.

But maybe the CBDC projects we should care about are wholesale, not retail. Developed market retail payments already work well enough for the public not to think about, but there’s always scope to make the backroom stuff a bit quicker or cheaper.

The national banks of Switzerland, France and Singapore last year began testing whether it’s worth settling interbank transactions with tokens. Singapore also has a joint project with the New York Fed, Cedar x Ubin+. that in sandbox tests can improve onboarding and settlement speeds. Banque de France and The European Investment Bank have also been experimenting with on-chain instruments.

The path to tokenising settlement infrastructure is littered with write-offs, but since the same is true of all infrastructure projects, we should keep our default knee-jerk cynicism in check.

All that’s left then is a request. When considering retail CBDCs the starting point needs to be what they’ll change, not how likely they are to be accepted, because at the moment they promise to improve nothing and nobody other than wonks and wingnuts cares either way.

Further reading

— Speak your brains: crypto edition (FTAV)

— The reasonable case against CBDCs (FTAV)

— CBDCs must be coupled with greater accountability (FTAV)

— How many banks might ECBitcoin break? (FTAV)

— Slouching towards Britcoin, parts one and two (FTAV)