One big rate cut to start: The Federal Reserve cut its benchmark interest rate by half a percentage point on Wednesday and signalled more reductions would follow, launching its first easing cycle since it began tightening monetary policy in 2022. Private equity firms and dealmakers are surely celebrating.

And some banker guardrails: JPMorgan Chase has tasked one of its bankers with overseeing the company’s junior banker programme, a response to renewed concerns about working conditions for young employees on Wall Street.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday to Friday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters. Get in touch with us anytime: [email protected]

In today’s newsletter:

-

Private equity’s new mantra

-

Billionaire Mohsin Issa steps back from Asda

-

The antitrust trial rocking the fashion world

The new lingo private equity lives by

Under the chandeliers, mythical frescoes and golden gilding of the Palais Garnier opera house in Paris last week, Europe’s private equity executives sipped champagne before a repertoire of pas de deux by the city’s principal ballet dancers.

But earlier that day, as the industry gathered for one of its annual summits, the mood was less festive.

Executives speaking on stage appeared intent on assuring their investors that they were focused on returning their cash, after a difficult period in which interest rate increases left the buyout industry struggling to exit investments.

“DPI is the new IRR,” said Tristan Tully, head of European private equity at Brookfield.

In plain English: distributions to paid-in capital, or the ratio of how much money a fund cumulatively gives back to investors relative to what they originally paid in is the new internal rate of return.

DPI is the metric by which Tully and his colleagues are now squarely being judged.

Tully’s counterpart at Carlyle, Michael Wand, joined in to suggest DPI was now the “magic word” — instead of the once-sacrosanct IRR, which the buyout industry long favoured to demonstrate it could beat the public markets.

Investors have recently focused their attention on DPI because of their struggles to get cash back from private equity funds. Higher interest rates have affected valuations and left buyout managers unable to sell many companies.

Funds that started making investments between 2019 and 2022 have disbursed about 15 cents on the dollar, according to a Goldman Sachs analysis on Preqin numbers. By the same age, funds of earlier vintages had returned well over half the money invested.

A London-based family office manager who invests directly with some of the “best in class” private equity firms told DD they had stopped allocating money to those firms’ future funds and had recently told one fund manager, “return me some money then I’ll invest more”.

“The gravy train has to stop somewhere,” they added.

But private equity’s returns, too, look terrible. Annualised IRR fell below 10 per cent in the year to March 2024, says PitchBook.

That’s far below the 25 per cent the industry used to aim for, and even below a rough benchmark for the cost of equity. Over the same — admittedly stonking — period, an unleveraged investment in the S&P 500 would have returned 30 per cent.

Whichever way you measure it, things are not looking good for private equity.

Asda’s co-owner steps back from grocery chain

One of Blackburn’s billionaire Issa brothers is taking a step back from the grocery chain Asda just a few years after buying it from Walmart alongside TDR Capital.

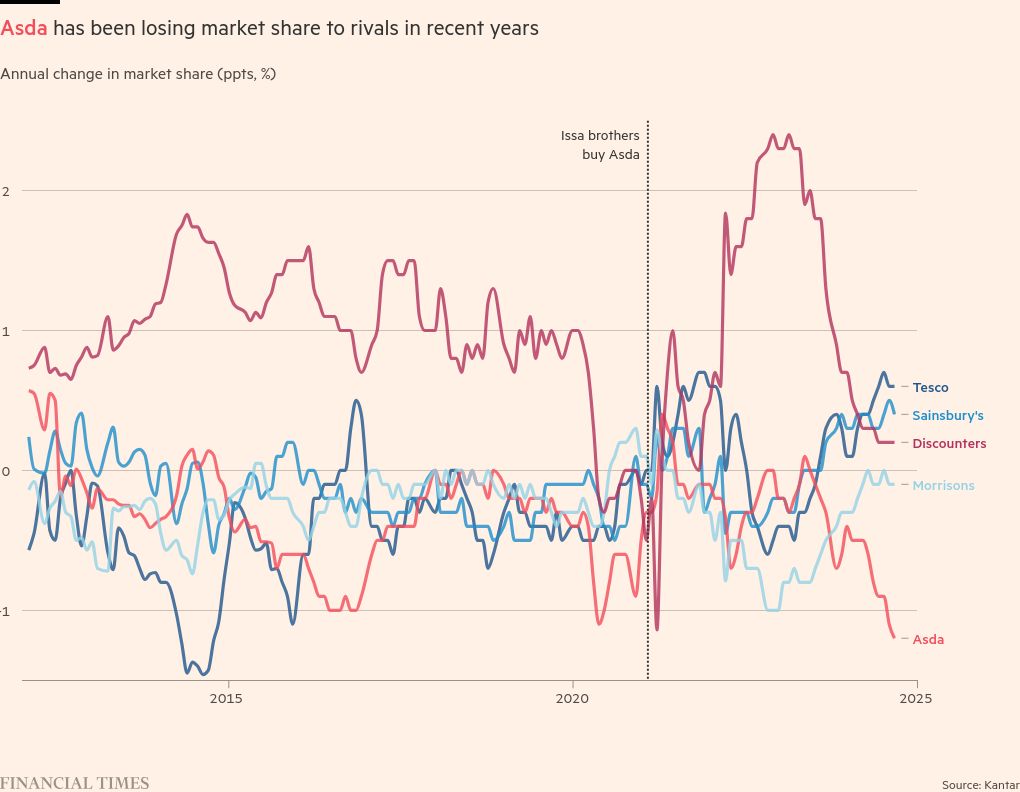

Co-owner Mohsin Issa is stepping down from running the company, which has lost market share to rivals over the past year.

The departure looks like a coup for company chair and retail veteran Stuart Rose, who in recent months has not so subtly signalled it might be time for Mohsin to leave.

Rose said last month that he was “embarrassed” by Asda’s decline and Mohsin should step back from day-to-day operations.

But even with Mohsin gone, the UK’s third-largest supermarket chain is still facing a high debt burden and shrinking sales. Rivals such as German discounters Aldi and Lidl have gained ground, as has Tesco.

While Asda continues its longtime search for a new chief executive, Rose and TDR executive Rob Hattrell will be running things — and seeking to claw back some of their lost sales.

Mohsin will instead focus his efforts on EG Group, the petrol station business he founded with his brother Zuber in 2001.

While Mohsin still holds a 22.5 per cent share of Asda, Zuber sold his stake of the same size to TDR in June.

Zuber has taken a step back from both businesses. At the end of October he’ll step down from being co-CEO at EG Group, leaving Mohsin to lead things alone.

There have been rumours of a rift between the siblings, but Mohsin told the BBC in February that the two get on “exceptionally well” (even though they’ve been busy splitting up their business empire).

Mohsin’s departure caps a tumultuous period for the grocery chain, which was the UK’s biggest leveraged buyout in more than a decade just a few years back.

The deal was a remarkable feat of financial engineering, with the Issa brothers and TDR stumping up just £200mn to buy Asda, which was valued at £6.8bn, through a complex chain of asset sales and debt deals.

While those convoluted financial manoeuvres made the transaction possible, it left the petrol business EG Group bearing the brunt of heavy costs.

It’s just one obstacle Mohsin will need to tackle.

The American fashion fight that could upend dealmaking

Editors, buyers and fashion executives who descended on Manhattan last week for New York Fashion Week may have struggled to get a seat at a triumphant Alaïa show at the Guggenheim (an event that drew Naomi Campbell, Rihanna and Linda Evangelista).

It simply was the hottest ticket in town.

Downtown, and out of view, another kind of fashion show was going on. And even though it was far more consequential, almost anyone could get a seat (DD’s own Amelia Pollard attended). That show was the US Federal Trade Commission’s first big attempt at blocking a major fashion deal.

The brands in question: Tapestry (which owns Coach, Kate Spade and Stuart Weitzman) and Capri (which owns Michael Kors, Jimmy Choo and Versace).

The court case could have major implications for the fashion world, which hasn’t historically worried about regulatory hurdles. LVMH and Kering have been able to turn themselves into European fashion behemoths by acquiring a stable of handbag makers and independent labels.

But this trial could change things. If regulators are successful with this case, any company looking to acquire a competitor — even if there are others in the market — would need to seriously weigh the regulatory implications.

“If there’s that kind of language in your documents, no matter what the product market is, you have to be concerned that you’ll get sued,” said George Paul, a partner at White & Case.

The agency’s case rests on a slice of the market it defines as “accessible luxury”: handbags that are relatively affordable but good quality and that are typically priced between $100 and $1,000.

It argues the merger would result in higher prices for consumers and a lower quality in products, “leading to undue concentration and a presumption of illegality”, according to court filings, because a few of the brands compete head to head.

The companies are adamant that the agency’s got it wrong. Their witnesses have testified that not only are there hundreds of other brands, but shoppers of varying incomes buy bags at all different prices.

They say they’re not fighting head to head. Instead, Coach and Michael Kors are simultaneously competing with athletic brand Lululemon, high-end brand Celine and even grocery chain Trader Joe’s, which sells a $2.99 mini-tote bag that’s gone viral.

The final witness testimony wrapped up this week, and each side will give closing arguments on September 30. Judge Jennifer Rochon, who is hearing the case, will make a decision sometime in the next few months on whether to freeze the deal.

Job moves

-

PJT Partners has struck a deal to buy Middle East-focused boutique investment bank deNovo Partners, which was founded by Morgan Stanley banker May Nasrallah.

-

BNP Paribas has hired Conor Davis as global head of institutional sales and investors and Asia Underwood as a managing director on its UK corporate advisory team. Davis previously worked at Citigroup, while Underwood joined from Bank of America.

-

Campari’s chief executive Matteo Fantacchiotti has resigned for personal reasons after less than six months in the role. The company has appointed chief financial officer Paolo Marchesini and general counsel Fabio Di Fede as interim co-CEOs.

-

ESPN journalist Adrian Wojnarowski, who was known for revolutionising sports reporting through his use of social media, is retiring from the profession.

Smart reads

Bank tie-ups A new US regulatory framework will make bank M&A even more difficult, Lex writes. But is that a good thing for our financial system?

Soccer boom Lionel Messi has helped to fuel a wealth boom for US Major League Soccer, Bloomberg reports. Now the league must contemplate its future after he retires.

Frequent-flyer upset Airline loyalty programmes have become mired in controversy recently, the FT’s Brooke Masters writes. How did a marketing gimmick designed to build customer loyalty become such a cultural flashpoint?

News round-up

Google wins appeal against €1.5bn EU competition fine (FT)

Private equity suitors line up for Bausch + Lomb eyecare auction (FT)

Grant Thornton US among shortlist of bidders for UK franchise (FT)

UK regulator pushes banks to give savers better value even as rates fall (FT)

Meta faces hefty EU antitrust fine over classified ads practices (FT)

L&G to sell Cala Homes to buyout firms for £1.35bn (FT)

Rolls-Royce wins pioneering deal to build mini nuclear plants in Czech Republic (FT)

Commerzbank readies talks with UniCredit but remains defensive (Reuters)

Due Diligence is written by Arash Massoudi, Ivan Levingston, Ortenca Aliaj, and Robert Smith in London, James Fontanella-Khan, Sujeet Indap, Eric Platt, Antoine Gara, Amelia Pollard and Maria Heeter in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please send feedback to [email protected]

Recommended newsletters for you

Full Disclosure — Keeping you up to date with the biggest international legal news, from the courts to law enforcement and the business of law. Sign up here

Scoreboard — Key news and analysis behind the business decisions in sport. Sign up here