This article is an on-site version of our Moral Money newsletter. Premium subscribers can sign up here to get the newsletter delivered three times a week. Standard subscribers can upgrade to Premium here, or explore all FT newsletters.

Visit our Moral Money hub for all the latest ESG news, opinion and analysis from around the FT

In 2020, a year when record-setting wildfires ravaged the US west coast, CME Group — the world’s largest futures exchange operator — launched a new contract for betting on future water availability in California.

Designed to allow big water consumers from alfalfa and almond farmers to electric utilities to hedge against future swings in water availability, the tool prompted a backlash from lawmakers including Massachusetts senator Elizabeth Warren. Earlier this year, Warren revived her push for a bill to ban the trading of water rights in commodity future contracts, citing the risk that such trading could lead to real-world price spikes because of market manipulation or speculation.

So far, the market for California water futures hasn’t taken off. But the debate over trading, pricing and allocation of the resource holds lessons for the future of water-stressed regions — as we highlight today with a tale from the other side of the Atlantic.

water pricing

Debate over Portugal lake prompts a rethink on water rights

Over the past decade, Europe’s biggest artificial lake has turned a sun-baked corner of rural Portugal into an oasis.

Alqueva, a lake that irrigates an area roughly the size of New York City, has taken some of the sting out of the region’s intensifying heat and drought by guaranteeing a source of water through dry spells.

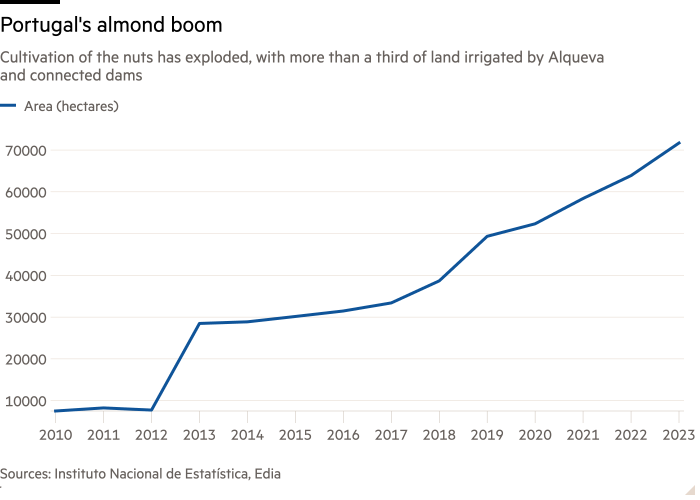

Investors have flocked to the region, once sparsely dotted with cattle pasture and traditional farms, to fund the planting of some 100 sq miles (259 sq km) of almond trees, interspersed with other water-intensive crops.

“It has changed completely the landscape and the economy,” according to Diogo Vasconcelos, president of Portugal’s Association of Young Farmers of the South, giving farmers the ability to plant crops through the scorching summer. “But with climate change, we have less rain . . . so everybody is turning to the water in Alqueva, like a magical solution.”

“We are a bit the victim of our success,” José Salema, chief executive of state-run Edia, which manages the irrigation system, told me.

Water that flows from the Alqueva dam, which was completed in 2015, is collected in a giant lake, and mostly drawn down in the summer. Nearby land prices have soared, and there is even talk of planting avocados, which are normally grown in more frost-proof areas closer to the ocean. But the water boom has sparked conflict between Portuguese and Spanish farmers’ groups, and tension between locals and foreign investors.

Under the current system, water is supplied based on land area, irrespective of how efficiently it is used. A farm’s allocation is set based on its acreage, multiplied by water usage rates for the crops they grow. Edia sets those rates and if a farm hits its water threshold, Edia turns off the tap.

But some investors are pushing for an overhaul of the way Alqueva’s finite water supply is allocated: by severing the legal ties between water and land, and allowing buyers to trade water.

Supporters say this would direct water to the farms most willing to pay for — and squeeze the most revenue out of — every last drop.

Others are sceptical. “This is not an economic problem. It’s not about selling water,” Vasconcelos told me. “It’s about not having enough water. It’s a political problem.”

The debate over whether to price and trade water raises questions such as: who is public water infrastructure for? Should the state look to maximise crop revenue by giving farms using the latest technology the ability to bid for more water, at the expense of farms — often owned by locals — with older infrastructure? And should the competing claims of other interest groups be settled by the state, or a market?

The role of state vs market in water infrastructure

“When I joined, I could not tell the difference between an olive tree and an almond tree,” Jorge Pena, the chief executive of Spanish olive oil producer Innoliva, told me.

The former BCG consultant got a hands-on education in farming, however, when Cibus Capital, private equity group and then-owner of Innoliva, recruited him to run the olive oil business in 2019.

Innoliva liked the area around Alqueva, he explained, because the lake’s enormous size insured it against multiyear drought.

But Pena has concerns about how Alqueva’s water is rationed. Under the current system, he explained, “I cannot decouple the water from the land.”

Water allocation is a function of land area — and crops under cultivation — so one farmer cannot pay another to access his water.

Water allocation rates have, unsurprisingly, proved controversial.

António Saraiva runs Portugal Nuts, a trade group representing what he called “modern producers” of almonds and walnuts — that is, those using advanced irrigation methods. He disputes the water allocation assigned to almonds, he told me, since it is “not enough for the full potential of the crops.”

Pena, though, doesn’t just dispute the rates set for specific crops. He would like to see the current system replaced with a market in which water is priced competitively, and rights to consume it are traded.

Rob Appleby of Cibus Capital is also enthusiastic. Appleby, who is based in the UK, told me he had seen water rights trading systems work in places such as Australia, which severed surface water from land rights beginning in the 1980s.

Exploring new approaches

Three years ago, Salema, of Edia, travelled to California to meet officials from the US Bureau of Reclamation and the state water regulator about their approach. He has also invited Australian academics to Alqueva, to discuss their country’s water rights, and has argued to Portuguese government officials that the country should adopt its own pricing-and-trading scheme.

In Australia, environment ministers purchase water to flow into rivers, for ecological stewardship, in the same way farmers and other users bid for water: on the market. By contrast, Salema said, “we just have an obligation to maintain a certain ecological flow, with no compensation”.

The share of water Alqueva must hold back for ecological flows — feeding downstream rivers, for example — was set in 2002, Salema said, and had not been modified since. A market, he argued, could create a more “integrated” approach for valuing resources.

Salema said his arguments had not yet persuaded Portuguese authorities. But pressure on the basin’s limited resources continued to mount, which could prompt a reappraisal.

In Australia as well as in California, markets for water rights have proved controversial. Critics have argued that structurally they give larger farms an advantage, often backed by investors based elsewhere, over local communities, indigenous groups, and traditional family farms.

This is not only because bigger investors can afford to pay for extra water, but because they tend to have more modern farm technology that uses it more efficiently, ultimately wringing more revenue out of each drop.

Water needs, meanwhile, are only growing. Spanish farmers have called for more water to be left in the reservoir and sent into their territory, which would further cut into stocks available for Portugal. Under a current agreement, according to Salema, Spain withdraws 50mn cubic metres of water from Alqueva each year.

Vasconcelos, for his part, is wary of a water-trading approach that lets in anyone — if they can pay the right price. “We’ve built a dam, we made investments, we spent the money,” he said. “I have nothing against Spanish farmers . . . [but] they’re trying to solve their problem with our water.”

“The desert is moving north,” he added, citing the decline in regular rainfall. Of Portuguese officials open to such an arrangement, he added, “how can they be sure that they have the capacity to give water to everyone?”

Smart reads

Recommended newsletters for you

FT Asset Management — The inside story on the movers and shakers behind a multitrillion-dollar industry. Sign up here

Energy Source — Essential energy news, analysis and insider intelligence. Sign up here